IonQ (IONQ), a quantum computing company, has scheduled its analyst day for Sept. 12, offering investors a comprehensive look at its strategic direction and technological progress. The event will feature presentations from IonQ's executive team, covering business strategy, recent milestones, and product roadmap updates.

The timing is notable as IonQ works toward achieving AQ 64, a critical technical milestone that would advance its quantum computing capabilities. The company's trapped-ion approach has already produced some of the world's most accurate quantum computers since its founding in 2015 by researchers Chris Monroe and Jungsang Kim.

Recent developments position IonQ at a pivotal moment. In 2025, IonQ acquired companies part of the quantum networking space, which include Entangled Networks and Qubitekk, among others. These moves support IonQ's vision of building quantum internet infrastructure with ultra-secure communications capabilities.

Moreover, IonQ sold its Forte Enterprise system to EPB, making the latter the first commercial customer to operate a quantum network and a quantum computer. This pioneering deployment enables applications such as energy grid optimization, demonstrating the real-world utility of quantum computing.

The analyst day should provide clarity on how IonQ plans to capitalize on its technical leadership and growing commercial traction in the rapidly evolving quantum computing market.

Is IONQ a Good Buy Right Now?

In Q2 of 2025, IonQ reported revenue of $20.7 million, which was 15% higher than management forecast. IonQ is focused on an aggressive acquisition strategy that positions it for dominance in quantum computing.

The company secured a transformational $1 billion equity investment from Susquehanna at a 25% premium, which is the largest single institutional investment in quantum computing history.

CEO Niccolo de Masi's appointment as chairman signals board confidence in his strategic vision, which centers on creating an integrated quantum ecosystem spanning computing and networking.

IonQ completed acquisitions of LightSync and Capella while also announcing the pending acquisition of Oxford Ionics. Oxford's world-record 99.99% two-qubit gate fidelity and electronic control architecture enable IonQ to project 10,000 physical qubits on a single chip by 2027. It also aims to scale to two million physical qubits and 80,000 logical qubits by 2030. These projections surpass those of competitors, with IBM (IBM) targeting only 2,000 qubits by 2033.

IonQ's commercial momentum accelerated with partnerships spanning government agencies and Fortune 100 companies. It has already demonstrated practical quantum advantage through collaborations with AstraZeneca (AZN), Nvidia (NVDA), and AWS (AMZN), achieving 20x speed improvements in drug development workflows.

Additionally, partnerships with Japan's AIST and South Korea's KISTI establish IonQ as the preferred quantum partner for nations building quantum economies. However, investors should note its R&D costs more than tripled year-over-year (YoY) to $103.4 million in Q2, while it is forecast to post an EBITDA loss of $200 million in 2025.

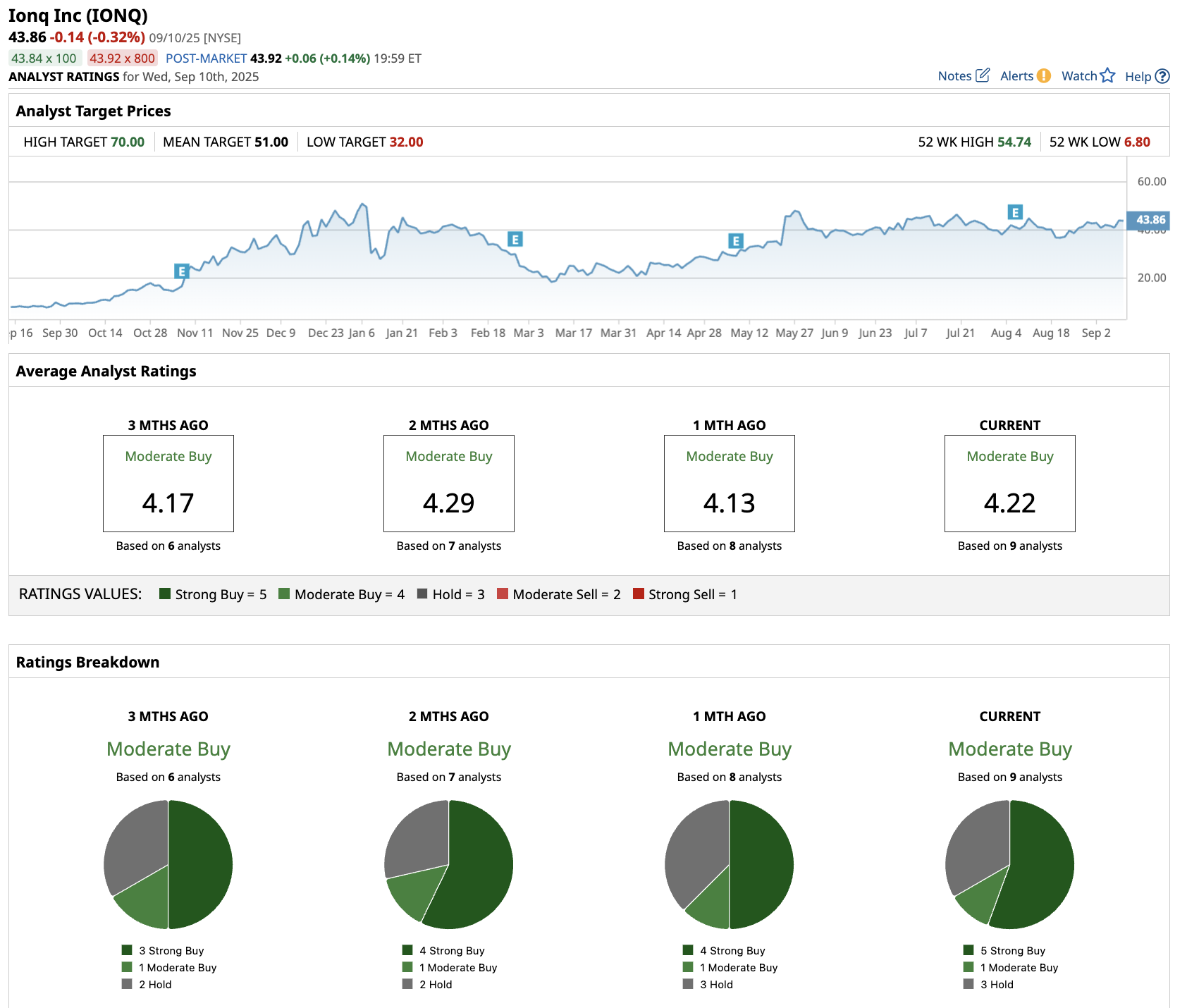

What Is the IONQ Stock Price Target?

The quantum networking division, led by acquired companies ID Quantique and others, offers production-grade security solutions already deployed by financial institutions and governments. This diversification beyond pure quantum computing provides multiple revenue streams, positioning IonQ uniquely in the emerging quantum internet infrastructure market.

Analysts tracking IonQ forecast revenue to rise from $43 million in 2024 to $775 million in 2029. While the company is expected to remain unprofitable, its net losses are forecast to narrow from $215 million in 2024 to $72 million in 2029.

Out of the nine analysts covering IONQ, five recommend “Strong Buy,” one recommends “Moderate Buy,” and three recommend “Hold.” The average IONQ stock price target is $51, indicating an upside potential of almost 20% from current levels.