/Etsy%20Inc%20logo%20by-%20viewimage%20via%20Shutterstock.jpg)

Tariff dynamics have affected the consumer class the most. After high-ticket items in big-box retailers like Target (TGT), Costco (COST), and Walmart (WMT) were hit by tariffs to various degrees, the final loophole for consumers through the “de minimis” exception is set to be done away with on Friday, Aug.29.

Applicable to items imported into the United States that have a value of $800 or less, the de minimis exemption of Section 321 of the Tariff Act of 1930 was already applicable to imports from China and Hong Kong. From Aug. 29, it will expand to other countries as well.

So, should shareholders of online marketplace Etsy (ETSY) be wary of this development? I think they should be, and here's why.

Tariff Impact on Etsy

The removal of the de minimis exemption, which previously allowed imports valued below $800 to enter the U.S. without customs duties or extensive documentation, is expected to create significant challenges for Etsy sellers dependent on low-cost international shipping. Under the new framework, import charges now range from 10% to 50% of an item’s value, or involve flat fees between $80 and $200. This will likely increase costs for U.S. buyers and affect demand for affordable products.

This change has already prompted suppliers in Europe and Asia to reduce or suspend shipments to the U.S., citing unclear procedures and administrative complexity.

Finally, Etsy could see a meaningful impact on its revenue as approximately 25% of its U.S. gross merchandise sales involve cross-border transactions. The combination of higher duties and potential shipping delays makes a potent combination to hurt sales.

About Etsy

Founded in 2005, Etsy operates a two-sided online marketplace that connects artisans, vintage goods sellers, and creative entrepreneurs with buyers seeking unique, handcrafted, and vintage products. The company's market cap currently stands at $5.6 billion.

ETSY stock has not seen much movement this year, rising by just 1.3% on a year-to-date (YTD) basis.

So, in times of such upheaval to its business model, is Etsy worth adding to the portfolio? Let's try and find out.

Etsy Is in a Precarious Position but May Bounce Back

Etsy, which is primarily focused on selling unique items and handmade goods and has a special emphasis on small-time artisans and local production, could actually benefit from the removal of the de minimis exception. The logic here is that the flood of cheap goods from places like China and Vietnam entering the United States, a market which, of course, is Etsy's largest consumer base, should begin to slow down. Perhaps most importantly for the company, these cheap mass-produced items should become more expensive, a rising price that could, in turn, make Etsy's unique crafts a more tempting alternative for shoppers.

On top of that, its Depop platform, which is a marketplace for buying and selling used and vintage clothing, has been enjoying strong growth; gross merchandise value (GMV) is up over 35%. In 2024, Depop recorded $789 million in GMS, marking a 31.6% increase from the prior year. Further, it is also worth noting that the app has been downloaded by over 10 million people on Android alone and has been appreciated by its users.

In terms of product investment, the company is focusing on a few areas like revamping its app experience to boost downloads, improving its search algorithm to showcase a greater diversity of users and sellers, and even testing a loyalty program called “Etsy Insider” in a beta to assess its impact on both purchase frequency and size.

Poor Financials

However, critical issues continue to plague the company, chief among them being its financial performance. Etsy's earnings, in fact, have missed Street expectations in six out of the past nine quarters, a trend that includes the latest quarter, which was the second consecutive quarter of a year-over-year (YoY) decline in earnings.

In Q2 2025, GMV declined by 4.8% from the previous year, settling at $2.8 billion, with revenues moving up by only a modest 3.8% in the same period to $672.7 million. The one bright spot here was that the take rate saw an improvement to 24% from 22%.

Yet, active sellers and buyers both declined on the platform, to 8.1 million and 93.3 million from 8.8 million and 96.6 million in the year-ago period, respectively.

Cash flow from operating activities also saw a decline for the first six months of 2025 to $157.3 million, down from $220.1 million in the prior year. Overall, the company closed the June 2025 quarter with a cash balance of $1.2 billion, which is higher than its short-term debt levels of $146.9 million.

However, the midpoint of Etsy's guidance for a GMV range of $2.6 billion to $2.7 billion reflects a decline of 9.2% from Q3 2024's GMV of $2.92 billion.

Finally, despite its differentiated offerings, Etsy faces competition from a number of other crafts and decorations companies, ranging from online superstores like Amazon (AMZN) to more upmarket retailers such as Restoration Hardware (RH).

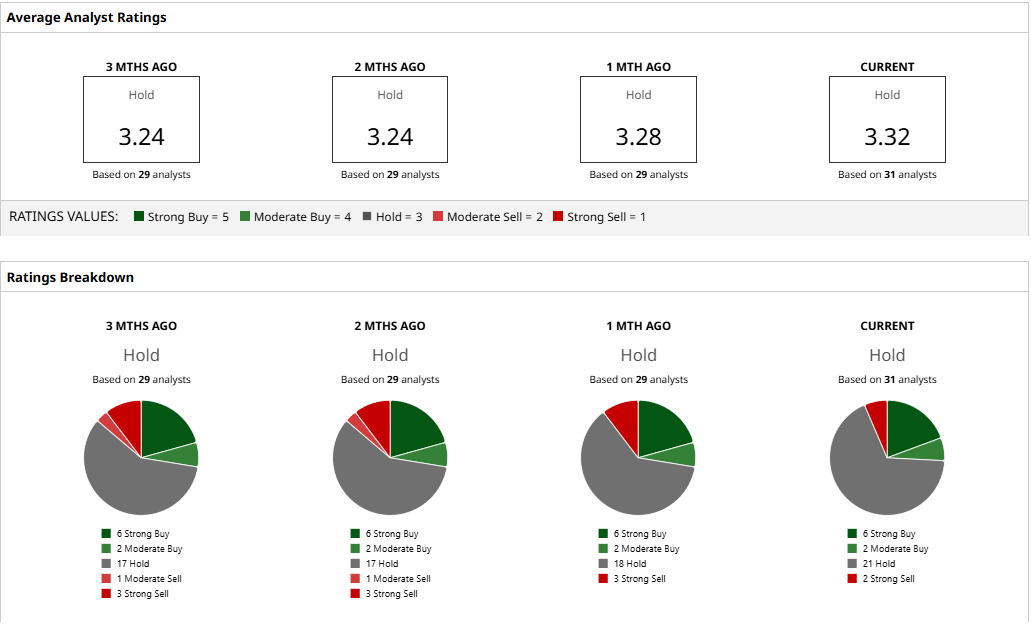

Analyst Opinion on ETSY Stock

Thus, such conflicting indications have led analysts to deem the ETSY stock a “Hold,” with a mean target price of $62.07. This denotes an upside potential of about 14% from current levels. Out of 31 analysts covering the stock, six have a “Strong Buy” rating, two have a “Moderate Buy” rating, 21 have a “Hold” rating, and two have a “Strong Sell” rating.