AppLovin (APP) — which provides developers with tools for analytics, advertising technology, and monetization — has enjoyed a strong recent run despite facing a wave of short sellers earlier this year. Investors now appear to have dismissed the short thesis, driving confidence in APP stock.

Shares of APP are up roughly 76% year-to-date (YTD). On Sept. 8, the stock surged nearly 12% in a single day. The rally comes as AppLovin, along with Robinhood Markets (HOOD) and Emcor (EME), is set to join the S&P 500 Index ($SPX) during the index’s next rebalancing on Sept. 22, before markets opens.

The three companies will replace Caesars Entertainment (CZR), MarketAxess (MKTX), and Enphase Energy (ENPH), which are being moved to smaller-cap indexes.

Inclusion in the S&P 500 brings immediate benefits for AppLovin, including buying pressure from index funds, broader institutional ownership through pensions and exchange-traded funds (ETFs), enhanced market credibility, greater liquidity, and lower costs of raising capital. The milestone will help cement AppLovin’s evolution into a large-cap, mainstream tech player.

About AppLovin Stock

Headquartered in Palo Alto, California, AppLovin provides a comprehensive marketing platform for app developers and global businesses. The company’s solutions encompass user acquisition, monetization, analytics, and artificial intelligence tools, helping clients reach, engage, and grow audiences efficiently.

With a market capitalization of approximately $191.8 billion, APP stock has outperformed the broader market by a wide margin. Over the past 52 weeks, shares have surged 485%, and in the past three months alone, gains have reached 49%. That's compared with the S&P 500’s 19% annual gain and 9% three-month advance.

Recent momentum remains strong, with APP stock climbing 23% in the last month and 14% over the past five trading days.

Currently, APP stock trades at 62.4 times forward adjusted earnings and 40 times sales. This shows that APP is sitting well above industry averages, reflecting investor confidence in its high-growth trajectory.

AppLovin Surpasses Q2 Earnings

On Aug. 6, AppLovin unveiled its second-quarter 2025 earnings results, surpassing Wall Street’s forecasts on both the top and bottom lines. APP stock gained approximately 12% intraday on account of the earnings results.

Revenue rose 77% year-over-year (YOY) to $1.26 billion, beating the analyst estimate of $1.21 billion. The company’s EPS, adjusted to account for discontinued operations, increased 163% from the year-ago value to $2.26, outperforming Wall Street’s $1.99 projection.

Net income from continuing operations surged 156% to $771.9 million, driven by strong performance in AppLovin’s advertising technology segment. The growth followed the company’s strategic divestment of its gaming apps division and a renewed focus on AI-powered ad solutions, which have become central to its business strategy.

Other financial highlights underline the company’s robust performance. Adjusted EBITDA reached $1.02 billion, up 99% YOY, while free cash flow jumped 72% to $768.1 million during Q2. Cash and cash equivalents stood at $1.2 billion at quarter-end, providing flexibility for reinvestment and strategic initiatives.

Looking ahead, management expects Q3 2025 revenue to fall between $1.32 billion and $1.34 billion, accompanied by adjusted EBITDA of $1.07 billion to $1.09 billion, signaling continued strong growth and robust margins.

Meanwhile, analysts foresee Q3 EPS rising 86% YOY to $2.32. For fiscal 2025, the bottom line is projected to increase 98% from the prior year to $8.95. Momentum is expected to carry into fiscal 2026, with EPS growth of 51% to $13.50.

What Do Analysts Expect for AppLovin Stock?

Analyst sentiment for APP stock remains overwhelmingly positive. Scotiabank raised its price target on APP to $575 from $450, maintaining an “Outperform” rating. The firm cited expectations for sustained margin improvement as management continues to hone cost structure.

Jefferies mirrored this optimism, raising its price target to $615 from $560 while keeping a “Buy” rating. Analysts highlighted multiple growth drivers, including increased spend from advertisers, expansion into international markets, and onboarding of significant new clients, which together are expected to fuel an e-commerce advertising inflection in Q4.

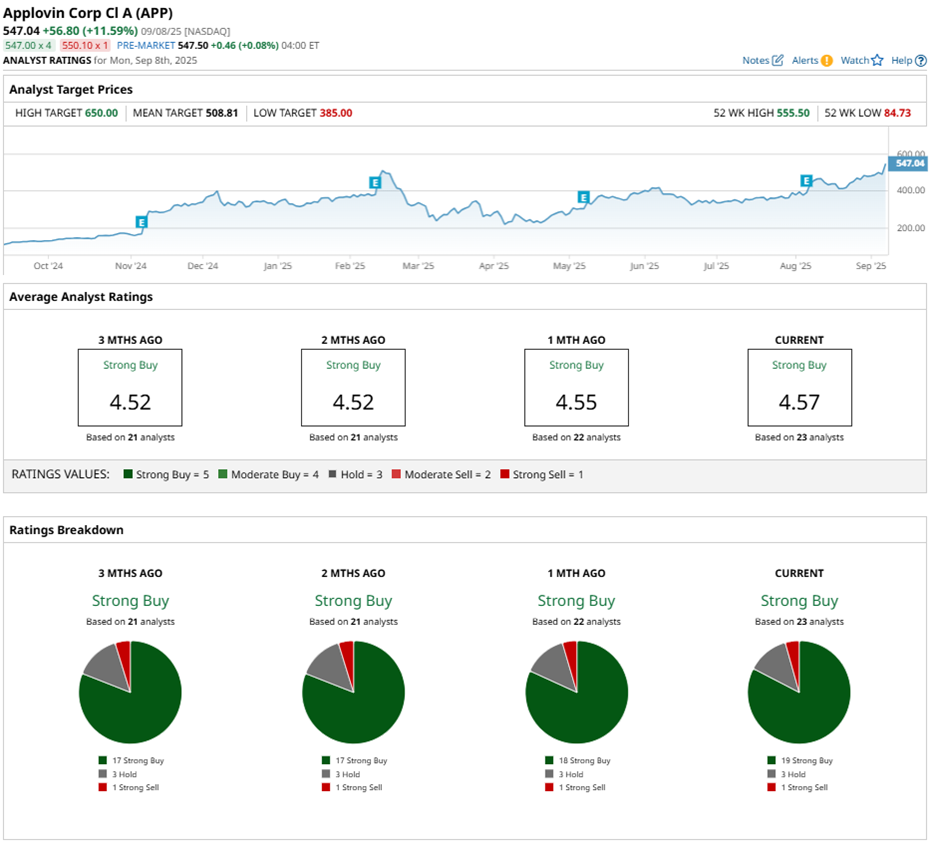

Overall, APP carries a “Strong Buy” consensus rating. Among 23 analysts covering APP, 19 recommend “Strong Buy,” three suggest “Hold,” and one rates it a “Strong Sell.”

APP stock already trades above its average price target of $508.81. Meanwhile, the Street-high target of $650 reflects a 14% potential gain from current levels.