/Amazon%20-%20Image%20by%20Tada%20Images%20via%20Shutterstock.jpg)

Amazon (AMZN) is a global technology leader renowned as the world’s largest online retailer and a dominant player in cloud computing through Amazon Web Services (AWS). Amazon has grown from an online bookseller to an expansive digital marketplace offering a wide range of products, including electronics, groceries, and streaming and smart device brands.

Founded in 1994 by Jeff Bezos, it is headquartered in Seattle.

Amazon Outperforms Market

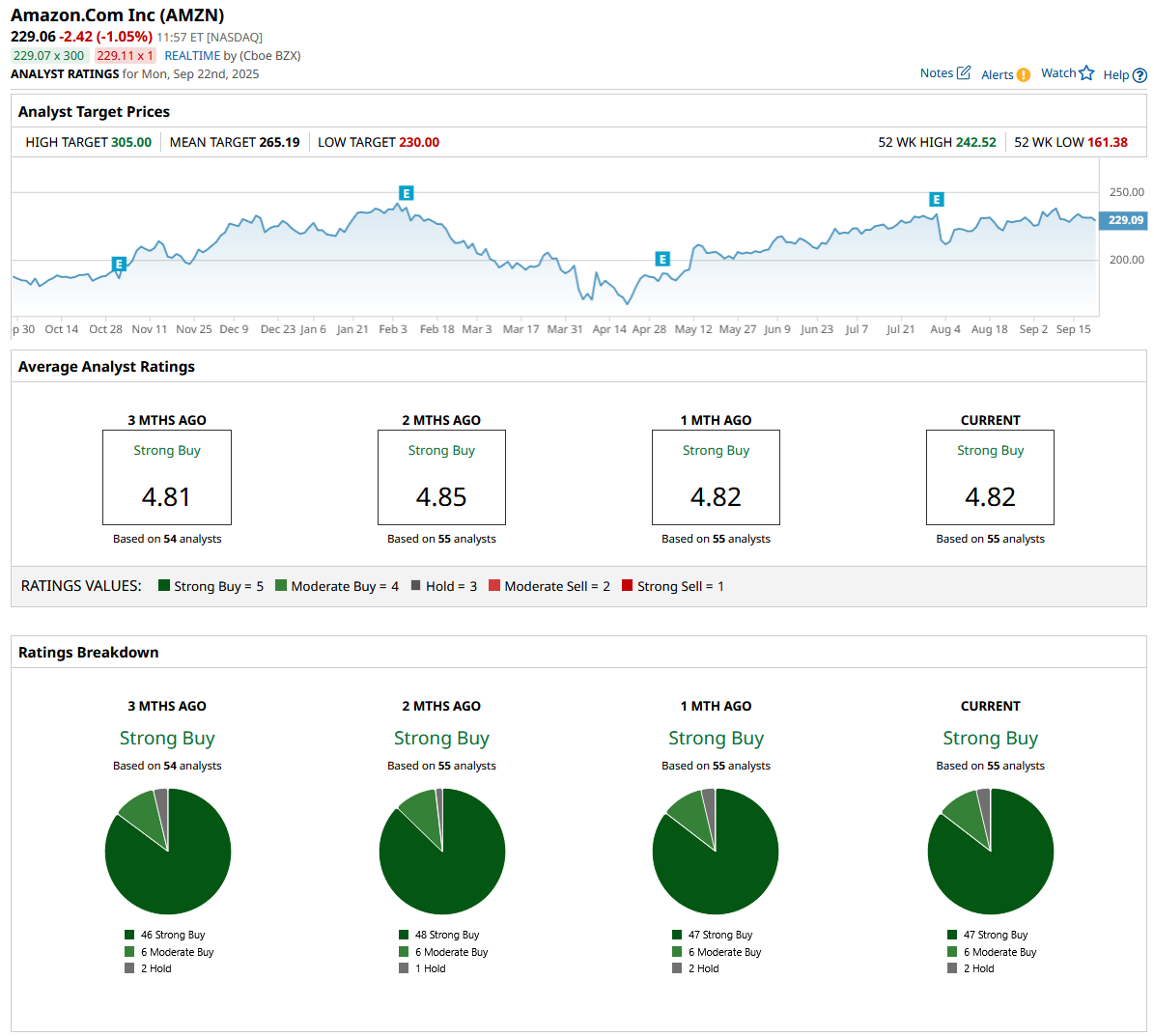

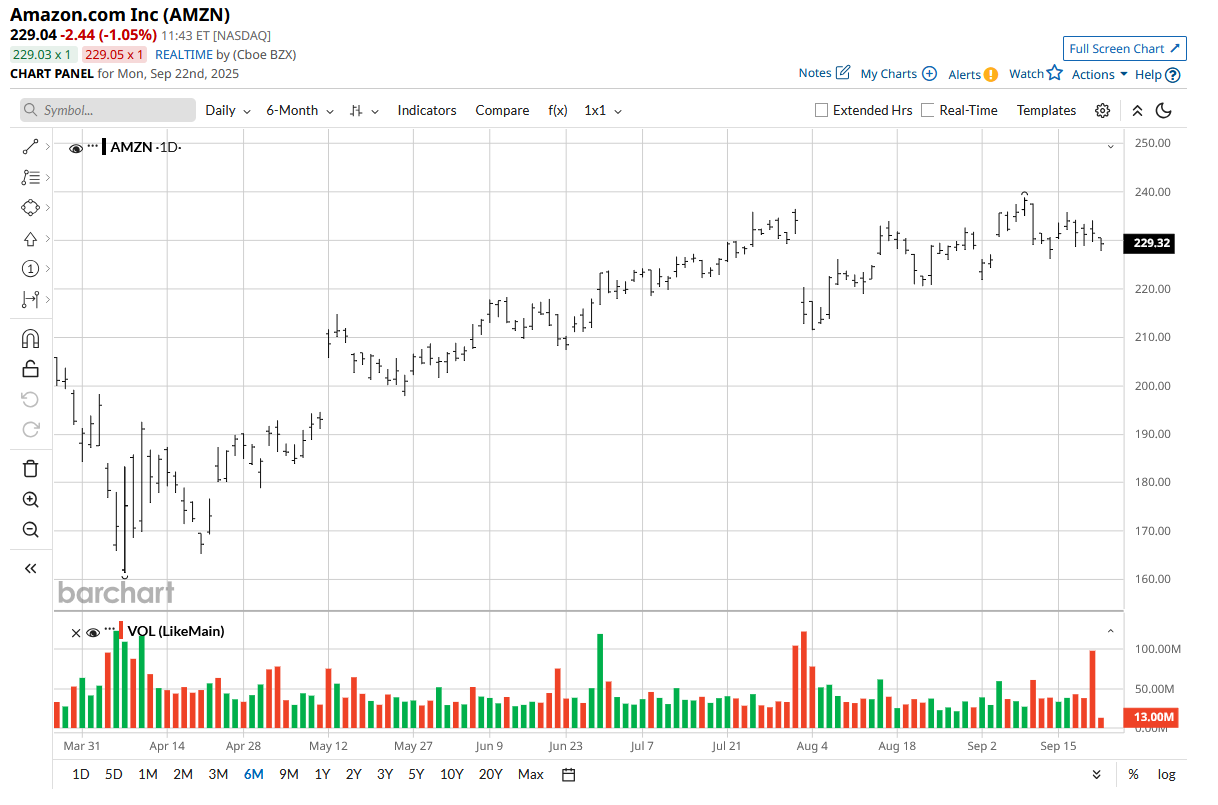

AMZN shares have dipped ever so slightly at 0.6% over the past five days but otherwise increased 0.5% for the month and a robust 17% over the last six months. The latter six-month performance stat solidly outpaces the S&P 500 ($SPX) during the same time period.

Strong e-commerce demand and continued growth in Amazon Web Services have powered these gains, positioning Amazon as a market leader and frequent outperformer compared to its benchmark index.

Amazon Q2 Results

Amazon reported strong second-quarter results for 2025, beating analyst expectations with earnings per share of $1.68, compared to the $1.33 consensus. Revenue rose 13% year-over-year (YoY) to $167.7 billion, surpassing forecasts of $162.2 billion. The company demonstrated robust growth across multiple segments, including North America, international markets, and AWS, showcasing its diversified revenue streams.

Key financial metrics underline Amazon's solid performance, with operating income reaching $19.2 billion, driven largely by AWS's operating income of $10.2 billion. North America's operating income surged to $7.5 billion, while international operations also saw significant gains. Advertising revenue jumped 22%, further boosting overall profitability.

Despite strong earnings, Amazon’s cash and cash equivalents decreased to $57.7 billion as of June 30, 2025, from $66.2 billion the previous quarter, reflecting increased investments and capital expenditures.

Looking ahead, Amazon provided cautious guidance for Q3 2025, projecting revenue between $174 billion and $179.5 billion, with operating income expected in the range of $15.5 billion to $20.5 billion. While the forecast indicates continued growth, investors reacted warily due to slower-than-anticipated margin expansion and intensifying competition in cloud computing.

Amazon Prime Day Sale

Amazon has scheduled its Prime Big Deal Days event for Oct. 7-8, kicking off the holiday shopping season early for Prime members. The two-day sale will feature exclusive discounts across a broad range of categories, including popular toys from Fisher-Price, Magna-Tiles, and Tonies, as well as electronics from Samsung (SMSN.L.EB), LG, and Sonos. Home and kitchen appliances from brands like Dyson, Ninja, and Shark will also be included.

This annual fall event serves as a precursor to the Black Friday rush, offering more deals than ever to Prime members, and has become a key moment for retailers to pull forward holiday sales traditionally occurring during the late November shopping period. Amazon's October Prime Big Deal Days continue to set the pace for seasonal promotions across the retail industry.

Should You Bet on AMZN?

The Magnificent Seven stock has been assigned a “Strong Buy” rating by analysts, with a mean price target of $265.19, representing an upside of 15% from the current market rate.

AMZN stock has been rated by 55 analysts so far, while receiving 47 “Strong Buy” ratings, six “Moderate Buy” ratings, and two “Hold” ratings.