Nvidia Corp. (NASDAQ:NVDA) might be facing fresh concerns, but analysts continue to say that it is the champion of the AI revolution.

Nvidia's AI Dominance Faces New Competition

On Wednesday, Wedbush analyst Dan Ives took to X and said that with trillions expected to be invested in the coming years, multiple Big Tech companies, including Alphabet Inc.'s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google and Broadcom Inc. (NASDAQ:AVGO) in the TPU chip space, stand to gain alongside Nvidia.

However, he cautioned that Nvidia is still "the indisputable Rocky Balboa champion of the AI Revolution."

Gene Munster Backs Nvidia, Predicts Bright AI Infrastructure Future

Deepwater Asset Management's managing partner Gene Munster reposted Ives’ post on social media and said, "I agree with @DivesTech, Nvidia is the champ. My prediction: AI infrastructure will be a bright spot for investing in 2026."

Notably, Deepwater owns Nvidia shares.

Meta And Google Deal Shake Up AI Chip Market

The statement comes after reports that Meta Platforms Inc. (NASDAQ:META) may tap Google AI chips for its data centers.

Google's tensor processing units are designed to deliver efficient, cost-effective performance across AI workloads, directly challenging Nvidia's dominance.

Broadcom Inc. (NASDAQ:AVGO) is also positioned to benefit from potential deals due to CEO Hock Tan's board role at Meta, according to Jim Cramer.

Meanwhile, Nvidia publicly acknowledged Google's advancements in AI while reaffirming its own leadership. In a social media post, the company expressed that it was "delighted" by Google's progress and underscored that it remains "a generation ahead" of its competitors.

Nvidia Stock Pullback Raises Questions

Nvidia's stock has experienced unusual volatility in November.

After climbing 33.03% over the past six months, shares fell 2.6% on Tuesday before rebounding 1.4% Wednesday, marking a five-day slip of about 8%.

Historically, November has been one of Nvidia's strongest months, with an average return of 10.55% and rare double-digit declines.

As of Nov. 25, Nvidia shares have declined 14% for the month, marking their worst monthly performance since September 2022.

Still, the company has returned over 1,300% in three years, underscoring its role as a generative AI pioneer.

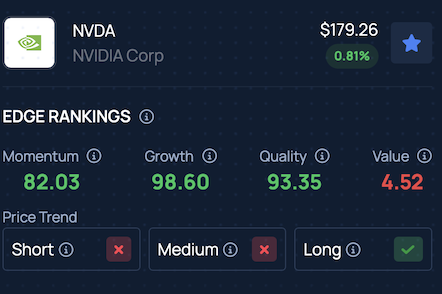

Benzinga's Edge Stock Rankings indicate that NVDA maintains a strong long-term price trend, though its short and medium-term performance remains negative. Click here to see how it compares with industry peers.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: Mehaniq/ Shutterstock