Tesla Inc. (NASDAQ:TSLA) CEO Elon Musk reiterates his commitment to the EV giant and his other ventures amid TSLA stock rally fueled further by his $1 billion share purchase.

Elon Musk Shares Busy Schedule

A user, Greggertruck, took to the social media platform X on Monday, hailing Musk and Tesla's recent stock rally that saw the share price cross the $400 mark on the NASDAQ.

The billionaire responded to the post by saying, "Daddy is very much home." Musk then said that he was "burning the midnight oil" working with the Optimus engineering team before arriving in Austin at 5 AM via a "redeye" flight on Saturday.

The CEO also said he spent "all Saturday afternoon in deep technical reviews for the Tesla AI5 chip design," adding that he then flew to Memphis to review the "excellent progress" on the Colossus II data center.

Following the data center visit, Musk said he then spent 12 hours attending back-to-back meetings with Tesla departments, with "particular focus on AI/Autopilot, Optimus production plans and vehicle production/delivery."

Elon Musk Is In ‘Wartime CEO Mode,' Says Dan Ives

Musk's post comes as Wedbush Securities' investor Dan Ives recently said that the billionaire was in "Wartime CEO mode" in a new investor's note released over the weekend. Ives also said that autonomous driving, as well as artificial intelligence, presented a $1 trillion market opportunity for Tesla.

However, the recently announced billion-dollar buy has also been criticized by experts like Gerber Kawasaki's co-founder Ross Gerber, who slammed Musk by saying that he should buy another 12% equity in Tesla instead of "taking it from shareholders."

Tesla Discontinues Cybertruck, Gigafactory Berlin Announces Production Boost

Meanwhile, Tesla has discontinued the most affordable trim of the Cybertruck, which retailed for $69,990 and boasted more range and fewer features when compared to the Standard and the Cyberbeast trim levels. The move could be a result of poor sales figures currently plaguing Tesla.

However, in a move that could go against sales data, which illustrates the EV giant's lackluster performance in getting cars off the showroom lots, the Gigafactory in Berlin announced it was scaling up production in Q3 and Q4 as it anticipated increased demand after receiving "positive signals" from the markets it served.

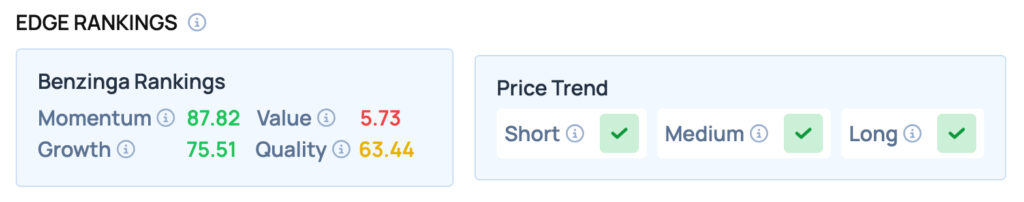

Tesla scores well on Momentum and Growth metrics, while offering satisfactory Quality, but poor Value. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock