For many veterans of the digital-asset world, the US Commodity Futures Trading Commission’s lawsuit against Binance Holdings Ltd. for allegedly breaking derivatives rules is just another day in crypto.

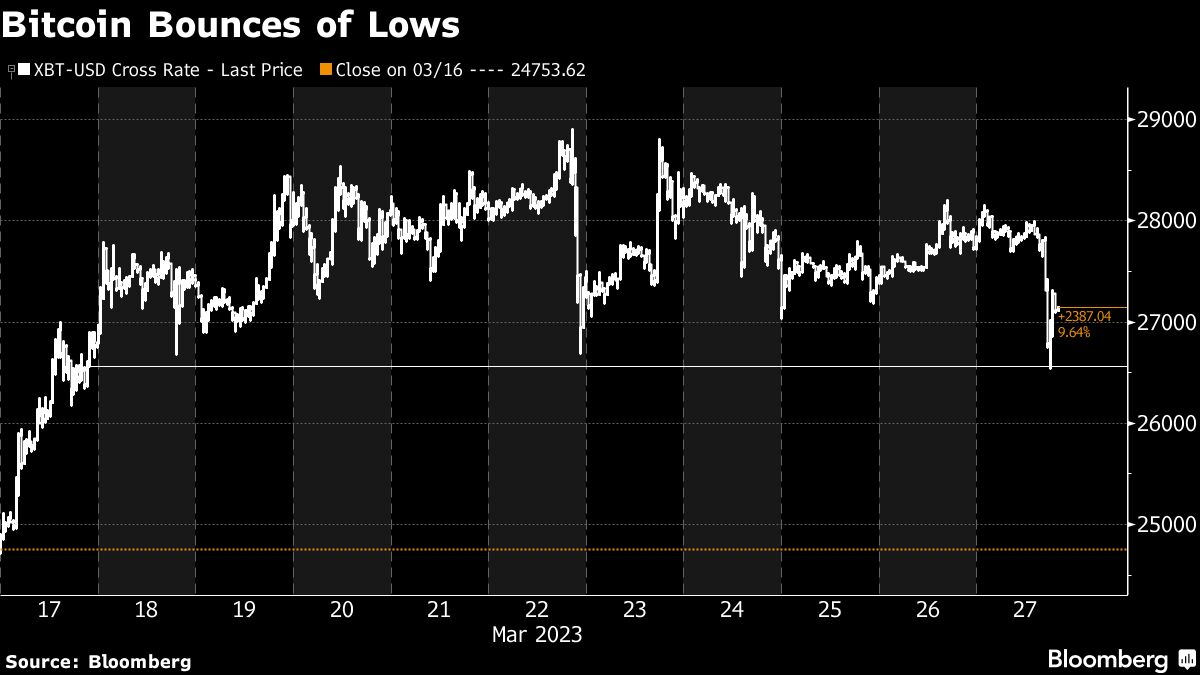

Token prices initially dropped after the CFTC filed the lawsuit Monday in a federal court in Chicago, only to quickly steady, and even pare losses in some instances. Many crypto advocates view the action by the US agency as just the latest assault on the sector by global regulators.

Binance Chief Executive Officer Changpeng Zhao, who was sued by the CFTC, has downplayed allegations of wrongdoing in the past. Zhao, who goes by CZ, has taken to flashing on Twitter the number four, which he uses to denote what he believes is negative or false information that should be ignored by crypto enthusiasts. Binance’s BNB token fell about 6%.

Here’s what crypto market participants are saying about the lawsuit and what it may all mean:

Mati Greenspan, founder and chief executive officer of Quantum Economics.

The price drop was “a bit of a knee-jerk reaction to the news,” Greenspan said. He added that the pullback is not all that surprising given how far the token’s price has moved above its 50-day average.

“The USA is behaving worse towards crypto than China. At least China is straightforward enough to let their citizens and entrepreneurs know what’s allowed and what’s not,” Greenspan said. “Americans have to constantly guess where the moving goalposts are headed.”

Stephane Ouellette, chief executive of FRNT Financial Inc.

It’s hard to see that the suit will have “real implications for crypto,” said Ouellette, who pointed out that it was already known that Binance was under investigation.

“In spite of this announcement continuing the narrative about US-regulators being antagonistic to crypto, assuming Binance’s business wasn’t secretly highly dependent on US-retail customers (there is little publicly available evidence to suggest that it was) this arguably has limited impact on the company’s business model,” Ouellette wrote in an email to Bloomberg News.

Matt Maley, chief market strategist at Miller Tabak + Co.

“There is no question that this could have a big impact on the crypto markets eventually. However, these kinds of battles can last a very long time, so it’s immediate impact should not be very strong. Just look at today’s action in Bitcoin. Yes, it’s down 3%, but given that it had rallied more than 40$ in just two weeks, today’s decline is not really a very big one.”

“My point is that Bitcoin had rallied 40% in just two weeks, so it had become overbought on a short-term basis. That level it vulnerable to a pullback anyway. So, the fact that it’s down only 3% after such a big rally shows that it’s going to take a while before we know the real implications of this lawsuit.”

Sylvia Jablonski, chief investment officer at Defiance ETFs.

“The crypto world did not need any additional turmoil after the last collapse of FTX sent Bitcoin and related currencies tumbling, particularly from a major player that seemed to be operating a clean operation. Events like this lead in investors to lose risk appetite and flee to the sidelines. In the past this could have been a wait and see moment in terms of how much Bitcoin would or wouldn’t fall, but between the recent run on the banks like SVB, Silver Gate and prior crypto frauds and blow ups like FTX, investors are likely to develop additional distrust in the crypto eco system, which in the short-term further discounts BTC’s price.”

Jeffrey Blockinger, chief legal counsel at decentralized exchange Vertex Protocol.

“This lawsuit comes after a series of suits against exchanges that have been brought in recent weeks by US regulators, so is not a huge surprise. The most interesting aspect of the complaint is the CFTC’s characterization of ETH and LTC as commodities, a view that the SEC appears to publicly disagree with. Given this caveat, it looks like this suit can indirectly be another chapter in the regulatory competition between the SEC and CFTC - and further adds to the cloud of uncertainty currently hanging over the industry in the US. Otherwise, the rest of the case is pretty standard other than its scope.”

Yankun Guo, a partner at the Chicago law firm Ice Miller.

“It’s worth pointing out that this case is against non-US Binance entities, which shows the extraterritorial reach that US agencies have. Even more fascinating, though, is that they labeled BTC, ETH, LTC, and at least two fiat-backed stablecoins, tether (“USDT”) and the Binance USD (“BUSD”), and other virtual currencies as “commodities,” which is in direct disagreement with the SEC and shows the confusion being caused by the lack of clear regulations in the US.”

“It shows that both the multifaceted nature of how tokens function and how they are used can cause them to be fall under multiple agency’s jurisdiction; but this is also an issue if the same company/exchange is sued by the multiple agencies for the same tokens. I wouldn’t be surprised to see a similar lawsuit by the SEC naming all the same tokens except BTC as securities.”

--With assistance from David Pan.

©2023 Bloomberg L.P.