Crunch is an interesting proposition, especially for the likes of freelancers, contractors, those who are self-employed and small business owners especially during the ongoing coronavirus crisis. The company now has Crunch Free too, an entry-level online accounting software package that supplements its paid-for options.

It’s not a one-stop accounting solution however, even though using their online outlet is one part of the process. In fact, along with that you also get to work hand-in-hand with their accountancy advisors, so you get the benefit of a decent online solution as well as having the bonus of being able to check things over with real people.

For some this might be the ultimate solution as it combines the convenience of an online software service with the back up of capable advisors. However, you might also want to look at alternatives, such as Sage Business Cloud Accounting, QuickBooks, Xero, FreshBooks, Freeagent, GoSimpleTax, TaxCalc, Nomisma, ABC Self-Assessment or Zoho Books.

- Want to try Crunch? Check out the website here

Crunch: Pricing

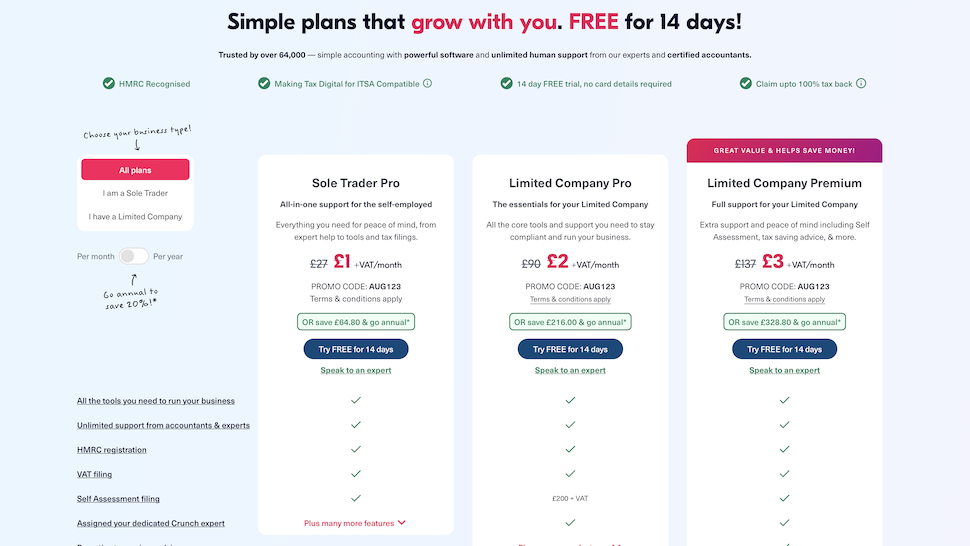

Alongside its free edition, Crunch currently comes in four different pricing tiers, but the company has removed its Crunch One plan which used to offer business owners the opportunity to pay 1% of their earnings (plus tax) in exchange for the accounting software's upgraded features (up to an annual cap).

That flexibility, where you pay nothing if you earn nothing, will be sorely missed.

Now, the first paid plan involves forking out a set fee of £27+VAT every month. For this, you get Sole Trader Pro, which adds unlimited expert and accountant support, HMRC registration, VAT filing, and Self Assessment filing.

Limited Company Pro, at £90+VAT per month, gets larger firms their own dedicated Crunch expert, but Self Assessment filings are not included so users will need to cough up £200+VAT for these.

Either that, or upgrade to Limited Company Pro which includes Self Assessment filing for £137+VAT/month. It also adds other features, like director payroll, IR35 support and more.

For £140+VAT per month, Premium Plus can link to ecommerce accounts and give you access to dedicated accountants and experts.

Upgrading is more of a challenge that it should be, with Crunch preferring to set you up with a phone consultation rather than making it a quick online transaction. It involves sharing some basic information and waiting for a call back, which isn't necessarily always instant.

Crunch: Features

Crunch comes bristling with oodles of rock-solid features that aim to get you through your accounting and financial management chores without too much pain. The feature set is essentially a two-pronged arrangement in that there are real humans that you speak with over the phone, or by email, and then there is the Crunch web interface, that is accessed online.

By combining these two features you’ll find that Crunch is a great solution for anyone running their own business who might need some human intervention as they navigate their finances.

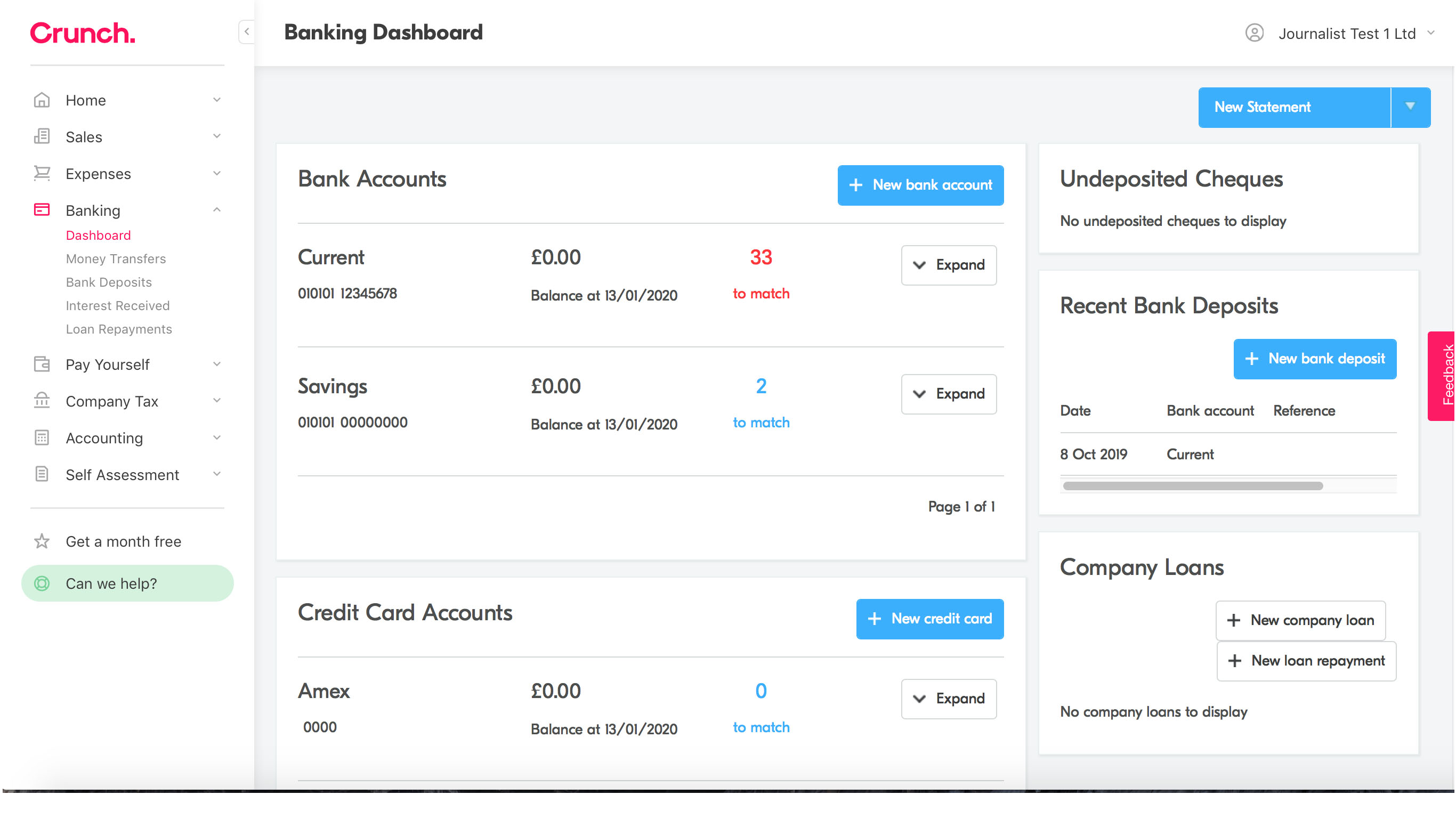

That web interface comes packed with features and functions, including tools for invoicing, expense tracking, bank reconciliation (via live feeds for 17 supported UK banks or manual uploading), but you can also access all of this via the mobile app, which includes all the core functionalities but we feel it could be better optimized for a streamlined mobile experience.

For finances, it's great, but more advanced bookkeeping functions like stock control and cash-flow forecasting aren't Crunch's strongpoint.

Besides the technical support (more on that below), paid plans get you access to human accountants, which can be contacted at the drop of a hat. This makes Crunch one of the most powerful tools in its class, because any queries or qualms can be personally addressed to your own situation.

Crunch: Performance

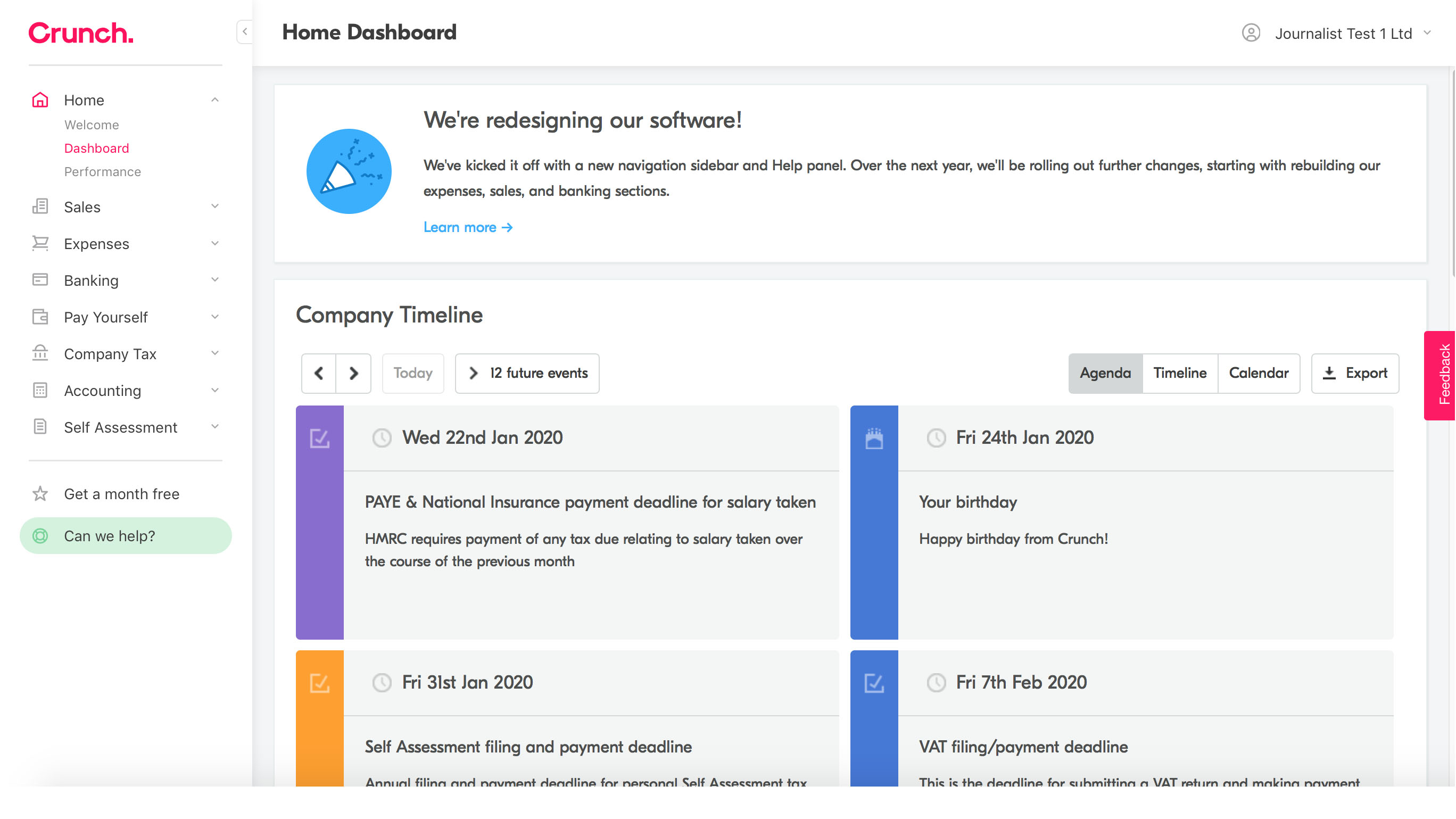

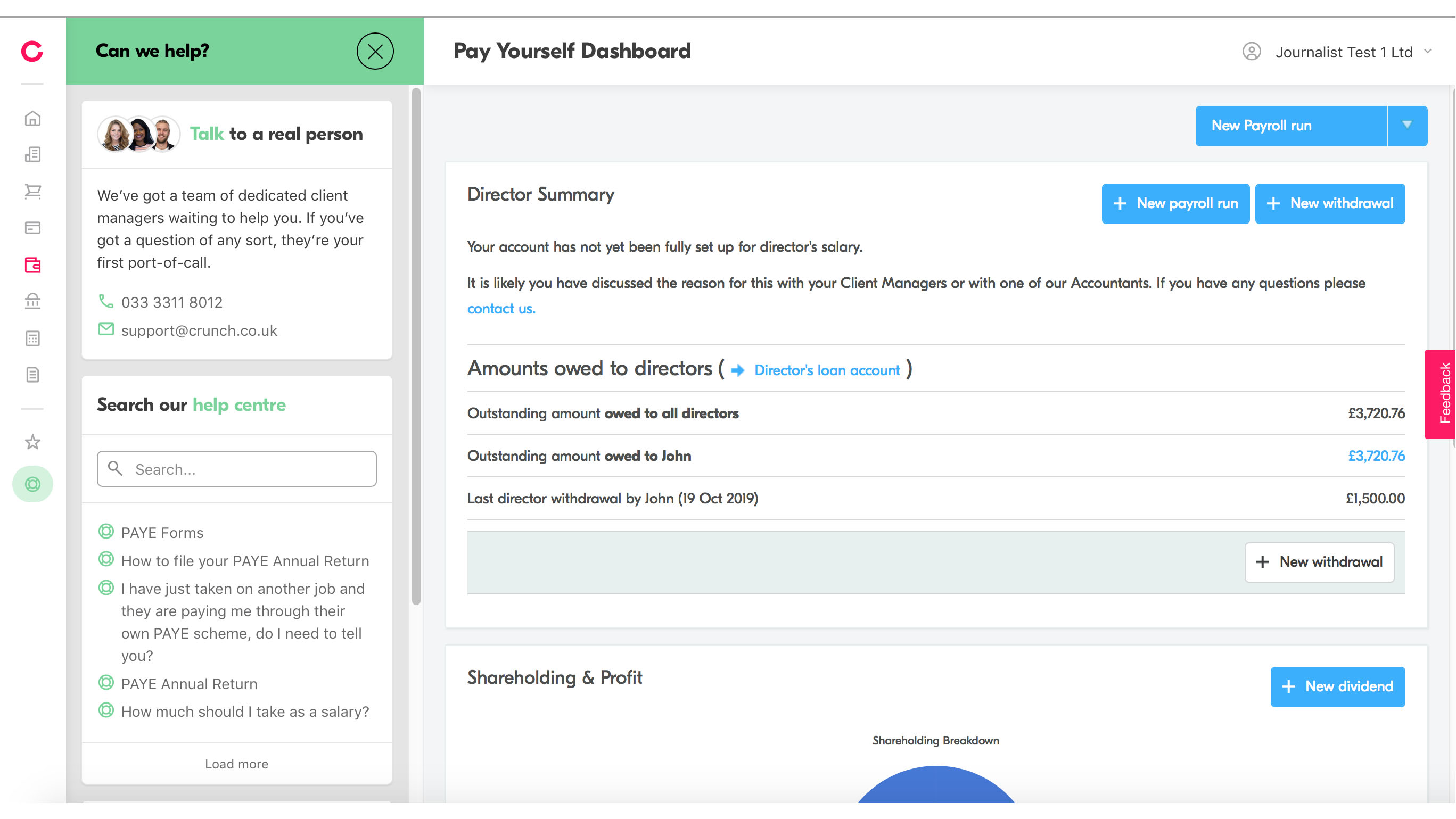

We found Crunch to be very impressive when working in and around the main dashboard space. The design seems to have been very carefully thought through, meaning that the workspace is clean and efficient.

Crunch is also currently enjoying some ongoing revisions too, so improvements are appearing all the time it seems. Being an online web-based arrangement you’ll obviously need to be connected to the internet in order to work within Crunch.

Plus, the other bonus is that should you encounter any performance issues along the way then you’ll be able to contact one of your support advisors to get reassurance or help if anything seems to have gone awry.

There appear to be two views available simultaneously – the Classic view has a less attractive, more text-heavy approach, while the Beta option shows a more simplistic interface filled with colour. In some cases, particularly using the Safari browser, we found that some actions required one of the two modes to work, but given the toggle is available, it's clear this is still a work in progress.

There's a distinct lack of automation or bulk editing, so customers will have to get used to manual entry unless some fields can be pre-populated with integrations or simple rules.

Crunch: Ease of Use

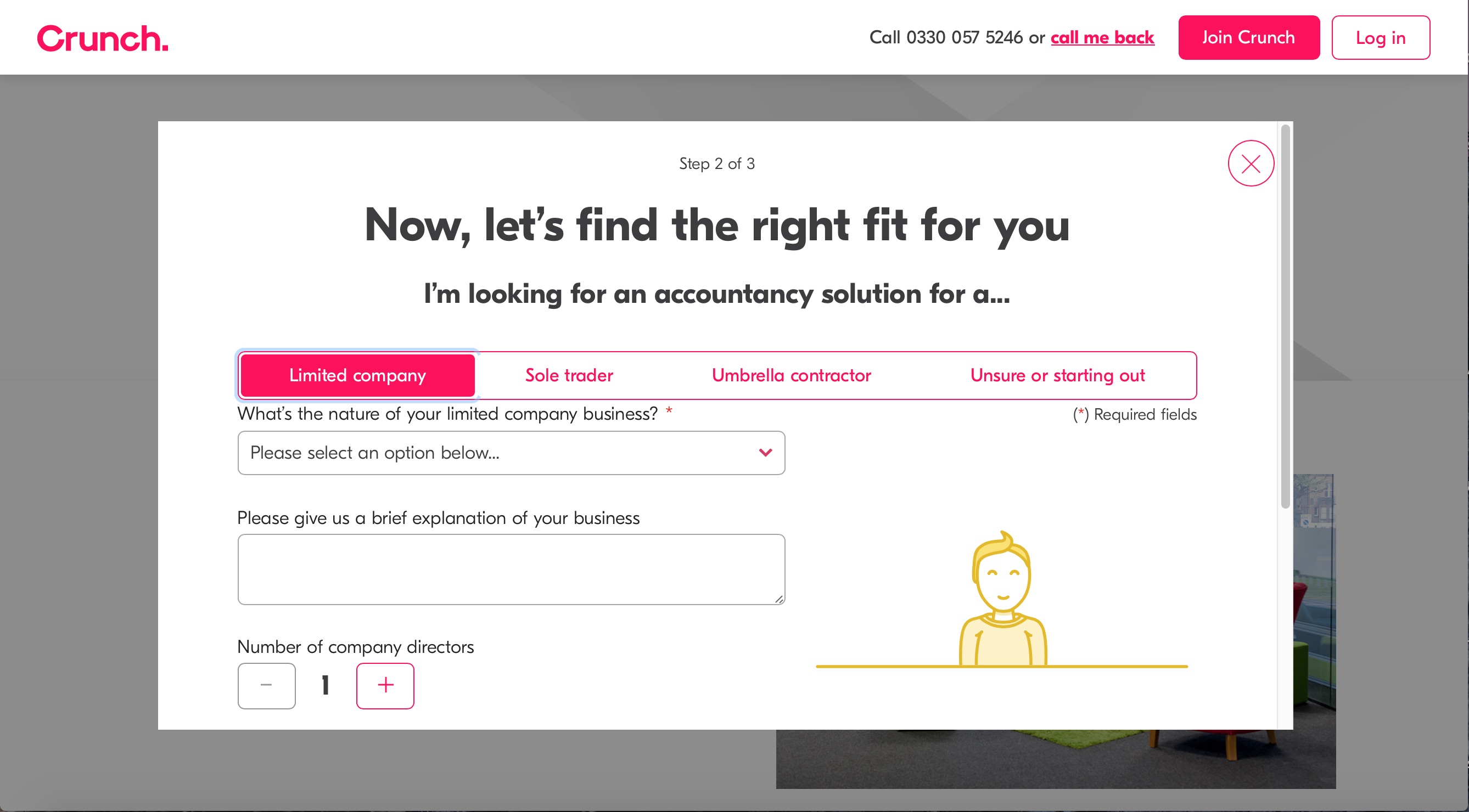

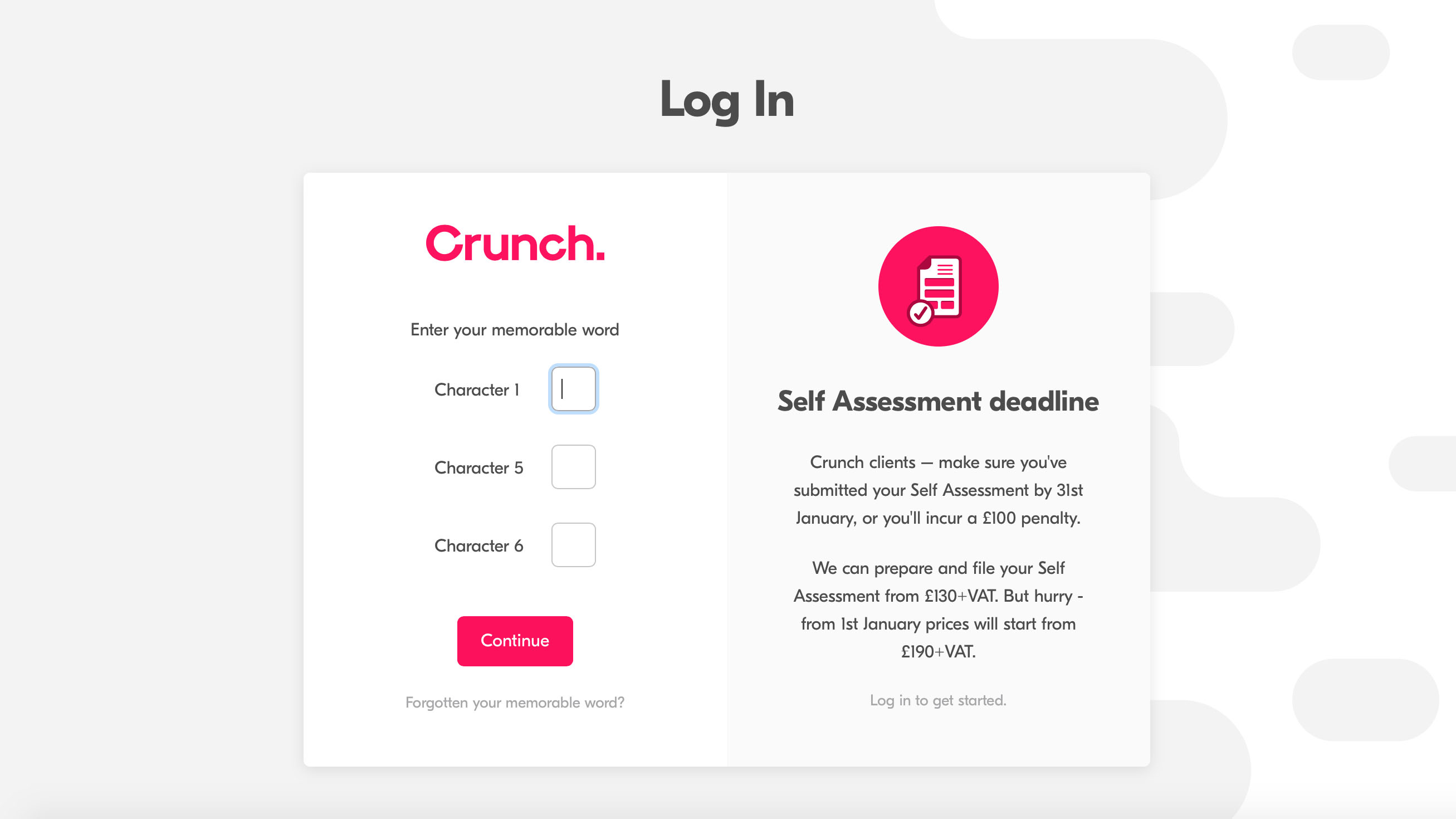

Crunch has a very decent website that is certainly intuitive, especially when you're first setting things up. Once you’ve got all of your login information sorted and an account set up you’ll be taken into the main online dashboard area.

The setup does lack some handy import tools or wizards, making it harder to migrate or onboard data if you're moving from a different provider.

Still, the attractive dashboard lays out all your core options in an easy-to-master interface. The main menu options are listed to the left of the screen, and these work in hierarchical fashion, so you can drill down through their individual features as and when you need to.

As for the main workspace across the page; this is also nicely laid out and showcases even numbers-heavy content such as bank transactions and expenses. Getting around these areas is, therefore, pretty enjoyable on the whole.

Crunch: Support

You’ll find that support is never far away when you’re in the Crunch zone. Indeed, within the interface itself you can navigate to a dedicated chat button on the lower left side of the service. A big part of the Crunch experience is having that support of real people, and you can do this with ease, via the phone.

There’s also an email address if you’d prefer to get things down in writing. Meanwhile, a searchable help centre area covers many of the more obvious questions about accounting and more besides. Remember too that you’ll also get a bit of an initial primer from a Crunch advisor, which acts as a great introduction to the service and website interface.

Equally, it also provides you with a perfect opportunity to ask any questions that you might have beforehand, prior to dipping into the Crunch workspace.

Crunch: Final Verdict

All in all, Crunch makes for a very capable accounting package that delivers the best of both worlds on the bookkeeping front.

Its distinctive offer of straightforward UK accounting and tax software, alongside direct access to human accountants on paid plans, makes it a powerful option for freelancers, contractors or small limited companies seeking support without hiring an external (and pricey) accountant.

You can organize an introductory chat with an advisor, which helps you decide which package is right for you and that support continues throughout your subscription time.

Adding to the value is the web-based interface, which comes fully featured and proves to be simple and straightforward to navigate. Indeed, the usability factor within Crunch seems very good indeed, with even more complex areas enjoyable simple to pick through.

Top it all off with lots of support structure and Crunch is well worthy of investigation. It might not be the cheapest out there, but you do get quite a lot for your money.

- We've also highlighted the best budgeting software