There are two key “outside markets” that commodity traders monitor closely to help them determine the daily price direction of their own markets: crude oil (CLU25) and the U.S. dollar index ($DXY). Lately, both crude oil and the USDX have been trending up. September Nymex crude oil futures today hit a five-week high. The U.S. dollar index today hit a two-month high.

Most market watchers agree that when oil prices are trending up, it is a rising tide that lifts all commodity market boats. Crude oil is arguably the leader of the raw commodity market sector. The impact on raw commodity markets’ prices from an up-trending U.S. dollar index is a bit murkier.

Let’s dig a little deeper into these two key outside markets, including their likely price trajectory in the coming weeks and months.

U.S. Dollar Index Showing Early Signs That a Price Bottom Is in Place

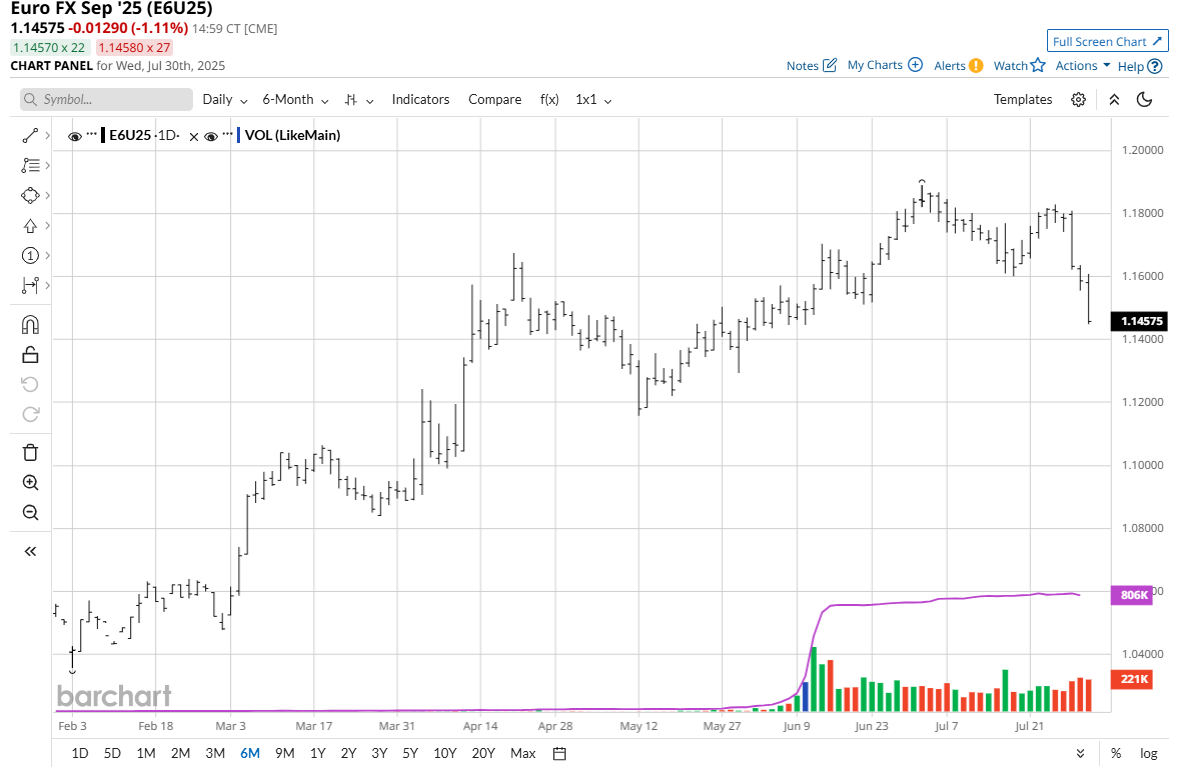

The U.S. dollar index (a basket of six major currencies weighted against the greenback) bulls are gaining technical strength after prices today hit a two-month high and are trending higher on the daily bar chart. The Euro currency (E6U25), a major component in the U.S. dollar index mix, today hit a nearly six-week low. Generally upbeat U.S. economic data recently, including today’s second-quarter gross domestic product report, as well as U.S. trade deals with other countries that are starting to fall into place, have boosted the USDX to begin to suggest it has put in a price bottom.

It has been argued an appreciating U.S. dollar is bearish for U.S. commodity markets. Most major commodities are priced in U.S. dollars. An appreciating dollar means those commodities are more expensive to purchase in non-U.S. currency. To counter that notion, I would argue a stronger dollar suggests a stronger U.S. economy, therefore meaning better domestic demand. And a healthy U.S. economy also helps other major global economies, who export to the U.S. Better exports to the U.S. from those other countries mean they, too, have stronger economies and have better demand for global goods and services. A higher USDX on any given trading day may be an excuse for traders to give when commodity markets are trading lower on that day. However, it’s my bias that a stronger U.S. dollar, overall, is more bullish for commodity markets than it is bearish.

Price trends in the currency markets tend to be stronger and longer-lasting than price trends in other markets. It appears the USDX is embarking on a price uptrend that is going to last quite a while, mainly due to a strong U.S. economy.

Crude Oil Technicals Are Bullish, But Fundamentals Are a Mixed Bag

With September Nymex crude oil futures today hitting a five-week high, a price uptrend on the daily bar chart that has been in place since the April low, is being extended. There is strong chart resistance at the June high of $75.98, which will be a tough nut to crack on the upside.

Fundamentally, solid U.S. economic growth and an improving Chinese economy suggest more demand for energy from the world’s two largest economies. That’s bullish.

On the potentially bearish side, any improvement in U.S. relations with Iran, such as a deal on monitoring Iran’s nuclear program, could put significantly more barrels of Iranian oil into the world market — up to 500,000 more barrels a day. Iran’s crude oil exports have been heavily sanctioned, led by the U.S.

It’s my bias that crude oil prices may challenge the June spike high of $75.98 in the coming months but are not likely to stay above that level for long. More likely is a trading range between $62.50 and $72.50 in Nymex crude oil futures. Of course, a major and unexpected geopolitical shock, especially in the Middle East, would throw my estimation right out the window.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.