/Salesforce%20Inc%20logo%20on%20phone-by%20Poetra_RH%20via%20Shutterstock.jpg)

Valued at $239.7 billion, Salesforce (CRM) has established itself as the leading player in the customer relationship management (CRM) market. The company had a slow start to the year, with the stock rising just 3.1% over the last 52 weeks. Despite strong results in the second quarter of fiscal 2026 that highlight both financial momentum and the scope of its artificial intelligence (AI) transformation, CRM stock is down 25% year-to-date (YTD).

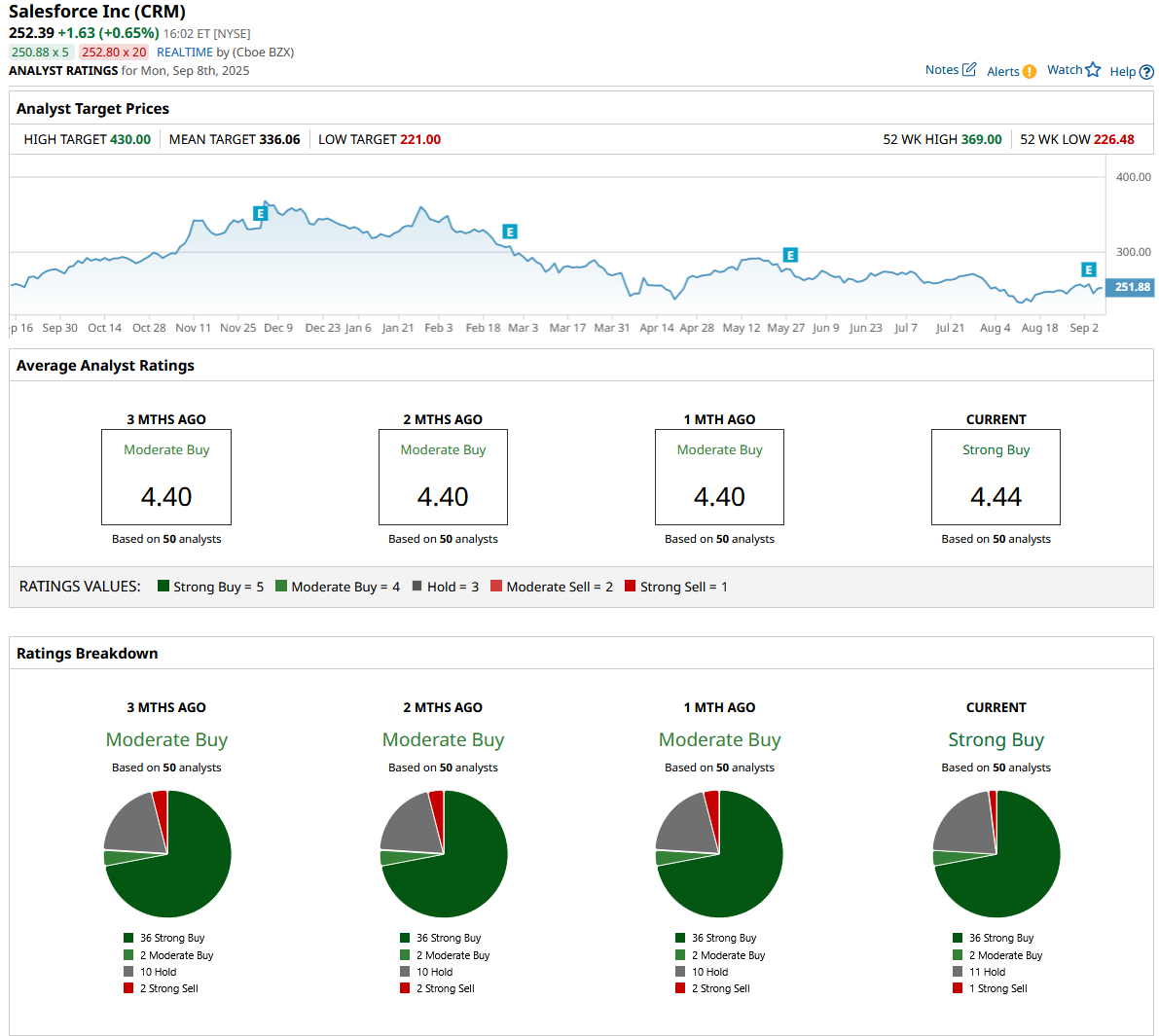

Nonetheless, Wall Street believes the stock has the potential to rally by 71% over the next year. Let us find out why.

Salesforce's Financials Remain Strong

Salesforce's CRM platform enables businesses to manage how they interact with customers, from marketing and sales to customer service and analytics, all through the cloud. The company makes money mainly from subscription fees for its cloud software, which contributes the most to its revenue. In the second quarter, revenue of $10.25 billion increased by 10% YoY, driven by an 11% increase in subscription and support revenue. Earnings increased by 33% to $1.96 per share. Net new bookings from deals exceeding $1 million increased by 26%, boosted by wins with Dell (DELL), Marriott (MAR), Eaton (ETN), U.S. Bank (USB), Japan Post Bank, Lululemon (LULU), and the U.S. Army.

The company's remaining performance obligations (CRPO) rose to $29.4 billion, up 11% YoY. The AI and Data product line experienced 120% growth, highlighting how important artificial intelligence (AI) has become to Salesforce's business model. Adjusted operating margin increased to 34.3%, marking the tenth consecutive quarter of margin expansion.

Last year, Salesforce launched its AI platform, Agentforce, with the goal of empowering organizations with AI agents that work alongside humans. Salesforce has signed over 6,000 paid deals (12,500 total), with 40% of new bookings coming from existing customers. CEO Mark Benioff believes that this is not just automation; it is a complete transformation of business operations. While Agentforce is gaining traction, Data Cloud remains the cornerstone of Salesforce's AI strategy, which is already worth $7 billion. In the quarter, Data Cloud increased its customer base by 140% YoY, with more than half of the Fortune 500 already using the platform. In particular, management highlighted how FedEx (FDX) has used Data Cloud to unify data across its platforms. FedEx has already seen a double-digit increase in customers signing contracts and beginning shipments thanks to AI-powered automation.

Salesforce's strategy continues to include both the private and public sectors. The U.S. government is its largest customer, with a multibillion-dollar footprint that includes the Veterans Administration, the Coast Guard, and now the Department of Defense. Investors can get more insight into Salesforce's update on Agentic Enterprise at its annual Dreamforce event, which will be held from Oct. 14 to 16. The company intends to show off not only the new ITSM product but also AgentForce version 4, as well as case studies from customers, including Dell, FedEx, Accenture (ACN), Williams Sonoma (WSM), Pfizer (PFE), and OpenAI.

Financial Growth With Capital Discipline

The company recently acquired Convergence.ai, Bluebirds, and Y, and has signed a definitive agreement to acquire Regrelo. These agreements are intended to strengthen Salesforce's AI and data capabilities. Meanwhile, the much-anticipated Informatica acquisition is expected to close in fiscal 2026 or fiscal 2027. Salesforce continues to strike a balance between investment and shareholder returns. In the second quarter, the company returned $2.6 billion in buybacks and dividends, bringing the total amount returned since inception to nearly $27 billion. Furthermore, the board has approved a $20 billion expansion of its share repurchase program, indicating a continued commitment to rewarding investors. With capital expenditure at just under 2% of revenue, free cash flow is expected to grow by 12% to 13%.

For the full-year fiscal 2026, management expects revenue to increase by 8.5% to 9% YoY, between $41.1 billion and $41.3 billion, while analysts anticipate 8.8% growth in revenue and an 11.2% increase in earnings. Furthermore, analysts predict revenue and earnings will increase by 9.1% and 12% in fiscal 2027, respectively. Valued at 19 times forward 2027 earnings, CRM appears to be reasonably valued.

What Does Wall Street Say About CRM Stock?

Overall, on Wall Street, Salesforce stock is a “Strong Buy.” Out of the 50 analysts who cover the stock, 36 rate it a “Strong Buy,” while two recommend a “Moderate Buy,” 11 rate it a “Hold,” and one suggests a “Strong Sell.” Based on the average target price of $336.06, CRM stock has upside potential of about 34% from current levels. Its high target price of $430 suggests the stock could rally 71% over the next 12 months.

With strong revenue growth, margin expansion, and rapid customer adoption, the company is certainly still the market leader. Whether it stays there will depend on execution, scaled adoption, and how well its competitors respond in the rapidly evolving AI-driven CRM market.