Criticism of Brazilian President Luiz Inacio Lula da Silva's economic policies grew on Wednesday, with analysts and a leading newspaper slamming ministers after local markets tanked in the leftist's first two days in office.

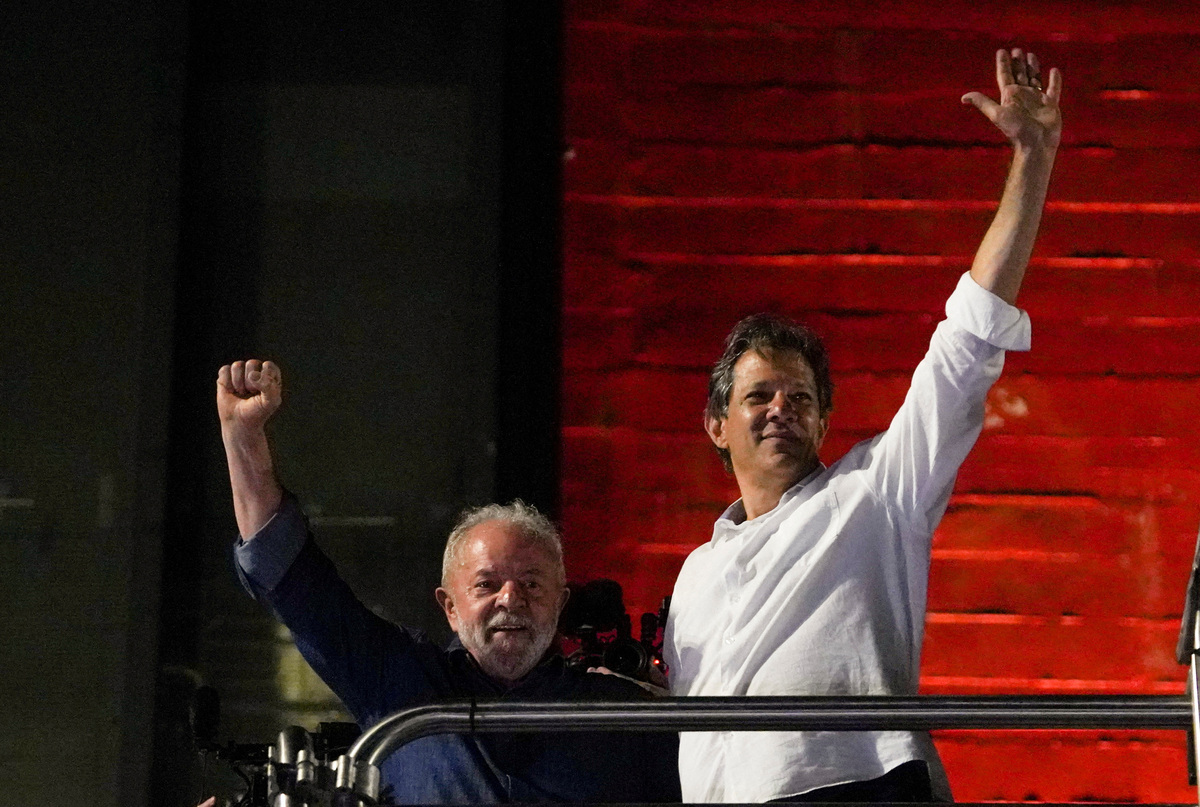

Financial Minister Fernando Haddad, a Lula loyalist who ran a failed presidential bid as the leftist Workers Party candidate in 2018, has been among the main targets, with his hometown newspaper O Estado de S. Paulo dubbing him a "decorative minister" on Wednesday.

Haddad, a former mayor of Sao Paulo, took office vowing to restore public accounts and with the challenge of presenting a credible fiscal framework after Congress passed a giant Lula social spending package.

Lula has said erasing poverty and hunger will be the "hallmarks" of his government, leading to fears of rampant spending and scant fiscal discipline.

Markets reacted badly to Haddad's first days in office, especially after Lula ordered a budget-busting extension to a fuel tax exemption which Haddad had publicly opposed.

"Haddad learned on his first day in office that he will be a decorative figure, a sort of task worker for President Lula," the conservative daily said in an editorial.

The paper, which did not shy away from criticizing former far-right President Jair Bolsonaro, added Haddad had been "discredited from day one" and should learn to say "no" to Lula.

Analysts at Citi said on Tuesday that despite Lula and Haddad's first speeches in office being consistent with their baseline scenario, both sounded less pragmatic and fiscally responsible than initially thought.

"In general, they have given off the impression of a government that is tone deaf - at least with respect to the types of tones that financial markets want to hear," FX strategists at BMO Capital Markets told clients, adding that their comments could lead to a situation in which "inflation will reassert itself and rate cuts will be out the window."

The Brazilian real has fallen by 3.8% against the dollar in the last three sessions, hitting its lowest level since July 2021, while the benchmark stock index Bovespa has dropped roughly 5% so far this year.

On Tuesday, markets were further rattled by remarks by Lula's social security and labour ministers.

Minister Carlos Lupi baffled the market with his comments that the country's social security system was not in deficit, despite Treasury figures showing an accumulated January-November deficit of 267.9 billion reais ($49 billion).

That was compounded when he said Lula's government would need to review the investor-friendly pension reform approved by Bolsonaro's administration.

Labor Minister Luiz Marinho, a critic of a 2017 labour reform approved under former President Michel Temer, said the new administration would prioritize regulating working relations established through cell phone apps and digital platforms.

Their remarks showed "the government remains in the path of reversing liberal reforms passed by the last two presidents," analysts at Guide Investimentos said.

($1 = 5.4797 reais)

(Reporting by Gabriel Araujo; Editing by Nick Zieminski)