Cracker Barrel Old Country Store Inc. (NASDAQ:CBRL) has seen its stock plummet 12.5% over the last five days, including a sharp 7.15% drop on Thursday, as the company grapples with fierce public backlash over its recent rebranding.

The significant sell-off was preceded by a surge in bearish bets against the company, with new data revealing that short sellers had been aggressively increasing their positions for months.

Check out CBRL’s stock price here.

Institutional Traders Anticipated The New Logo Backlash?

The market turmoil coincides with Cracker Barrel’s decision to unveil its first new logo in over 40 years, a move that has been widely criticized on social media as “woke” and has drawn comparisons to Bud Light’s controversial marketing campaign.

The backlash was amplified by prominent figures like Donald Trump Jr., sparking threats of customer boycotts.

This negative sentiment appears to have been anticipated by institutional traders. According to financial analytics firm S3 Partners, short interest in Cracker Barrel has been building steadily.

The firm noted that “shorts started adding early in 2025 before the convertible issuance in June and accelerated after.” This increased bearish activity created a volatile environment for the stock.

CBRL’s Long-To-Short Ratio Halved Before Major Sell-Off

A key metric highlighted by S3 Partners underscores the shifting momentum. “The Long-to-Short ratio has compressed from 2.3x at the start of the year to ~1.4x,” S3 stated, “signaling increased volatility and conviction on both sides.”

This compression indicates that while long-term investors were losing confidence and selling shares, short sellers were doubling down on their bets that the stock price would fall.

The combination of a controversial corporate decision and predictive trading data created a perfect storm for the iconic brand.

While Cracker Barrel’s CEO claimed feedback on the new logo was “overwhelmingly positive,” the sharp stock decline and the preceding surge in short interest tell a different story, leaving the company’s recently raised financial outlook in jeopardy as it braces for a potential hit to its customer base.

Price Action

After a 7.15% fall on Thursday, the stock was up 0.23% in after-hours. It declined 12.46% in the last five sessions, 19.60% in a month, and 0.22% year-to-date. However, it was up 34.05% over the past year.

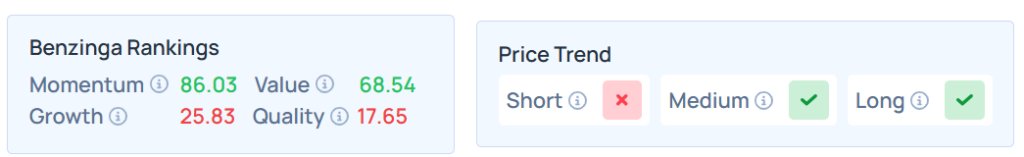

Benzinga’s Edge Stock Rankings indicate that CBRL maintains a stronger price trend in the medium and long terms but a weaker trend in the short term. The stock scores well on the value rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell on Thursday. The SPY was down 0.40% at $635.55, while the QQQ declined 0.46% to $563.28, according to Benzinga Pro data.

On Friday, the futures of the S&P 500, Dow Jones, and Nasdaq 100 indices were trading mixed.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Jonathan Weiss via Shutterstock