Cracker Barrel Old Country Store Inc. (NASDAQ:CBRL) shares jumped 7.09% in after-hours trading on Tuesday after the restaurant chain partially reversed its controversial logo rebrand amid political pressure and presidential commentary.

Check out the current price of CBRL stock here.

Trump Weighs In, Stock Responds

President Trump took to Truth Social on Tuesday, advising Cracker Barrel to “go back to the old logo” and calling the controversy “a billion dollars worth of free publicity.” The Republican Party’s official X account amplified Trump’s message with “Make Cracker Barrel A Winner Again!”

According to Benzinga Pro, the Tennessee-based restaurant chain and country store, closed regular trading on Tuesday at $57.71, up 6.35%, before surging to $61.80 in after-hours trading. The stock trades within a 52-week range of $33.85-$71.93, with a market capitalization of $1.29 billion and price to earnings ratio of 22.40.

See Also: OpenLedger To Launch OPEN Token In September After Raising $15 Million For On-Chain AI Models

Logo Reversal Strategy

Today, following customer backlash, Cracker Barrel announced its new logo “is going away” while the traditional “Old Timer” character will remain. The company stated on X: “We said we would listen, and we have.”

The restaurant chain initially defended the rebrand but reversed course after conservative criticism, including comments from Donald Trump Jr. questioning the company’s direction under CEO Julie Felss Masino.

Board Member Under Scrutiny

Conservative activist Robby Starbuck targeted Board Director Gilbert Davila, CEO of DMI Consulting, a diversity and inclusion firm since 2010. Davila joined Cracker Barrel’s board in July 2020, sparking questions about the company’s strategic direction.

Earnings Impact Ahead

The country dining chain, known for Southern hospitality, is expected to report fourth-quarter results in September. Analysts will likely probe traffic impacts from the controversy and potential boycotts. The company showed 1.0% comparable store growth in the third quarter, marking four consecutive quarters of positive growth, while beating earnings per share estimates but missing revenue forecasts.

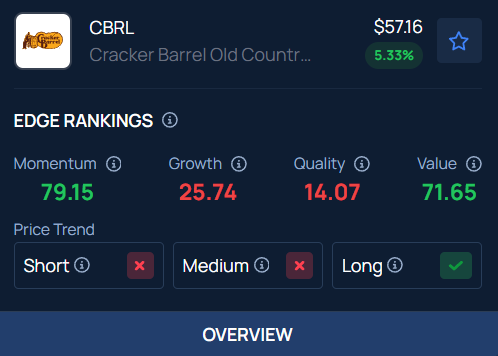

Benzinga’s Edge Stock Rankings indicate that CBRL has a Momentum score of 79.15. Here is how the stock fares on other parameters.

Read Next:

Photo: Ken Wolter / Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.