With a market cap of $418.5 billion, Costco Wholesale Corporation (COST) is a global operator of membership warehouses that offer a wide selection of branded and private-label products across diverse categories at discounted prices. The company generates revenue primarily through store sales and membership fees while also operating e-commerce platforms and ancillary services worldwide.

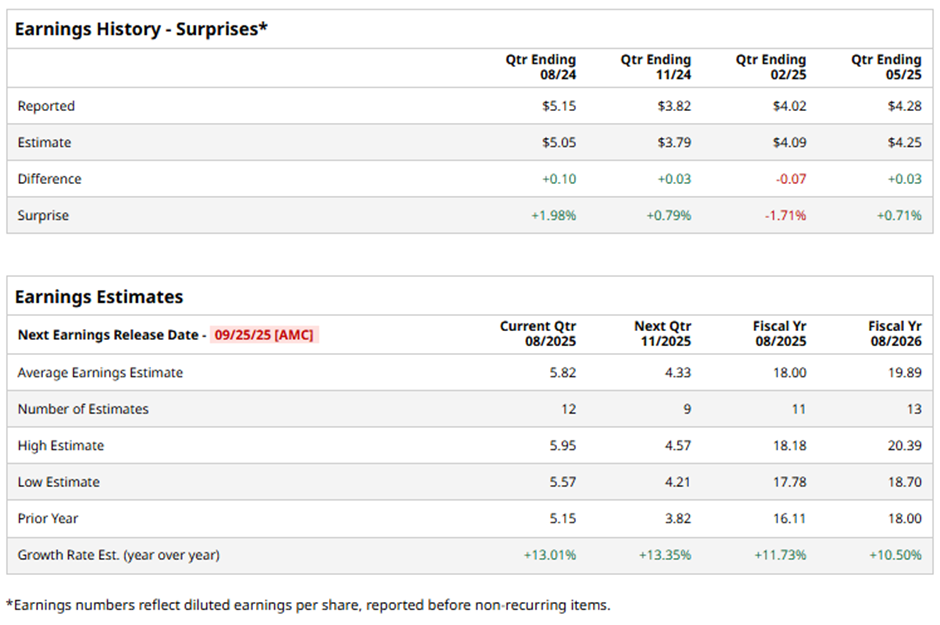

The Issaquah, Washington-based company is scheduled to release its Q4 2025 results after the market closes on Thursday, Sept. 25. Ahead of the event, analysts project an EPS of $5.82 for the quarter, reflecting more than 13% growth from $5.15 a year earlier. The warehouse club operator has surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

Moreover, analysts expect full-year fiscal 2025 EPS to rise 11.7% to $18 from $16.11 in fiscal 2024.

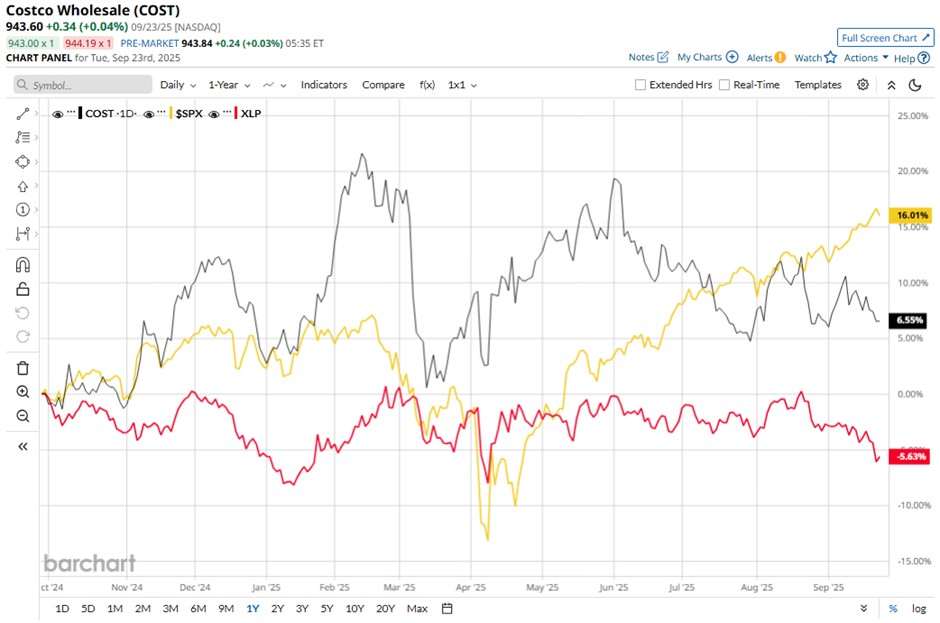

Shares of Costco Wholesale have risen 2.9% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 16.4% return. However, the stock has outpaced the Consumer Staples Select Sector SPDR Fund’s (XLP) 5.7% decrease over the same period.

Despite posting better-than-expected Q3 2025 EPS of $4.28 and revenue of $63.21 billion on May 29, Costco shares dipped marginally the next day. Gross margin, though up to 11.3%, was negatively impacted by a $130 million LIFO charge and higher SG&A expenses, which rose to 9.2%. Additionally, FX headwinds shaved $35 million off international income, and concerns around slightly lower renewal rates for digital memberships.

Analysts' consensus view on COST stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 34 analysts covering the stock, 15 recommend "Strong Buy," four suggest "Moderate Buy," and 15 advise "Hold." This configuration is slightly less bullish than three months ago, with 16 analysts suggesting a "Strong Buy."

The average analyst price target for Costco Wholesale is $1,092.44, indicating a potential upside of 15.8% from the current levels.