/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

Shares of CoreWeave gained substantially from its initial public offering (IPO) price of $40, reflecting the significant demand for its offerings. However, CRWV stock recently took a sharp hit, sliding about 34% from its peak of $187.

The company provides cloud infrastructure optimized for accelerated computing, supplying enterprises and leading artificial intelligence (AI) labs with the GPUs, CPUs, high-speed networking, and storage needed to power cutting-edge applications. CoreWeave combines purpose-built hardware with proprietary software and services, creating a full-stack platform tailored for AI workloads. Demand for this type of infrastructure has been explosive, which helps explain why the stock has soared from its IPO price.

However, the expiration of CoreWeave’s post-IPO lock-up period, which allowed insiders and early investors to cash out, weighed on its stock price. At the same time, uncertainty around its pending acquisition of Core Scientific (CORZ) has added caution. CoreWeave is also in the middle of a massive infrastructure build-out, pouring capital into new capacity that takes time to translate into revenue. While this expansion is critical for capturing market share in a fast-growing sector, it also means margins could feel a pinch in the near term.

CoreWeave’s Growth Momentum Remains Strong

Still, the company’s growth numbers are hard to ignore. CoreWeave recently crossed the billion-dollar revenue threshold for the first time, reporting $1.21 billion in the latest quarter, up 207% from a year ago. Profitability is also moving in the right direction with adjusted EBITDA rising to $753.2 million from $249.8 million last year, while adjusted operating income more than doubled to $199.8 million.

Looking ahead, CoreWeave projects revenue between $1.26 billion and $1.30 billion. Moreover, it raised its 2025 guidance for the second quarter in a row. Management now projects $5.15 to $5.35 billion in revenue next year, up from a prior forecast of $4.9 to $5.1 billion.. The upgrade reflects robust customer demand and expanding infrastructure, along with a solid backlog of orders that provide visibility into future growth.

CoreWeave Is Building a Durable AI Growth Story

CoreWeave’s long-term trajectory remains strong as it rapidly scales to meet surging AI demand. The company expects to deliver more than 900 megawatts of active power by year-end, supported by rising orders and an expanding client base.

At the end of Q2, CoreWeave reported a $30.1 billion contracted backlog, up $4 billion from the prior quarter and more than double its level earlier this year. Key drivers include a $4 billion expansion deal with OpenAI, new partnerships with AI startups, and expansion contracts with both of its hyperscale customers. This broad and diversified pipeline reflects robust demand across industries.

Its networking services are also gaining traction. One of the largest AI labs now uses CoreWeave’s infrastructure to connect a multi-cloud inference system, highlighting the company’s growing relevance in high-performance AI workloads. Upcoming product rollouts are expected to further accelerate growth.

Further, its strategic acquisitions will likely accelerate its growth. The acquisition of OpenPipe, a leader in reinforcement learning, deepens vertical integration and expands CoreWeave’s tools for developers. Combined with other deals, including Weights & Biases and the pending Core Scientific acquisition, the company is strengthening both its infrastructure and AI capabilities.

An agreement with Nvidia (NVDA), valued at $6.3 billion, provides additional upside. Under the deal, Nvidia will purchase any unused cloud computing capacity through 2032, giving CoreWeave a safety net while securing capacity for one of the world’s largest AI players.

On the financing side, CoreWeave is diversifying its funding sources to lower capital costs. This will support rapid expansion and drive its share price.

Conclusion: A Volatile but Promising Play on AI Infrastructure

CoreWeave’s recent 34% decline reflects short-term pressure. However, the long-term trajectory remains intact. With soaring revenue growth, expanding partnerships, and a robust backlog, CoreWeave is building a durable AI-driven business.

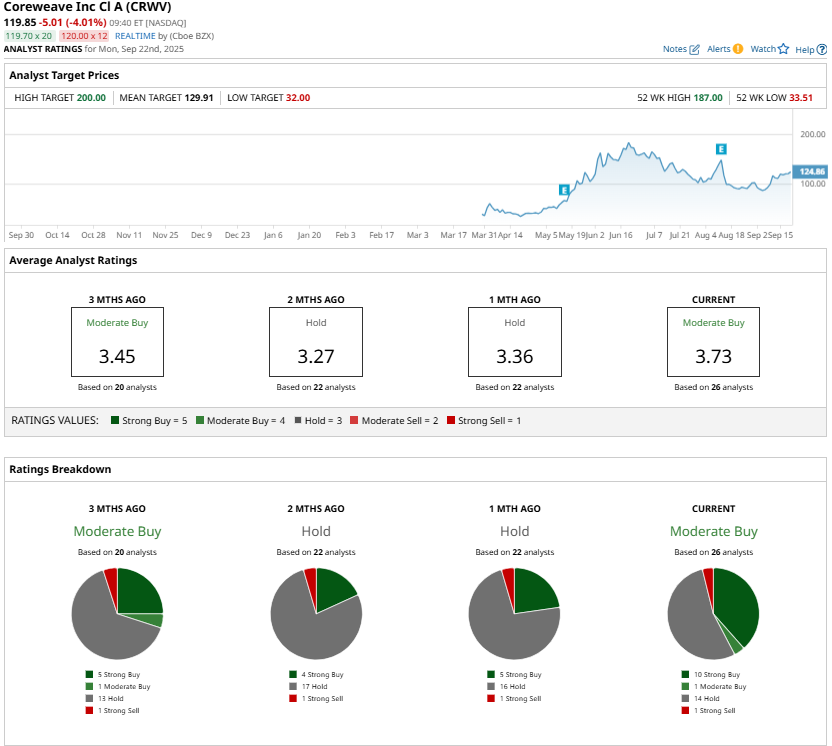

That said, the stock will likely remain volatile as the company invests aggressively and integrates acquisitions. While analysts have a “Moderate Buy” consensus on CRWV, the pullback presents a solid entry point for long-term investors to capitalize on the growing investment in AI infrastructure.