On Tuesday, 209 NYSE stocks hit new 52-week highs, compared to just 43 hitting new 52-week lows. On the Nasdaq, 393 stocks reached new 52-week highs, while 70 hit new 52-week lows.

There is no question that the near-term consensus on stocks is bullish. Further afield, it’s anyone’s guess once the effect of tariffs kicks in.

One of the 43 stocks on the NYSE that hit new 52-week lows yesterday was Conagra Brands (CAG), a struggling branded food company. Tuesday’s new 52-week low was the 46th of the past 12 months. CAG stock now sits at a 10-year low.

If you’d never heard of the Chicago company and I told you that you could buy its stock for less than 10 times its 2026 earnings per share estimate of $1.87--the S&P Consumer Staples forward 12-month P/E ratio is 22.1x--there’s a good chance you’d consider it a value play for further consideration.

However, the near-term technicals suggest that Conagra’s stock is a strong sell, and more likely a value trap than a value buy.

Here’s an argument for both.

Value Destruction Is Conagra’s Middle Name

If you go to the company’s investor relations site, you’ll see the following headline and subheading:

“Creating Shareholder Value Through Innovation: Focused on results, we’re transforming our portfolio, capabilities and culture.”

Really?

Over the past 20 years, CAG stock has declined by 5.5%, compared to a 442% gain for the S&P 500. That’s classic value destruction in my books. This return doesn’t include dividends. Over the past 10 years, CAG stock declined by 42%, but its annualized total return, which does include them, was 0.78%, a slightly less pronounced display of poor performance.

Of the 17 analysts covering its stock, just two rate it a Buy (2.94 out of 5), with a target price of $20.60, which is approximately 13% higher than its current trading price. That’s hardly enough upside to get most investors to fork over their hard-earned capital.

According to S&P Global Market Intelligence, Conagra’s fiscal 2005 (May year-end) revenue was $11.38 billion; in 2025, it was $11.61 billion, representing a $230 million increase over the 20 years. That’s terrible growth.

A long-time shareholder would point out that this has happened, in part, because of divestitures over the years.

For example, the company’s largest divestiture in its history was the 2016 sale of its private-label brands to TreeHouse Foods (THS) for $2.7 billion. This part of Conagra’s business generated annual revenues of $3.6 billion in 2015, so we can add this to the growth calculation. Additionally, it sold Chef Boyardee in early June for $600 million. It had approximately $450 million in annual sales.

Excluding these two divestitures, Conagra’s net revenue growth was 38% over the past two decades. That’s better, but still not great.

The Margins Are Better

Looking at its business with a glass-half-full perspective, its EBIT (earnings before interest and taxes) margin in 2025 was 14.5%, 410 basis points higher than in 2005. In only five of those 20 years was the margin higher than in 2025.

So, the question value tire-kickers have to ask themselves is whether CAG’s valuation multiples deserve to be higher than they currently are.

For example, its TEV (total enterprise value) in September 2005 was 12.38 times EBIT. In September 2025, it is 9.32 times EBIT, about 25% less, despite a higher EBIT margin.

Now, the bearish argument would be that times have changed, and as a result, multiples have deteriorated for what investors are willing to pay for slow-growth legacy food companies.

We’ve seen a similar story from several of these companies in recent times: General Mills (GIS) (down 15% over the past five years), Kraft Heinz (KHC) (down 9%), and The Campbell's Co. (CPB) (down 29%).

The average EV/EBIT multiple for the trailing 12 months for the three peers mentioned above is 11.1 times, about 19% higher than Conagra’s.

So, while there has been multiple erosion across the board, there is some evidence that Conagra’s is slightly overdone.

Assuming an enterprise value of 11.1 times EBIT, like its peers, the enterprise value would be $18.67 billion, based on $8.24 billion in net debt and $10.43 billion in market capitalization.

Based on 479 million shares outstanding, that would value its shares at $21.77, about 20% higher than its current share price.

The Bottom Line on CAG Stock

If you’re an income-focused investor with an additional value bent, Conagra’s share price might be low enough to consider a small bet on its future appreciation.

However, the company stated in its Q4 2025 press release in July that its adjusted operating margin for 2026 would be 11.25% at the midpoint of its guidance, down significantly from 14.1% in 2025. Furthermore, its organic net sales are expected to remain flat compared to 2025, indicating another year of no growth.

It is expected to release its Q1 2026 results on October 1. I doubt that anything it reports will inflict much more damage than has already been done to its share price.

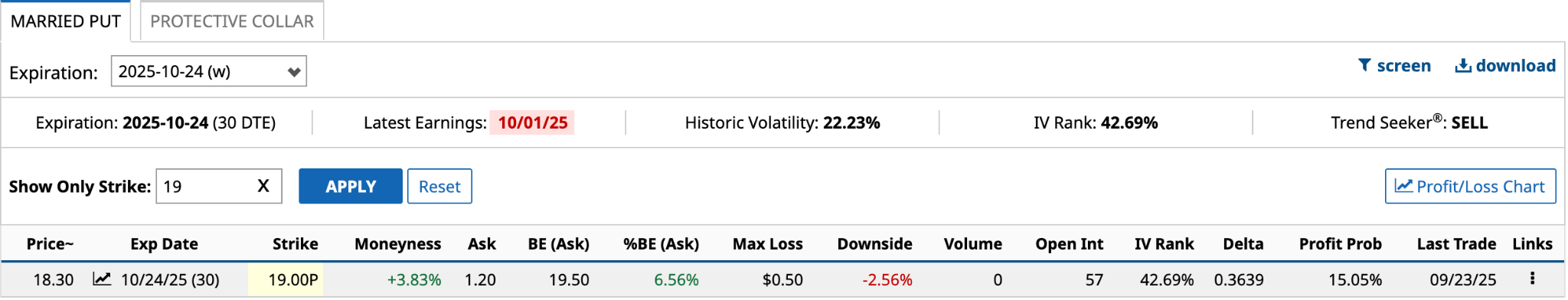

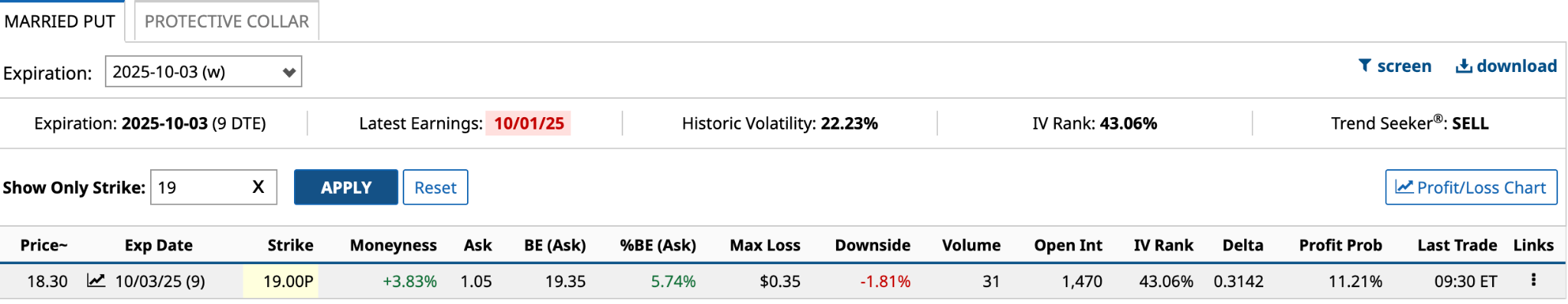

A possible play would be a married put where you simultaneously buy 100 shares of Conagra stock and buy one long put to protect your downside.

The $19 put strike in the above example would cost $105 for one long put and $1,830 for 100 shares of Conagra. The put is ITM (in the money) by 3.83%. Your maximum loss on this play is $35 [$18.30 share price + $1.05 ask price - $19 strike price].

The $19 put strike in the above example would cost $105 for one long put and $1,830 for 100 shares of Conagra. The put is ITM (in the money) by 3.83%. Your maximum loss on this play is $35 [$18.30 share price + $1.05 ask price - $19 strike price].

So, while the downside is less than 2%, the upside is unlimited based on future appreciation of the share price. To do a $19 put with an expiration date that’s further out--say 30 days on Oct. 24--would cost you $120 instead of $105, but would give you 21 additional days of downside protection beyond the Oct. 1 earnings release. Either way, you probably won't get rich off owning Conagra stock unless something drastically positive happens in the next 3-5 years.