As I pondered what to write about this morning, VF Corp.’s (VFC) two unusually active options from yesterday caught my attention, but not for the reasons you might think.

The apparel and footwear company has been working on a turnaround plan for its Vans brand, whose sales have declined significantly over the past couple of years. It’s not going swimmingly.

As is often the case in today’s markets, the call for class action lawsuits has surfaced. It seems in the current environment, U.S. equity investors sue anytime they lose money. It couldn’t be my fault for the loser bet, goes the thinking.

The potential class action centers on the company’s disclosures regarding the steps taken to address Vans' declining sales. The class action lawyers believe management failed to reveal that “an additional set of deliberate actions” had been taken to fix the problems faced by the brand.

However, the cynic in me believes that the 15.8% decline in VF’s share price on May 21, the day the company released its Q4 2025 results, is the driving force for this potential investor litigation.

Since VF announced Bracken Darrell as the new CEO on June 20, 2023, the company’s stock has lost 24% of its value. From its all-time high in 2020, its shares have declined by 86%.

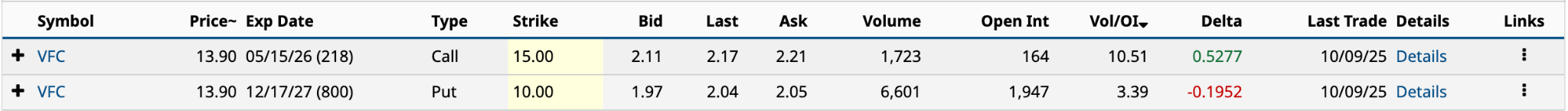

In yesterday’s unusual options activity, VF had two with Vol/OI (volume-to-open-interest) ratios of 1.24 or higher and expiring in seven days or more.

The options provide bullish and bearish investors an opportunity to benefit from the company’s current trials and tribulations.

Here are my two cents on both.

Have an excellent weekend.

My Thoughts on VF

I’ll be honest, I thought Darrell’s hiring was a good move. He’d done a turnaround with Logitech (LOGI), delivering considerable shareholder returns over his 10-year stint before joining VF. I believed he could do the same at the apparel and footwear company.

“Darrell’s hiring is similar to Best Buy's (BBY) recruiting of Hubert Joly in 2012. Joly knew very little about the apparel business. However, he’d been in hospitality for a long time and understood people. Joly’s bold moves saved Best Buy from the scrap heap of retail history,” I wrote on Oct. 17, 2023. “The former Logitech CEO has an opportunity to do the same with VF.”

At the time of my comments, activist investor Engaged Capital was pushing for extreme change at VF. It thought VF’s shares could be worth nearly $50 within three years if it were bold with its turnaround plans.

According to Capital IQ, Engaged continues to hold 5.42 million shares (1.4% of the company) in VF. It has the largest stake among activist investors. It is the activist’s third-largest holding, accounting for 18.81% of its June 30 13F assets. Clearly, Engaged has lost its faith in Darrell.

VF’s Most Recent Moves

On Sept. 15, VF announced that it was selling its Dickies brand to Bluestar Alliance LLC for $600 million, $220 million less than it paid for the workwear brand in 2017.

As I wrote in 2023, one of the activist’s sore points with the company was former CEO Steve Rendle’s failed acquisition strategy, which included buying Dickies and Supreme--it bought Supreme for $2.1 billion in 2024, $600 million less than it paid for it in 2020--while underinvesting in Vans, in large part, due to the hit to the balance sheet.

While it has taken a bath on Supreme and Dickies, these moves were necessary to lower its debt and refocus the overall business. The concern here is that the company invests a significant amount of money in Vans, but it doesn’t translate into a turnaround in the brand’s revenue growth.

That’s business.

I fail to understand why investors who’ve lost money on VF feel the need to sue the company. Sometimes turnarounds take longer than expected. And, unfortunately, they often don’t take, and stocks remain dead money for lengthy periods.

Right now, investors debate whether VF is the former or the latter. I believe it’s the latter.

Breaking it down, VF’s Outdoor segment saw revenues increase by nearly 8% in Q1 2026, compared to a 4.8% decline a year earlier. Meanwhile, its Active segment, which includes Vans, had a 9.9% decline in revenue in the first quarter, 170 basis points less than a year ago.

Things are going in the right direction.

VF’s Unusually Active Put Option

In Wednesday’s trading, VF had one unusually active call and one put.

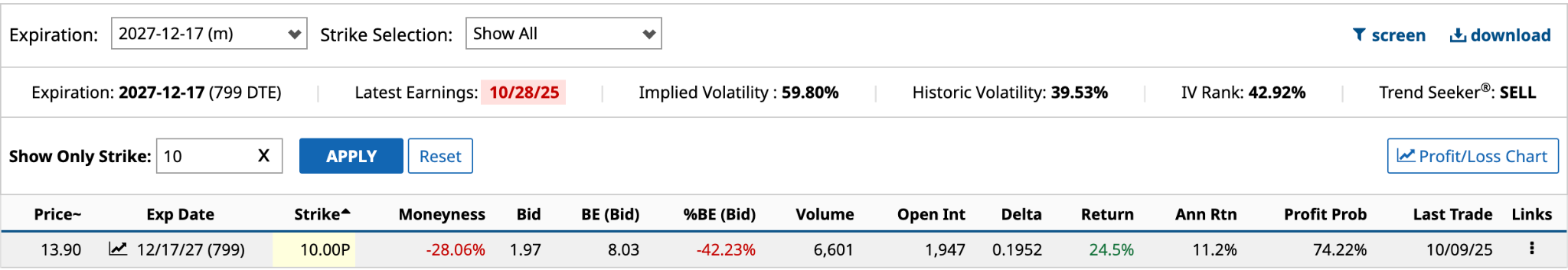

The volume on the put was 3.8 times that of the call. The $10 strike is 28.0% out of the money. With a DTE (days to expiration) of 800 days, the breakeven on the put is $7.95. The likelihood of the share price being below that in 27 months is 25.4%. In other words, there’s a 75% chance the share price won’t fall below $7.95. However, the expected move, up or down, is $7.52 (54.12%) over the 800 days, so there is a possibility that you could make money on the long put, but your chances are slim.

Examining the volume breakdown on the put, there were numerous decent-sized trades, but none exceeding 1,000 contracts or higher, which suggests that both retail and institutional investors may have been selling the puts to generate income. As shown in the chart below, the annualized return is 11.2%.

That’s not half bad if you’re parking money.

VF’s Unusually Active Call Option

VF’s Unusually Active Call Option

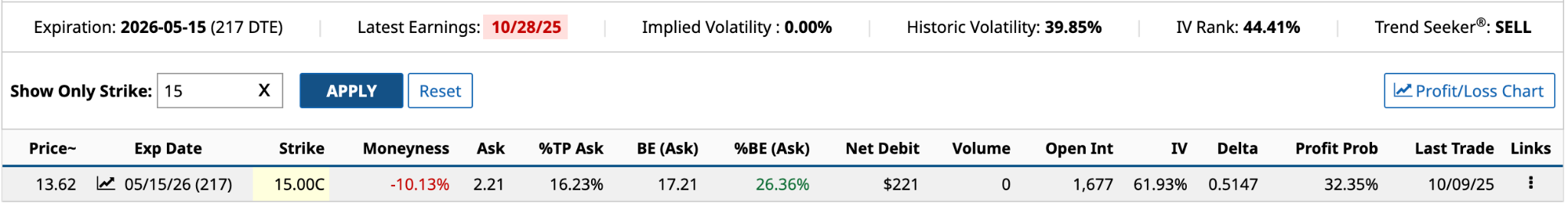

The call, although having a lower volume than the put, had a significantly higher Vol/OI ratio. With a DTE of 218, the duration is longer than average, but not in LEAPS (Long-Term Equity Anticipation Securities) territory, which are one year or longer.

A quick look at the trade sizes of the $15 call shows a significant number of trades between 10 and 50 contracts. To me, it suggests institutions were dipping their toes in VF’s waters, taking a small initial position through calls, rather than buying shares outright.

In the bullish example above, the ask price of $2.21 for the $15 call expiring in 217 days is reasonable at 16.23% of the share price. The likelihood of VF stock trading above the $17.21 breakeven price is 32.35%.

Meanwhile, the expected move is $4.13 (30.33%) over the next 217 days. If you’re debating an investment in VF, going long the $15 strike makes a lot of sense. If it does move up 30.33% to the $17.75 breakeven, you exercise your right to buy 100 VFC shares. If, instead, the shares drop by 30.33%, you’re out $221 instead of $413 per 100 shares if you had bought them outright.

Interestingly, if you combine the short put and long call, you lower your net debit to $24 [$1.97 put bid price - $2.21 call ask price], while you gain two potential chances to buy VF stock--but you’ve got to be very bullish.