With a market cap of $22.2 billion, Church & Dwight Co., Inc. (CHD) is a leading developer, manufacturer, and marketer of household, personal care, and specialty products. Best known as the U.S. leader in sodium bicarbonate production, the company’s portfolio includes iconic power brands such as ARM & HAMMER, Trojan, OxiClean, Waterpik, and Vitafusion.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Church & Dwight fits this criterion perfectly. Operating across domestic, international, and specialty product segments, Church & Dwight serves consumers worldwide through retail, e-commerce, and industrial distribution channels.

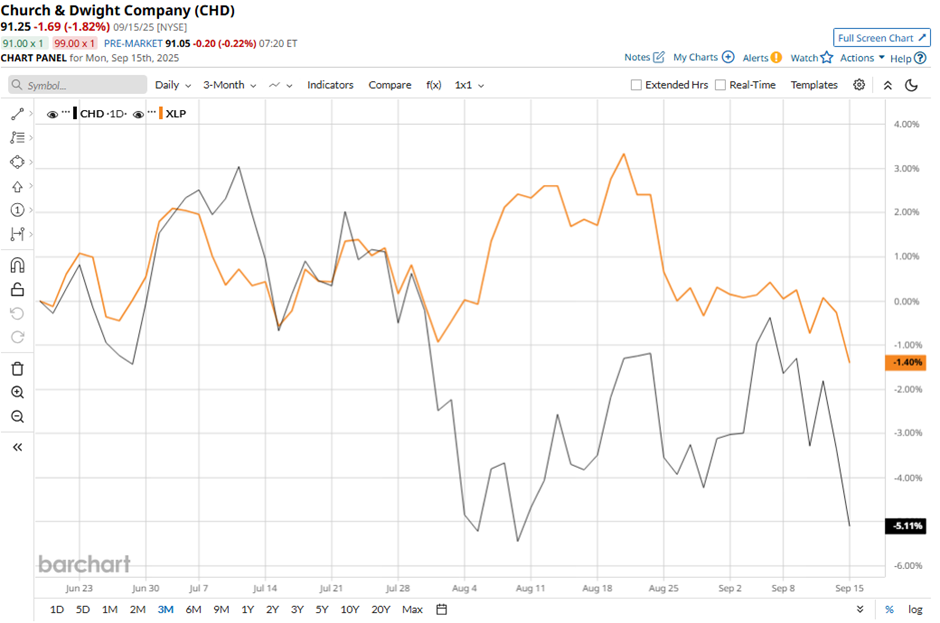

Shares of the Ewing, New Jersey-based company have pulled back 21.7% from its 52-week high of $116.46. CHD stock has fallen over 6% over the past three months, lagging behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 1.9% decline over the same time frame.

Longer term, CHD stock is down 12.9% on a YTD basis, underperforming XLP’s 1% return. Moreover, shares of the household and personal products maker have decreased 12.3% over the past 52 weeks, compared to XLP’s 5.4% drop over the same time frame.

Despite a few fluctuations, the stock has been trading mostly below its 50-day and 200-day moving averages since early April.

Shares of Church & Dwight recovered marginally on Aug. 1 as the company delivered stronger-than-expected Q2 2025 results, with adjusted EPS of $0.94 and revenues of $1.51 billion. Strength in Consumer International sales and continued momentum in e-commerce, which accounted for 23% of consumer sales, helped offset softness in the Consumer Domestic segment.

In addition, rival The Clorox Company (CLX) has significantly underperformed CHD stock. CLX stock has dipped 24.4% on a YTD basis and 26.1% over the past 52 weeks.

Despite CHD’s underperformance relative to the sector, analysts are moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 22 analysts in coverage, and the mean price target of $101.94 is a premium of 11.7% to current levels.