Coffeehouse chain Starbucks Corp. (NASDAQ: SBUX) is facing stiff competition in China, and its stock remains under pressure, marking a sharp divergence from its China-based arch-rival, Luckin Coffee Inc. (OTC: LKNCY), which has been soaring and hitting new highs throughout this past year.

Mounting Pressure In China Amid Nationalist Wave

Starbucks’ China unit has been facing severe competitive pressures, primarily from its biggest competitor, Luckin Coffee. The company, founded in 2017, has already expanded to 26,206 stores globally, while the 54-year-old Starbucks stands at 35,711.

In China, Luckin’s stores already outnumber Starbucks, significantly impacting the company’s market positioning and margins. This has since prompted the Seattle-based company to search for a buyer for its Chinese unit.

The company has already courted bids to the tune of $10 billion from private equity giants such as Centurium Capital, Hillhouse Capital, The Carlyle Group, and KKR & Co. that are currently vying for a stake, with Starbucks expected to retain a 30% stake in its Chinese unit.

Things are, however, a lot more complicated right now, with the company’s market share in China dropping from 34% in 2019 to just 14% in 2024, something that’s also been buoyed by a rising nationalist wave that’s been sweeping across the country, according to a Reuters report.

Luckin Soars As Starbucks Struggles

Luckin and Starbucks shares show a sharp divergence in 2025, with the former continuing to soar, while the latter continues to languish.

1. Luckin Coffee Inc.

Shares of Luckin Coffee are up 40.23% year-to-date, following its spectacular fourth-quarter performance early this year, when it posted $1.3 billion in revenue, up 36.1% year-over-year, while its operating and net incomes rose by triple digits, by 368% to $140 million, and 184% to $110 million.

The stock’s relative strength index or RSI indicator now stands at 47.918, which is a medium score, meaning that it is neither overbought nor oversold. Luckin shares were up 1.34% on Wednesday, closing at $37.75.

2. Starbucks Corp.

Starbucks shares, on the other hand, have had a fairly volatile year and are currently down 8.57% year-to-date, as it pursues a turnaround under new CEO Brian Niccol.

This comes amid growing macro and geopolitical pressures, such as the global shortage of coffee beans that are sending prices soaring, alongside the tariffs imposed on key production regions such as Brazil by President Donald Trump.

The stock currently has an RSI score of 40, according to Benzinga Pro, which essentially indicates a bearish market momentum in the near-term.

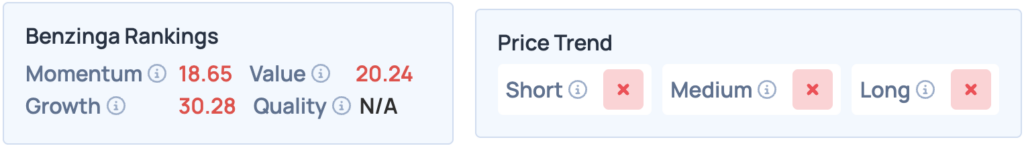

Starbucks shares were down 1.66% on Wednesday, closing at $84.27, and are up 0.39% after hours. The stock scores poorly across the board in Benzinga’s Edge Stock Rankings, with an unfavorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, and to see how it compares with Luckin.

Read More:

Photo Courtesy: ChameleonsEye on Shutterstock