Major Chinese aluminum producers posted bumper profits in the first quarter as high demand and rumors of production curbs drove prices higher.

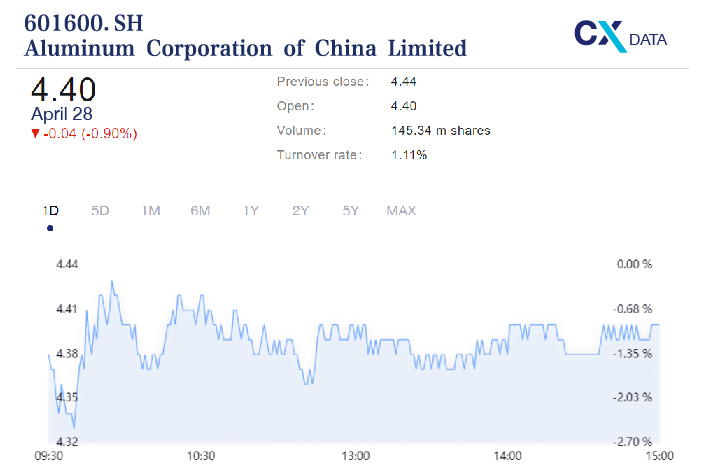

Aluminum Corp. of China Ltd. (601600SH./02600.HK), the world’s largest producer of the metal, reported net profits of 967 million yuan ($149 million) in the first three months of the year, a record 30-fold rise compared with the same period in 2020, when China’s Covid-19 outbreak prompted business closures and a steep decline in output.

The figures also represent a 117% rise from the first quarter of 2019, well before the pandemic started. The state-owned metals behemoth, also known as Chalco, is listed in Shanghai and Hong Kong.

Other industry titans announced similarly impressive results. Net gains rose 2.25 times from last year’s low base to 3.7 billion yuan at Shanghai Hongqiao New Material Co. Ltd., the main electrolytic aluminum subsidiary of Hong Kong-listed China Hongqiao Group Ltd. (01378.HK), the world’s largest private aluminum firm.

Aluminum processor Henan Shenhuo Coal & Power Co. Ltd. (000933.SZ) saw net profits balloon by 14.7 times year-on-year to 586 million yuan, while Tianshan Aluminum Group Co. Ltd. (002532.SZ) logged (links in Chinese) a threefold rise to 819 million yuan. Both companies are listed in Shenzhen.

Several aluminum companies attributed their strong results to high prices and increased production and sales. Chalco said its average post-tax selling price for raw aluminum was 16,120 yuan per ton, marking a year-on-year increase of more than 20%.

The prices have been buoyed by speculation that China’s government is poised to order producers in areas including the western Xinjiang Uygur autonomous region to curb output as part of efforts to cut carbon dioxide emissions.

Shen Lingyan, a senior analyst at Beijing Antaike Information Co. Ltd., said such sustained high prices are “extremely rare.” The research firm forecasts that rates will stay between 15,000 and 19,000 yuan in the medium term as emissions reductions drive a prolonged supply squeeze.

Contact reporter Matthew Walsh (matthewwalsh@caixin.com) and editor Flynn Murphy (flynnmurphy@caixin.com)

Follow the Chinese markets in real time with Caixin Global’s new stock database.