Conservative political activist Charlie Kirk issued a sharp warning on the growing use of Buy Now Pay Later services among young Americans, calling the debt model “predatory” and structurally unhealthy.

Check out the current price of AFRM stock here.

What Happened: Speaking on Tucker Carlson’s show on Monday, Kirk criticized BNPL companies such as Klarna, Affirm Holdings Inc. (NASDAQ:AFRM) and AfterPay, owned by Block Inc. (NYSE:XYZ), for offering what he described as an unregulated path to consumer debt.

“Buy now, pay later is how 60%… of Generation Z is paying for things month-to-month,” Kirk says, adding that they are not credit cards, and are thus not regulated by the Credit Bureaus, and have no credit checks.

See Also: Demystifying PayPal Holdings: Insights From 14 Analyst Reviews

To further underscore the nature of this practice, he says, “You can split a pizza into four payments… This is the modern tech economy. Buy a pizza on credit.”

“We have millions of young people that are financing their Coachella tickets,” Kirk said, but emphasized that contrary to popular belief, “most are actually doing this to meet their means,” not to live beyond them.

Kirk notes that two of the three major BNPL providers are foreign companies, with Klarna based in Sweden and Afterpay in Australia. He says these services often bypass traditional financial safeguards and expose young users to hidden costs, “the late fees and the penalties make these companies eventually hold cause they know they got you.”

Kirk warned that the widespread use of BNPL could have long-term consequences on Gen Z's financial health. “This generation can't own anything,” he says. “They owe so much more money than generations prior.”

Why It Matters: According to a recent survey, at least “half of buy now, pay later users have experienced issues like overspending and missing payments.”

This comes as a growing share of Americans use BNPL apps, not just for electronics and clothes, but to pay for groceries. According to a survey conducted by LendingTree, 25% of users on these apps reported using them to pay for groceries, up from 14% in 2024.

During its recent first-quarter earnings call, PayPal Holdings Inc. (NASDAQ:PYPL) reported that BNPL users spend 33% more per transaction and complete 17% more transactions compared to the average user.

Price Action: Shares of Affirm were down 3.12% on Monday, trading at $66.75, and are up 0.58% after hours.

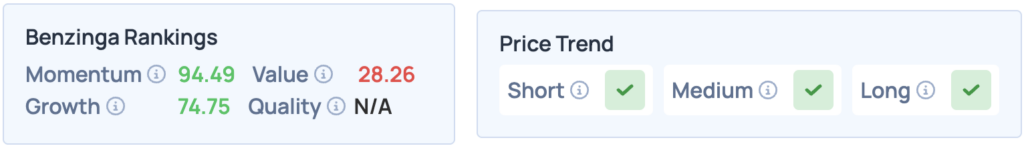

Affirm scores well on Benzinga’s Edge Stock Rankings, and has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, and to see how it compares with peers and competitors in the BNPL space.

Photo Courtesy: ANDREI ASKIRKA on Shutterstock.com

Read More: