Air taxis are moving toward the reality of everyday life, and Cathie Wood‘s ARK Invest is already making wagers on who will control the skies.

Through three of its theme funds, ARK Space Exploration & Innovation ETF (BATS:ARKX), ARK Autonomous Technology & Robotics ETF (BATS:ARKQ), and flagship ARK Innovation ETF (BATS:ARKK), ARK has established significant positions in Archer Aviation (NYSE:ACHR), which is among the most highly watched electric vertical takeoff and landing (eVTOL) developers.

Also Read: EXCLUSIVE: Archer CEO Says Trump’s eVTOL Push Is A Game-Changer

For investors, it’s a traditional ARK play: early access to a potentially revolutionary technology, diversifying the risk with a basket of companies. ARKX, with a lean toward aerospace and satellite, provides 5.3% exposure to Archer alongside orbital and defense stocks. ARKQ combines Archer (with a 4.8% weighting) with automation and robotics players, in its portfolio.

ARKK, the core fund, combines Archer with a broader list of disruptive technologies, including genomics, fintech, and AI. Collectively, the three allow investors to support urban air mobility (UAM) without betting on one unstable stock.

It is not coincidental timing. Archer just finished its longest test flight, 55 miles in 31 minutes, a significant step toward FAA certification expected in 2026. Major U.S. metros, such as Los Angeles, Miami, New York City, and San Francisco, will most likely be among the first to gain commercial service. At the same time, Abu Dhabi will host an initial air taxi network later in 2025.

Archer’s lead Midnight plane is capable of carrying four people and a pilot for 100 miles, set to transform a 45-minute grind between downtown LA and LAX into a 10-minute flight. Funding support from United Airlines Holdings Inc (NASDAQ:UAL), Stellantis NV (NYSE:STLA), and defense contractor Anduril, along with a $6 billion order book, lends credibility to the company in commercial terms.

Competitors like Joby Aviation Inc (NYSE:JOBY), Boeing Co's (NYSE:BA) Wisk Aero, and Hyundai's Supernal are chasing the same skies, but ARK's conviction signals where it sees asymmetric upside.

Urban air mobility is moving from science fiction to regulated airspace. For investors, ARK ETFs offer a cleaner, more risk-controlled way to participate in this megatrend, as opposed to speculating on a single eVTOL name.

Read Next:

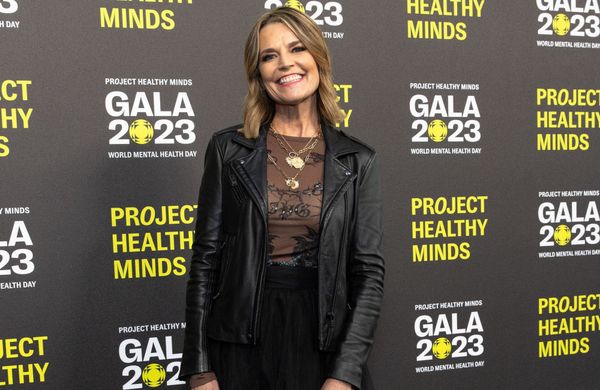

Photo courtesy of Archer Aviation.