Tech stocks are known for high growth potential, high valuation, cyclical business models, and, of course, volatility. These days, the biggest movers are in tech. So, as an income investor, I wouldn’t blame you if you don’t consider them as viable options.

But you’d be surprised at just how many tech stocks pay dividends. Microsoft, Apple, Meta, and Nvidia all pay dividends. Granted, they don’t pay high distributions, and barely any of them reach a 1% yield. But, the pattern is evident: some tech companies are not averse to rewarding their shareholders.

So if you want to add tech stocks to your dividend portfolio, here are the best ones to consider.

How I Came Up With The Following Stocks

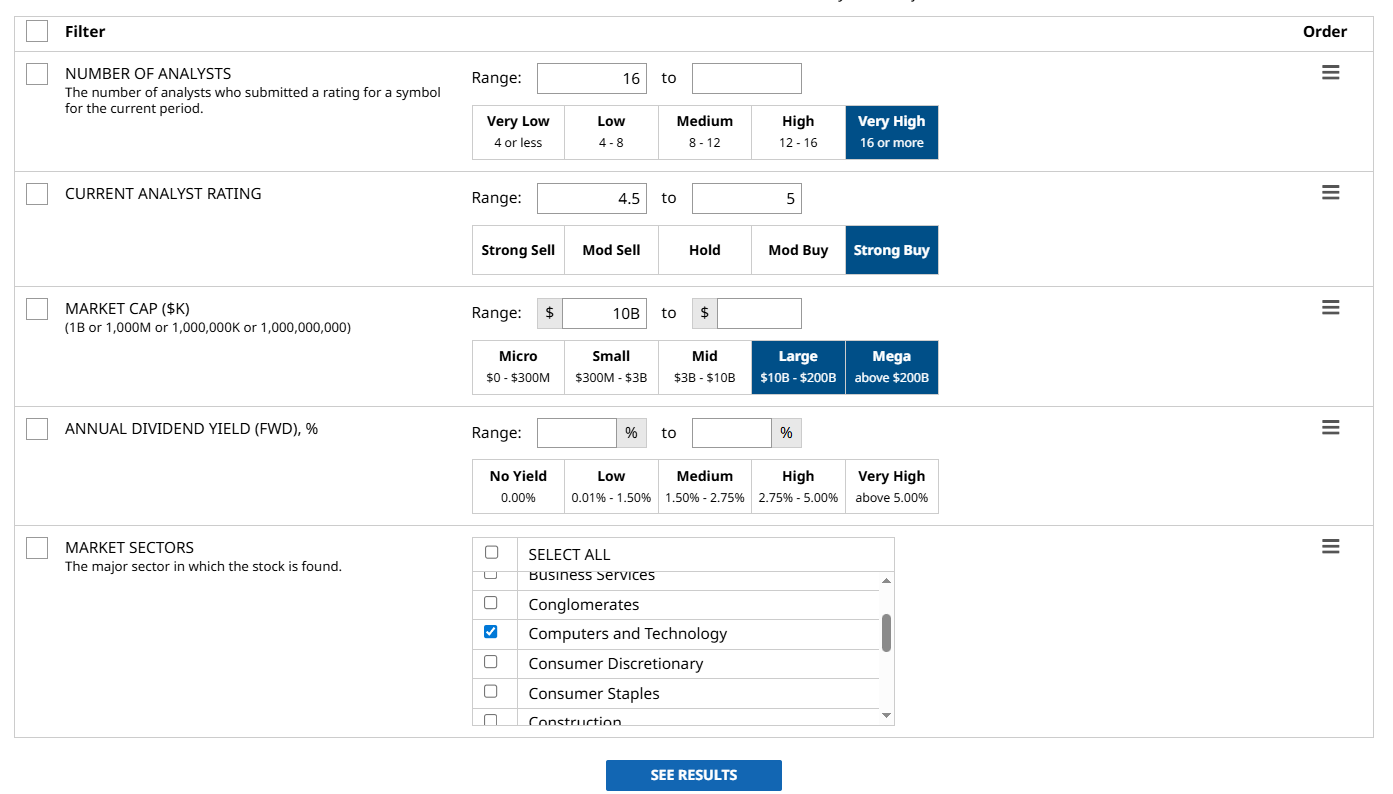

On Barchart’s Stock Screener, I used the following filters:

- Number of Analysts: 16 or more. I’m aiming for the best-covered companies on Wall Street for this list.

- Current Analyst Rating: 4.5 to 5 (Strong Buy). To further strengthen the thesis of best dividend-paying tech stocks, I’m limiting the results to the highest-rated companies only.

- Market Cap: $10 billion and above. For a measure of safety, I’m only considering large and mega-cap stocks. This way, I know the companies have established businesses with strong balance sheets. It also filters out the more speculative, high-risk names that might not sustain dividends long term.

- Annual Dividend Yield (Forward): Left blank so I can arrange the list based on this criterion.

- Market Sectors: Computers and Technology. Barchart’s Stock Screener comes with a nifty filter for sectors, which makes it easier to create sector or theme-specific lists.

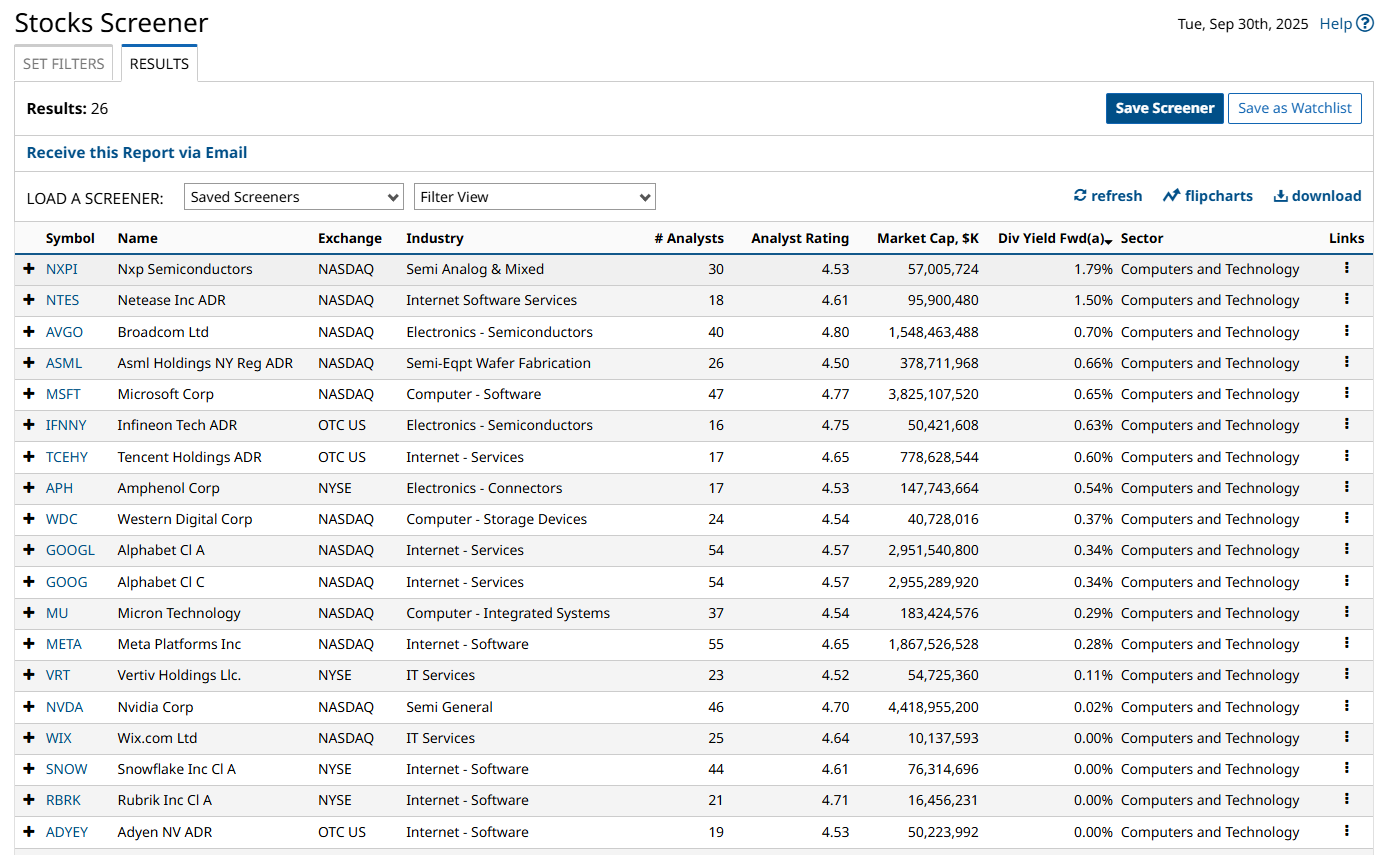

With those out of the way, I ran the screen and got 26 results, which I then arranged based on the highest forward yield.

Let’s discuss the top three companies, starting with number one:

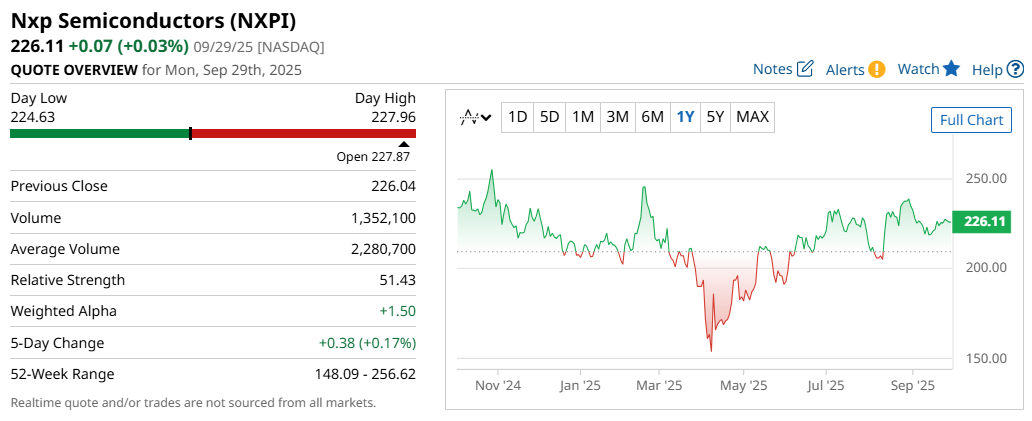

NXP Semiconductors (NXPI)

Those familiar with the tech space may be familiar with NXP Semiconductors. The company was originally part of Phillips in 2006 and now designs and distributes various types of silicon, with a focus on mixed-signal and analog, radio frequency, wireless communication, and automotive chips. Its four operating segments are Automotive, Industrial & Internet-of-Things (IoT), Mobile, and Communications Infrastructure & Others. NXP has locations in over 30 countries and prides itself on its secure and cost-competitive operations.

Today, the company pays $1.014 quarterly, which works out to a 1.79% forward annual yield. It’s not exactly high, but given that this tech company allotted nearly 39% of its earnings for dividend payments, I’d say it’s more than decent.

And besides, the whole point of investing in tech stocks that pay dividends is to take part in their growth- while earning income.

A consensus among 30 analysts rates NXPI stock a “Strong Buy,” so I’d say there’s a pretty good chance it will perform well in the next 12 months.

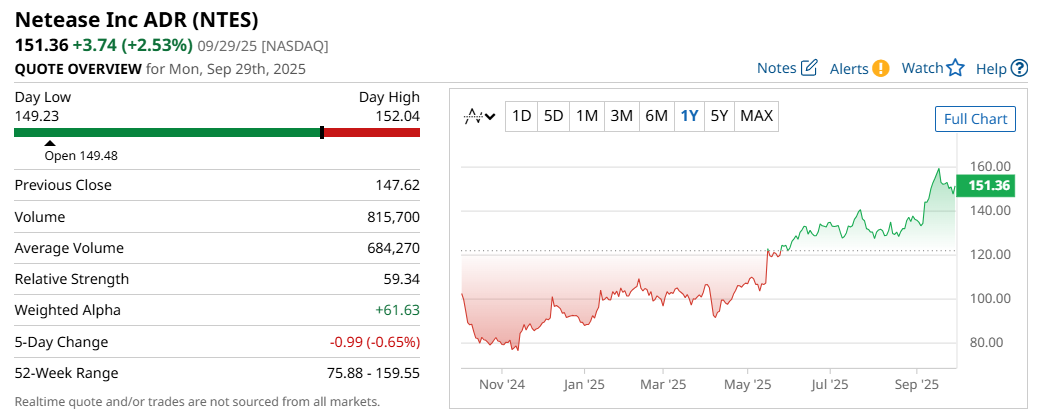

NetEase Inc ADR (NTES)

Next up is NetEase, a Chinese online gaming company that develops and publishes PC and mobile games. The company’s portfolio includes Nakara: Bladepoint, a free-to-play battle royale game that has amassed a dedicated online following, and Marvel Rivals, one of the biggest and most popular hero shooters released in recent years.

NetEase focuses on free-to-play games with built-in optional microtransactions, which provide a steady revenue stream while keeping their games accessible to a wide range of gamers.

The company’s dividend payouts typically fluctuate, though its trailing twelve-month (ttm) yield is around 1.9%, making it a relatively solid choice for a dividend-paying tech stock. A consensus of 18 analysts rates it a “Strong Buy,” although its average score has decreased slightly over the last three months.

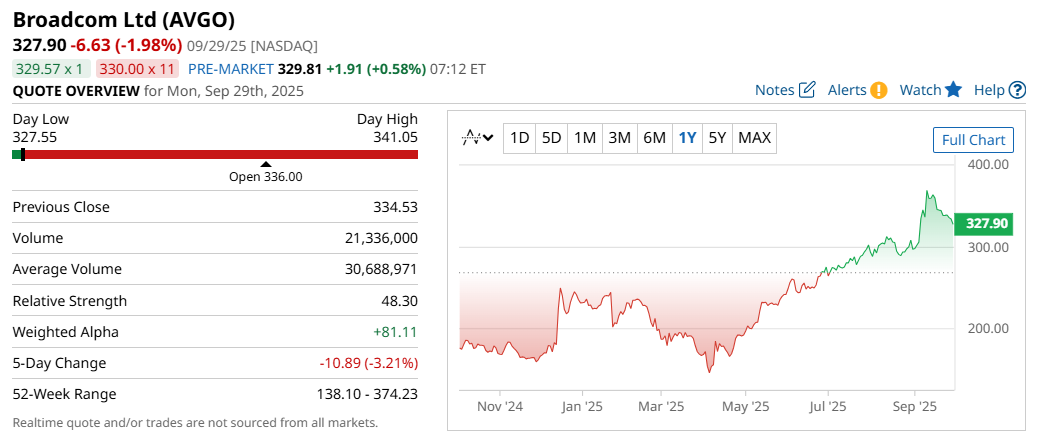

Broadcom Ltd (AVGO)

Last but not least is Broadcom. The company designs, develops, and distributes a broad range of semiconductor devices, including chips for networking, broadband, wireless, and storage applications. Its products serve a wide array of markets, from data centers and enterprise networking to smartphones and set-top boxes. It’s also known as one of the handful of companies that have reached trillion-dollar valuations, joining the ranks of TSMC, Berkshire Hathaway, and, of course, the Magnificent 7.

Broadcom pays 59 cents quarterly, which translates to a 0.70% forward yield. It has also increased dividend payouts for fourteen consecutive years, with December 2025 expected to kick off the fifteenth year. Not bad for a tech stock.

Meanwhile, a consensus among 40 analysts rates the stock a “Strong Buy,” with the highest average score on this list at 4.80.

Final Thoughts

It pays to explore your options when investing. For example, these tech stocks offer income streams while you participate in their growth. However, tech stocks are notoriously volatile, with prices that can swing sharply based on market sentiment, innovation cycles, and regulatory changes.

That's why investors should always consider the balance between growth potential and stability, and keep a close eye on the news, as some of these companies may experience significant fluctuations based on the headlines.

.png?w=600)