Shares of Carnival Corp (NYSE:CCL) are falling Tuesday in sympathy with competitor Royal Caribbean Group after the company released its third-quarter earnings report.

- CCL is among today’s weakest performers. See the full breakdown here.

What To Know: While Royal Caribbean beat earnings-per-share estimates and raised its full-year guidance, investors focused on troubling details seen as industry-wide headwinds.

Chief among the concerns were rising costs, with RCL reporting a 4.3% increase in constant currency net cruise costs, excluding fuel. This signals that persistent inflationary pressures will likely impact Carnival's profitability as well.

Furthermore, Royal Caribbean's revenue slightly missed analyst forecasts, and its fourth-quarter earnings guidance of $2.74 to $2.79 came in below the $2.89 consensus estimate.

This softer-than-expected outlook suggests that even with strong consumer demand, climbing operational expenses could weigh on near-term profitability for the entire cruise sector, dragging Carnival shares down despite no company-specific news.

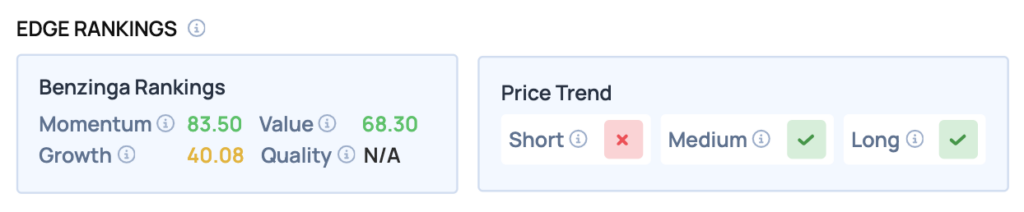

Benzinga Edge Rankings: According to Benzinga Edge rankings, the stock shows strong Momentum with a score of 83.50, but weak Growth prospects at just 40.08.

CCL Price Action: Carnival shares were down 4.06% at $28.23 at the time of publication on Tuesday, according to Benzinga Pro data.

Read Also: AMD, Nvidia, Broadcom’s Combined Value Surges 1000% In Just Three Years — And Bulls Want More

How To Buy CCL Stock

By now you're likely curious about how to participate in the market for Carnival – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock