/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

Financial services company SoFi (SOFI) will release its third-quarter results on Tuesday, Oct. 28. The company has been consistently delivering strong quarterly financials, with its revenue growth accelerating, thanks to the momentum across all of its businesses. Further, SoFi’s strategic pivot toward a lower-risk, fee-based, non-lending business model and growing deposit base has helped stabilize its financial and credit performance, boosted its bottom line, and driven its share price higher.

Over the past six months, SoFi’s stock has skyrocketed by more than 167%, a reflection of growing optimism around its business transformation and earnings potential. Adding to the bullish outlook, expectations of declining interest rates are improving the macroeconomic backdrop for financial technology firms like SoFi. A more favorable rate environment could enhance borrowing demand and reduce funding costs, paving the way for continued financial growth and potentially stronger stock performance in the quarters ahead.

SoFi Set to Deliver Strong Q3 as Growth Momentum Continues

SoFi is entering the third quarter confessional with robust momentum, building on impressive gains from the first half of the year. The fintech’s top line is set to benefit from an ongoing surge in new members and product adoption. In Q2, SoFi added 850,000 new members, a 34% increase from the prior year, bringing its total membership to 11.7 million. At the same time, it added a record 1.26 million new products, also up 34% year-over-year, helping revenue climb 43% compared to the same period last year.

SoFi’s financials are likely to benefit from the transformation into a diversified financial services company. By expanding beyond traditional lending and focusing more on capital-light revenue streams, the firm is reducing its exposure to credit risk while building a more predictable revenue base. In Q2, SoFi’s total fee-based revenue reached $378 million, up 72% year-over-year, driven by strong performance from its Loan Platform Business (LPB), higher origination, referral, and brokerage fees. On an annualized basis, fee-based revenue now exceeds $1.5 billion, reflecting that SoFi’s strategic shift toward capital-light business models is paying off well.

The LPB will once again drive fee-based revenue in Q3. SoFi is leveraging its large customer base to originate tailored loans for third parties and transfer them off its balance sheet, reducing credit risk while earning scalable fees.

SoFi’s Tech Platform business is also gaining traction, further diversifying its business. At the same time, its lending division could once again deliver strong growth in Q3. SoFi’s lending business has shown resilience even in a prolonged high-interest-rate environment. Student lending originations reached nearly $1 billion in Q2, a 35% increase from the prior year. This growth is expected to continue into Q3, supported by new refinancing solutions that help borrowers manage cash flow while pursuing long-term savings. With a potential rate cut on the horizon and a large student loans refinancing market, SoFi is well-positioned to deliver solid growth.

Home loans are another bright spot. Q2 originations nearly hit $800 million, up over 90% year-over-year. SoFi’s home equity product has been a major driver, accounting for almost a third of home lending volume within just a year of launch. As interest rates ease, the company is well-positioned to capitalize on increased demand for both home purchases and refinancing.

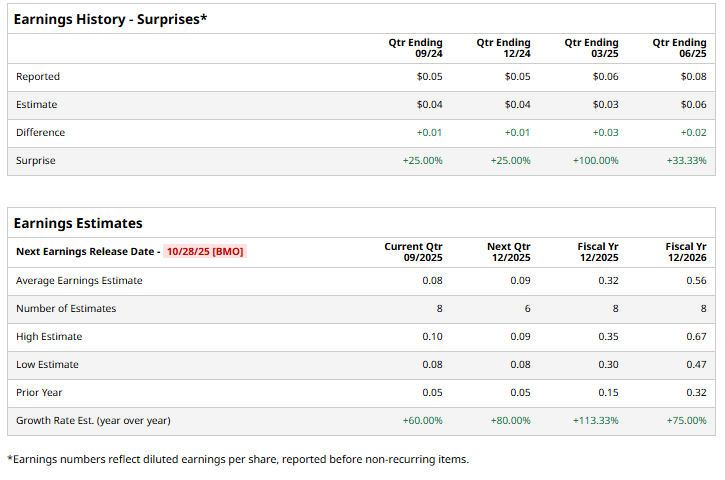

With top-line growth accelerating, steady credit performance, and a low-cost deposit base supporting the bottom line, analysts anticipate SoFi will report EPS of $0.08 in Q3, up 60% from a year ago. SoFi has exceeded analysts’ earnings expectations in each of the past four quarters.

Will SoFi Stock Continue to Trend Higher?

The significant rally in SoFi stock and analysts’ “Hold” consensus rating suggest some caution ahead of the company’s Q3 earnings. However, a shift toward fee-based revenue streams, strong demand in both student and home lending, and a favorable interest rate environment point to continued upside potential. However, a pullback in the stock could be a buying opportunity or to add to positions.