/Watching%20a%20streamer%20by%20CeltStudio%20via%20Shutterstock.jpg)

In recent years, the streaming industry has undergone a significant transformation. Platforms such as Netflix (NFLX), Disney (DIS), Amazon (AMZN) and Apple (AAPL) are fighting for subscribers in an increasingly crowded market.

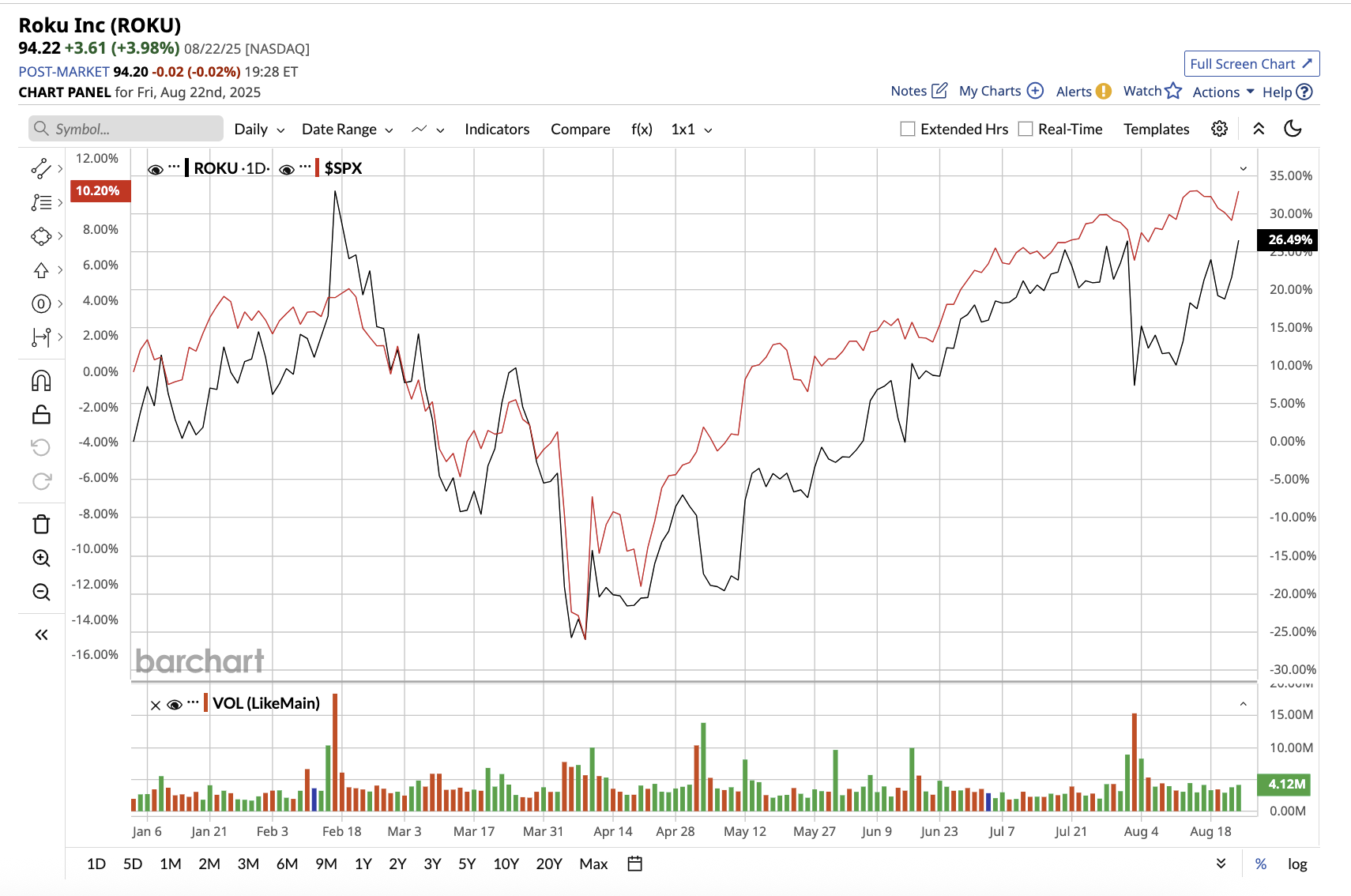

In this environment, Roku (ROKU), a company that does not create content but rather provides a platform for its distribution and monetization, finds itself at the center of the streaming wars. Roku stock is up 28% year to date, outperforming the broader market’s 9.9% gain.

With competitive pressures mounting, let us see if Roku’s business model can withstand the streaming wars.

Roku’s Business Model Works

Unlike Netflix, Disney, and Amazon, Roku does not spend billions of dollars on original content. Instead, it provides smart TV operating systems, streaming devices, and an effective advertising platform. The company now has millions of subscribers in the U.S., giving it tremendous scale and influence. Roku generates revenue through two sources: device sales (players and TVs running its operating system) and platform revenue (advertising, subscription billing, content distribution, and services such as Roku Ads Manager). Importantly, the latter has become its most significant growth engine, accounting for the majority of its revenue and providing higher margins than hardware sales.

In the second quarter, platform revenue increased 18% year over year to $975 million, outpacing the broader digital advertising markets. The strength was fueled by video advertising, an increase in Roku-billed subscriptions, and the integration of its recent acquisition, Frndly TV, which improves its live TV offerings. Total revenue increased 15% year over year to $1.1 billion. Adjusted EBITDA increased 79% to $78.2 million.

Roku relies heavily on advertising revenue. To expand its advertising demand base, Roku has integrated deeper third-party integrations and launched Roku Ads Manager, which opens the door to small and medium-sized advertisers who have traditionally relied on social media. CFO Dan Jedda stated during the Q2 earnings Q&A that performance marketing is a $60 billion market, and Roku is only scratching the surface.

Importantly, investors have been particularly concerned about the company’s ability to balance growth and profitability. Management emphasized that Roku is now on track to achieve operating income profitability by the fourth quarter of 2025, with plans to maintain profitability into 2026 and beyond. Notably, Roku expects its EBITDA margin to increase in 2025, with further gains in 2026. This showcases to investors that Roku is more than just a growth story. It is evolving into a business capable of generating long-term profits.

Can Roku Maintain Its Edge?

Despite improving financials, Roku faces some challenges. Companies such as Netflix and Disney are increasingly developing direct relationships with customers, which could reduce Roku’s role as an intermediary. Furthermore, Netflix and Disney+ have introduced ad-supported tiers, and Amazon has made Prime Video ad-supported by default. This worsens competition for digital ad budgets, on which Roku relies heavily for growth.

Roku’s business model, which combines consumers, content, and advertisers, gives it a distinct advantage. To survive and potentially thrive, Roku must continue to broaden its advertising tools and content partnerships. While the U.S. remains its largest market, global expansion represents a massive untapped opportunity that Roku can capitalize on for long-term growth.

Roku generated free cash flow of $392 million for the trailing 12 months. The company has also authorized a $400 million share repurchase program. Roku ended the second quarter with $2.3 billion in cash, cash equivalents, and short-term investments, and plans to use this cash balance to fund repurchases. This indicates that it can generate long-term shareholder returns while pursuing growth.

Looking ahead, the company anticipates a 13.3% increase in net revenue to $4.6 billion for the full year, which is consistent with consensus expectations. Management also expects to report net income of $20 million for the year.

What Does Wall Street Say About Roku Stock?

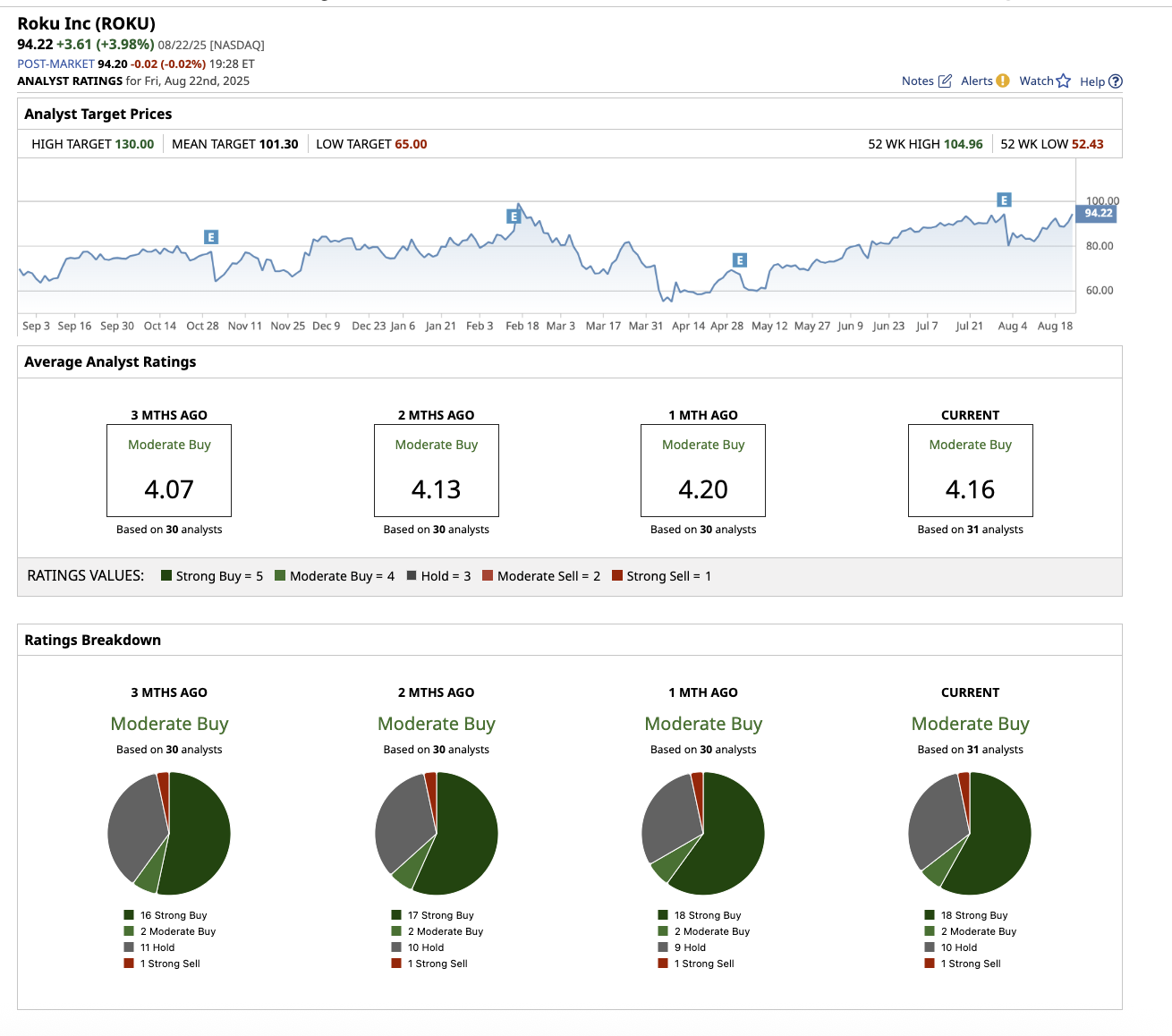

Overall, on Wall Street, analysts rate the stock a “Moderate Buy.” Out of the 31 analysts covering Roku stock, 18 have a “Strong Buy” recommendation, two rate it a “Moderate Buy,” 10 suggest a “Hold,” and one says it is a “Strong Sell.” The average price target for Roku stock is $101.30, suggesting potential upside of roughly 7.5% over the next 12 months. Furthermore, the Street-high target price of $130 implies that the stock could rise by up to 38% from current levels.

The Bottom Line

With financial discipline, improving margins, a return to operating profitability, and a clear advertising growth strategy, Roku has momentum on its side for now. However, whether it can maintain its advantage as the streaming wars worsen will determine its long-term value. Long-term investors who can handle the volatility may find Roku an appealing growth stock to buy now.