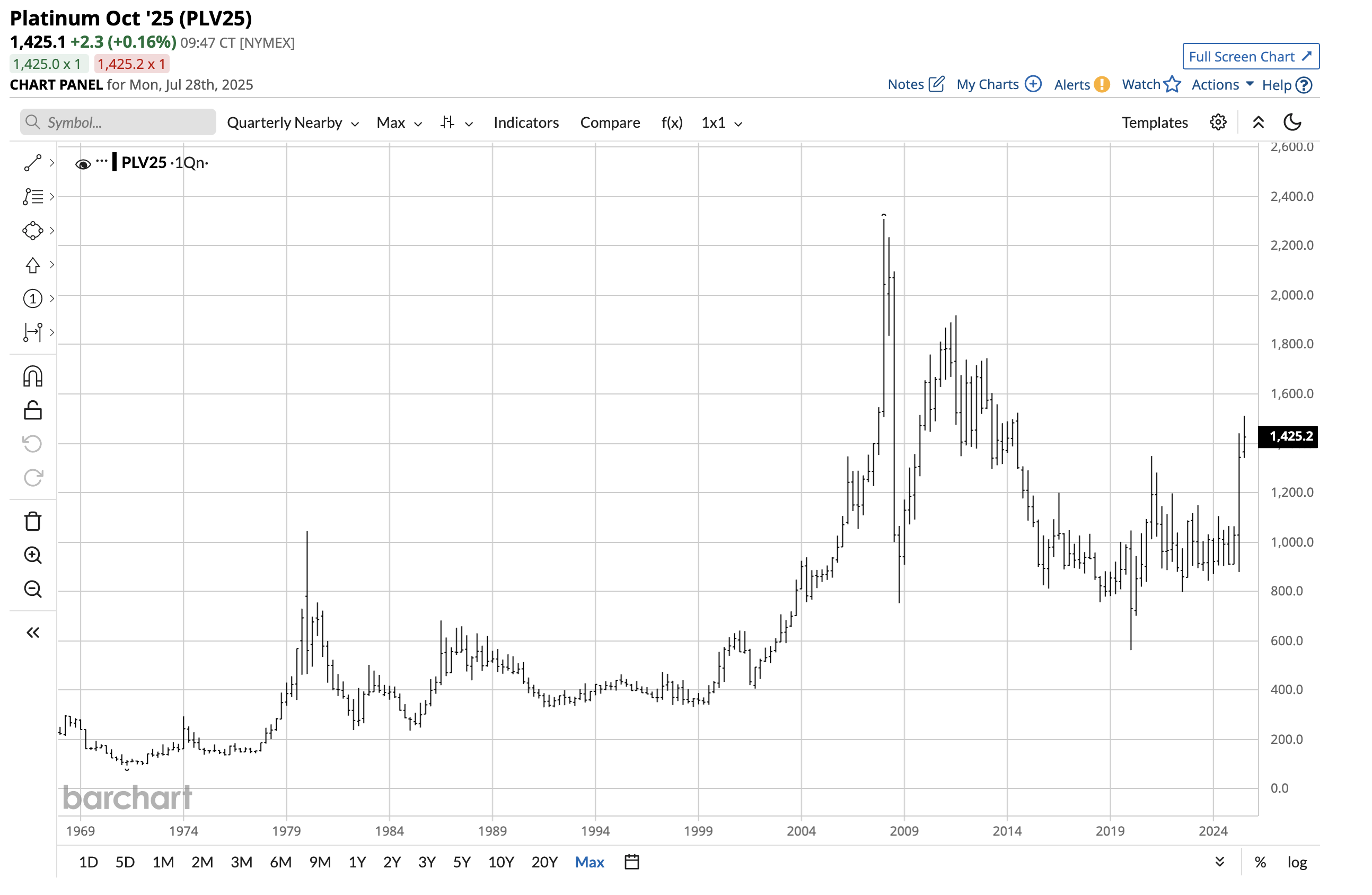

NYMEX platinum futures posted a 32.12% gain in Q2 and were 49.22% higher over the first six months of 2025. After years of lagging gold, platinum posted the most significant gain in the precious metals sector and the commodities asset class in Q2 and the first half of 2025.

I concluded my Q2 Barchart report on precious metals with:

Silver, platinum, and palladium formed powerful bullish formations in Q2, with each metal falling below its Q1 low and closing the quarter above the previous quarter’s peak. The bullish key reversal patterns could indicate that the bullish trend in the precious and industrial metals will continue over the coming months and quarters, as silver, platinum, and palladium catch up with gold.

Platinum closed Q2 at $1,334 per ounce on the nearby NYMEX futures contract. The price continued to appreciate in July 2025.

A bullish key reversal leads to more gains

In Q2 2025, NYMEX platinum futures fell to a slightly lower low than in Q1 2025 before closing the second quarter above the first quarter’s high, forming a bullish key reversal on the long-term chart.

The quarterly continuous futures chart highlights platinum’s bullish technical price action that caused the rare precious metal to move substantially above the $1,000 pivot point that had dominated price action from 2015 through Q1 2025. In early Q3, platinum futures continued their ascent, rising to over $1,500 per ounce, the highest price since Q3 2014. Nearby platinum futures were around the $1,425 level on July 28.

Approaching the next upside target

Platinum futures are closing on the next technical resistance level at the Q3 2014 high.

The monthly continuous contract chart illustrates that platinum’s next upside target is $1,523.80 per ounce, the high from July 2014. Above there, the February 2013 high of $1,774.50, the August 2011 high of $1,918.50, and the March 2008 record peak of $2,308.80 are technical resistance levels and upside targets.

Platinum was once “rich person’s gold”

In March 2008, when platinum reached its record $2,308.80 high, gold’s peak was $1,033.90 per ounce. Platinum commanded a nearly $1,275 premium over gold. Platinum is a rarer precious metal, with approximately 170 tons of annual production. Most platinum output comes from South Africa and Russia. In South Africa, production is primary, while in Russia, platinum is a byproduct of nickel production in Siberia’s Norilsk region.

Annual gold production is approximately 3,600 tons. While China and Russia lead the world in gold output, Australia, Canada, the United States, Kazakhstan, Mexico, Indonesia, South Africa, Uzbekistan, Peru, and many other countries are leading gold producers, making gold output far more ubiquitous than platinum production.

Meanwhile, in 2008 and for many years prior, platinum traded at a premium to gold, earning it the nickname “rich person’s gold.” However, since 2008, platinum’s price took a backseat to gold as the golden bull has taken the yellow precious metal to a series of higher record highs, leading to the latest 2025 peak at the $3,500 per ounce level.

Platinum’s liquidity could mean a parabolic move is on the horizon- Fundamentals in a dangerous world support more gains

As highlights, annual output of 170 metric tons of platinum compared to approximately 3,600 tons of gold makes platinum a far less liquid market. Moreover, the data from the futures arena highlights platinum’s illiquidity compared to gold. Open interest is the total number of open long and short positions in a futures market. While gold trades on the CME’s COMEX division, platinum futures trade on the CME’s NYMEX division. A gold futures contract contains 100 ounces of gold, while a platinum futures contract contains 50 ounces of platinum.

As of July 25, 2025:

- COMEX gold futures open interest was 466,174 contracts or 46,617,400 ounces. At $3,310 per ounce, the total value was over $154.304 billion.

- NYMEX platinum open interest was 88,775 or 4,438,750 ounces. At $1,425 per ounce, the total value was $6.325 billion.

The platinum market is far smaller than the gold market. Lower liquidity often leads to higher volatility. In platinum’s case, a herd of buying can exacerbate price action as we have seen over the first half of 2025, with platinum’s over 29% gain. At the current price, platinum could have a long way to go on the upside before challenging the 2008 all-time high of $2,308.80 per ounce.

PPLT and PLTM are platinum ETF products

The most direct route for an investment or trading position in platinum is the physical market for bars and coins. Platinum futures on the CME’s NYMEX division are a secondary route, as they offer a physical delivery mechanism. Two of the dedicated ETF products that hold physical platinum, trade on the NYSE Arca, and track the metal’s price action are:

- The Aberdeen Physical Platinum ETF (PPLT) is the most liquid platinum ETF product. At $127.05 per share, PPLT had over $1.663 billion in assets. PPLT trades an average of nearly 398,000 shares daily and charges a 0.60% management fee.

- The GraniteShares Platinum Shares ETF (PLTM) provides exposure to platinum. At $13.45 per share, PLTM had over $89.288 million in assets. PPLT trades an average of nearly 450,000 shares daily and charges a 0.50% management fee.

Platinum remains in a bullish trend, with plenty of upside room before it approaches the 2008 all-time high. Given gold’s ascent over the past years and platinum’s liquidity constraints, platinum could head back to its former position as “rich person’s gold.”