/Intuit%20Inc%20TurboTax%20display-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

Intuit (INTU) is a financial technology company that develops software and platforms to help individuals and businesses manage their finances more easily, leveraging software, data, and artificial intelligence (AI). It is widely known for its products, including TurboTax, QuickBooks, Credit Karma, and Mailchimp.

Intuit ended its fiscal 2025 on a high note, driven by explosive growth across all business segments. Intuit shares are up 4.9% year-to-date.

While the attention remains on the flashier fintech names, Intuit’s business model, consistent growth, and expanding use of AI suggest it may be one of the most underappreciated growth opportunities in the market. According to Wall Street’s high price estimate, the stock could surge over 51% to touch $1,000. Let’s find out if INTU is a buy now.

A Strong Finish to Fiscal 2025

Intuit ended fiscal 2025 with a strong performance that highlights the power of its AI-driven platform strategy. In the fourth quarter, revenue of $3.8 billion increased 20% year-over-year (YoY), with adjusted earnings surging 38% to $2.75 per share.

The full-year performance was equally impressive, with revenue rising 16% year on year to $18.8 billion and adjusted earnings increasing 19% to $20.15 per share.

Intuit’s long-term bets on AI and expert-driven services are now yielding tangible results in its business segments. Notably, the Global Business Solutions Group’s revenue rose 16% to $11.1 billion. Consumer Group revenue increased by 10%, driven by TurboTax Live’s 47% revenue growth to $2 billion. Meanwhile, ProTax revenue increased at a steady 4% to $621 million.

Credit Karma is emerging as one of the company’s most significant growth drivers. Credit Karma’s full-year revenue increased by 32%, driven by contributions from personal loans, credit cards, and auto insurance. Credit Karma is also driving cross-platform synergies with TurboTax and increasing year-round engagement.

The Intuit Growth Story Is Just Beginning

Intuit’s growth story is led by its all-in-one business platform, which includes QuickBooks Online, Intuit Enterprise Suite, Mailchimp, and a growing suite of AI-powered services. In fiscal 2025, the company took a bold step by introducing a virtual team of AI agents capable of performing tasks on behalf of customers, aided by AI-enabled human experts. While Intuit has long dominated the small business space, its recent entry into the mid-market segment represents a significant new growth opportunity. The company estimates that the total addressable market (TAM) is $89 billion, with the Intuit Enterprise Suite (IES) expected to drive growth in this segment.

Importantly, Intuit followed a balanced approach to growth and shareholder returns. At the end of Q4, the company’s cash and investments totaled $4.6 billion, with $6 billion of debt. In the fourth quarter, the company repurchased $748 million of shares. Intuit also pays a dividend, yielding 0.73%, which is not particularly attractive. However, its aggressive dividend hikes, including the most recent 15% increase in the quarter, may entice income-seeking investors.

Looking ahead, management expects to deliver another year of double-digit revenue growth of 12% to 13% in fiscal 2026, driven by investments in data, AI, and human intelligence, all of which are integrated into its expanding all-in-one platform. Adjusted earnings are expected to increase by 14% to 15% in fiscal 2026. These projections reflect management’s belief that growth will be balanced among small business, consumer, and professional tax offerings. With consistent double-digit revenue growth, expanding margins, and a TAM of more than $180 billion, Intuit enters fiscal 2026 on a solid footing.

Analysts covering the stock predict a 12.4% increase in revenue to $21.1 billion, followed by a 15% increase in earnings in fiscal 2026. Intuit stock is trading at 28 times forward earnings, lower than its five-year price-earnings average.

What Does Wall Street Say About INTU Stock?

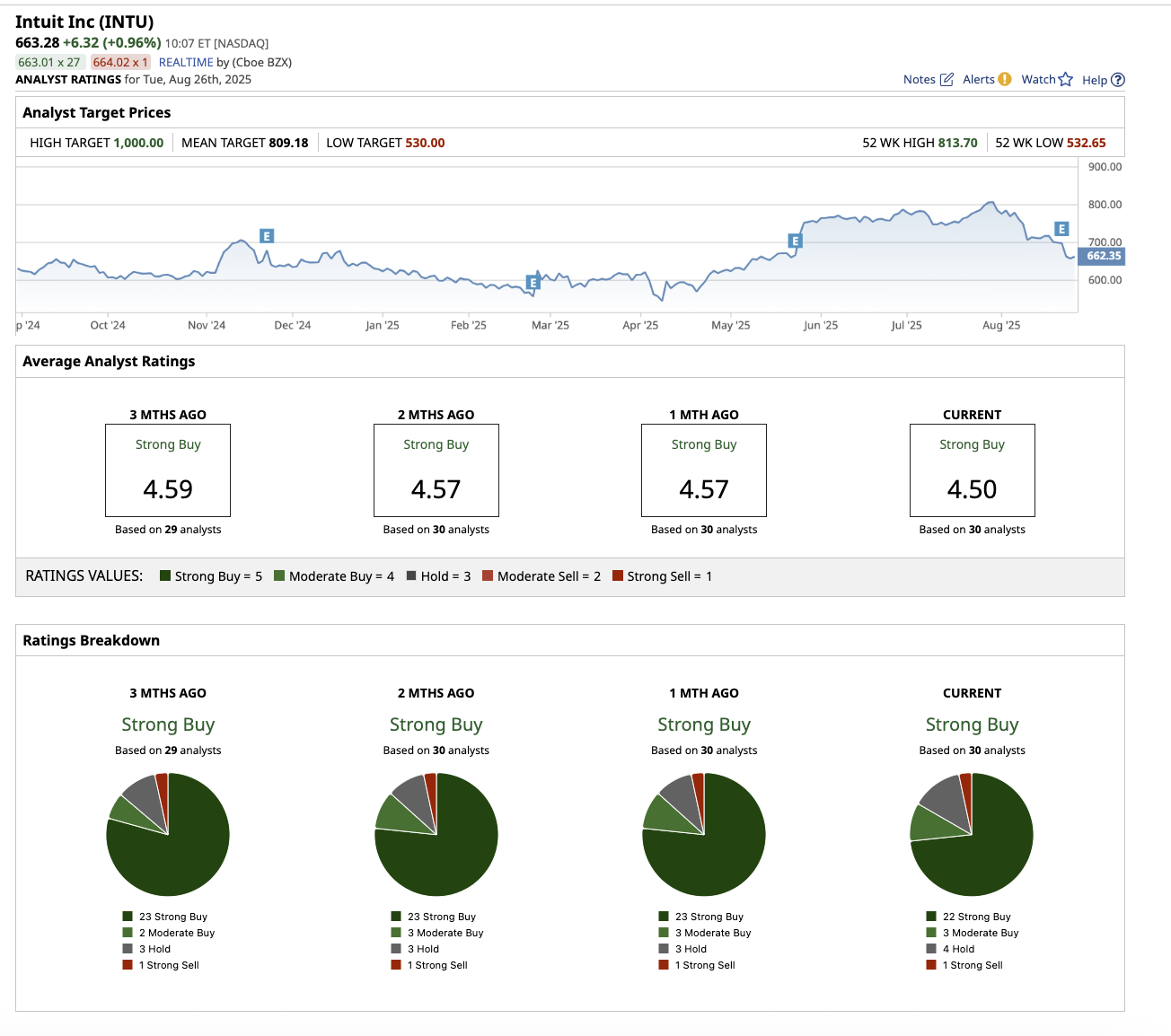

Overall, Intuit stock is a “Strong Buy” on Wall Street. Out of the 30 analysts who cover INTU stock, 22 have given it a “Strong Buy,” while three have a “Moderate Buy” rating, four rate it a “Hold,” and one says it is a “Strong Sell.” Based on the mean target price of $809.18, INTU stock has upside potential of 22% from current levels. Plus, the high target price of $1,000 suggests that the stock could rise 51% over the next 12 months.

Intuit has come a long way since its early days in tax software. Today, it is a diversified fintech powerhouse with multiple growth engines, strong customer relationships, and a clear AI-driven future strategy. At this rate of explosive growth, there is no doubt Intuit’s stock can touch $1,000.

I believe Intuit stock remains a quiet fintech giant with enormous upside potential for long-term investors.