/Quantum%20Computing/A%20concept%20image%20with%20a%20brain%20on%20top%20of%20a%20blue%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

Notable quantum computing firm D-Wave Quantum (QBTS) is experiencing a significant surge in its stock price as demand for quantum computing continues to grow.

In May, the company launched its sixth-generation quantum system, the Advantage2. With more than 4,400 qubits, this system is designed to tackle complex computational problems that traditional systems cannot solve. Moreover, with a wide range of scientific and industrial use cases, Advantage2 stands as the most powerful quantum computer launched by the company to date.

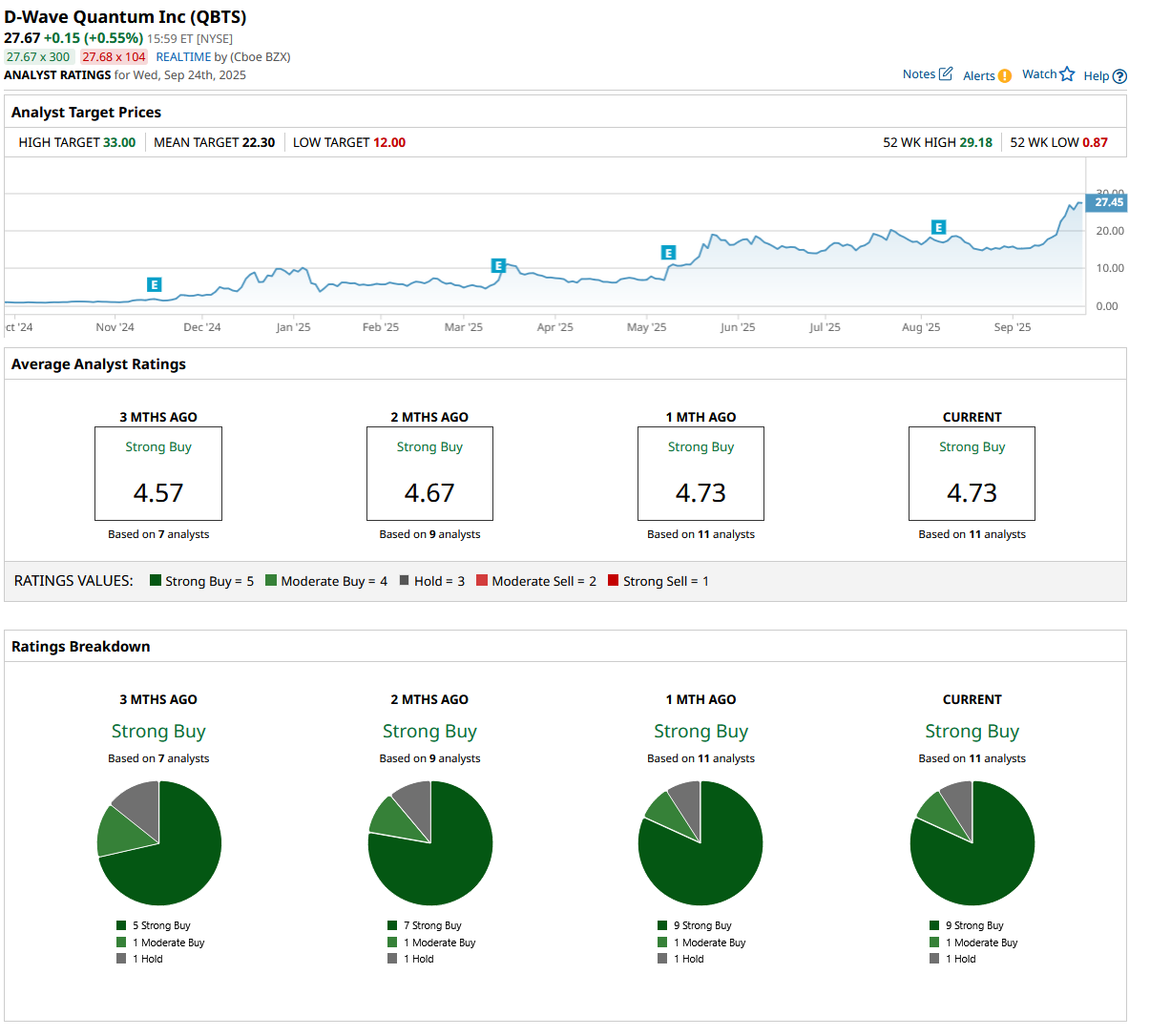

All such developments have made QBTS stock attractive. Recently, analysts at B. Riley Securities maintained a “Buy” rating on D-Wave Quantum’s shares while raising the price target from $22 to $33. This new Street-high price target indicates an upside of 28.6% from current levels. B. Riley analysts cited the Quantum World Congress global event that highlighted the industry’s potential in commercial operations.

Can QBTS stock touch this target?

About D-Wave Quantum Stock

D-Wave Quantum stands out as a leader in quantum computing, offering advanced hardware, software, and services for solving practical problems in logistics, finance, drug discovery, and other fields. The company is the only one, to date, to provide both annealing and gate-model quantum systems, helping organizations around the world achieve unique computational advantages every day.

D-Wave has its principal headquarters located in Palo Alto, California, with a significant engineering hub in Burnaby, British Columbia. Through its cloud services and collaborative industry approach, D-Wave supports over 100 clients, driving progress across academic and business sectors. The company has a market capitalization of $8.78 billion.

As the company faces exponentially growing demand for quantum computing, QBTS stock has been surging. Over the past 52 weeks, the stock has skyrocketed, growing by a whopping 2,874%. The stock is up by 232% year-to-date (YTD). The stock reached a 52-week high of $29.18 yesterday, Sept. 24. D-Wave’s Advantage2 quantum computer appears to have given it a new boost, as the stock is up 86% over the past three months.

D-Wave Quantum’s valuation sits at an eye-watering level. Its price-to-sales (P/S) ratio sits at 294.98 times, which is significantly stretched compared to the industry average of 3.74 times.

D-Wave Quantum’s Topline Is Growing

On Aug. 7, D-Wave Quantum reported its second-quarter results for fiscal 2025. The company’s revenue grew by 41.8% year-over-year (YoY) to $3.10 million. This was higher than the $2.59 million figure that Wall Street analysts were expecting.

On the other hand, D-Wave Quantum continues to record significant losses. For Q2, the company’s net loss per share increased significantly YoY to $0.55. Contrarily, on an adjusted basis, the company’s net loss per share dropped from $0.12 in Q2 2024 to $0.08 in Q2 2025. However, Wall Street analysts were expecting a net loss per share of $0.05; therefore, D-Wave Quantum missed bottom-line estimates.

During the quarter, D-Wave Quantum completed a $400 million at-the-market (ATM) offering. This contributed significantly to the company’s cash balance, which grew to a record $819.31 million by the end of the quarter. The cash is expected to be used for strategic acquisitions and to provide additional working capital.

D-Wave Quantum also highlighted its initiative to develop advanced cryogenic packaging. Through steps like this, the company aims to strengthen its manufacturing capabilities and support its product roadmap on the path to achieving 100,000 qubits.

Wall Street analysts expect D-Wave Quantum’s losses to keep narrowing. For the third quarter, the company’s bottom-line losses are expected to narrow by 36.4% YoY to $0.07 per share, while for the current year, losses are expected to narrow by 69.3% to $0.23 per share.

What Do Analysts Think About QBTS Stock?

Apart from analysts at B. Riley, other Wall Street analysts are also reasonably bullish on QBTS stock. In August, analysts at Piper Sandler maintained an “Overweight” rating on the stock while raising the price target from $13 to $22, based on the increased traction surrounding Advantage2.

In the same month, analysts at Stifel initiated coverage of the stock with a “Buy” rating and a $26 price target. Stifel analysts noted D-Wave Quantum as a pioneer in commercial quantum annealing systems and highlighted its substantial funding. Benchmark analysts also maintained their “Buy” rating and a $20 price target, citing strong client acquisition and performance.

D-Wave Quantum is in the limelight on Wall Street, with analysts giving it a consensus “Strong Buy” rating overall. Of the 11 analysts rating QBTS stock, nine analysts have rated it a “Strong Buy,” while one analyst suggests a “Moderate Buy,” and one analyst gave a “Hold” rating. The consensus price target of $21.20 represents a 19% downside from current levels.