/Cadence%20Design%20Systems%2C%20Inc_%20logo-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Valued at a market cap of $94.1 billion, Cadence Design Systems, Inc. (CDNS) is a leading electronic design automation (EDA) company. The California-based company develops software, hardware, and IP solutions for designing integrated circuits (ICs), SoCs, printed circuit boards (PCBs), and even aerospace, defense, and pharmaceutical systems.

This software company has outperformed the broader market. Shares of CDNS have gained 22.8% over this time frame, while the broader S&P 500 Index ($SPX) has soared 14.3%. Moreover, on a YTD basis, the stock is up 15%, outpacing SPX’s 8.7% return.

Narrowing the focus, CDNS has also slightly outpaced the iShares Expanded Tech-Software Sector ETF’s (IGV) 22.7% rise over the past 52 weeks and 6.2% return in 2025.

Cadence is establishing itself as a key force in the AI and semiconductor design ecosystem, leveraging innovations such as the Cerebrus AI Studio, Millennium M2000 AI supercomputer, and strategic partnerships with other industry titans. Backed by its expanding AI-driven product portfolio and collaborative alliances, the company is cementing its position as a cornerstone of next-generation chip design, while skillfully navigating regulatory and legal challenges.

On Jul. 28, Cadence delivered stellar Q2 2025 results, and its shares popped 9.7% in the following trading session. Its revenue surged 20% year-over-year to $1.3 billion, and non-GAAP EPS reached $1.65, exceeding forecasts. The company finished the quarter with a solid backlog of $6.4 billion and reaffirmed its growth momentum by raising full-year revenue and EPS guidance.

For the current fiscal year, ending in December, analysts expect CDNS’ EPS to grow 21.6% year over year to $5.47. The company’s earnings surprise history is mixed. It topped or met the consensus estimates in three of the last four quarters, while missing on another occasion.

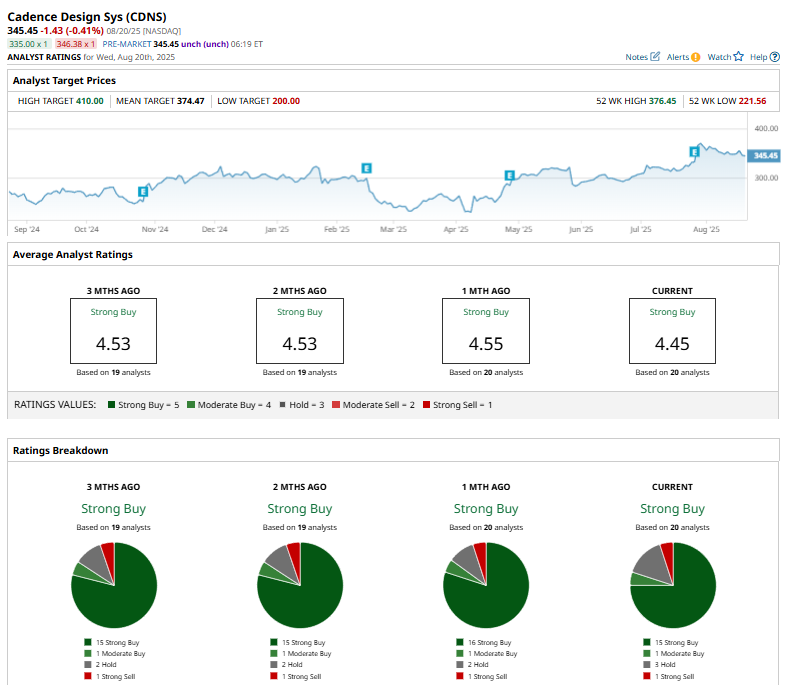

Among the 20 analysts covering the stock, the consensus rating is a “Strong Buy,” which is based on 15 “Strong Buy,” one “Moderate Buy,” three “Hold,” and one “Strong Sell” rating.

This configuration is bearish than a month ago, when 16 analysts had recommended a “Strong Buy” for the stock.

On July 29, Loop Capital raised its price target for Cadence Design to $390 from $370 while reiterating a “Buy” rating, citing the company’s strong financial position and performance.

The mean price target of $374.47 represents an 8.4% premium from CDNS’ current price levels, while the Street-high price target of $410 suggests an upside potential of 18.7%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.