.jpg?width=1200&auto=webp&crop=3%3A2)

The latest UK economy data was confirmed on Tuesday, after the Office for National Statistics (ONS) said earlier this month there was zero growth in gross domestic product (GDP) month on month in July, against 0.4 per cent growth in June. Today’s confirmation means GDP grew by 0.3 per cent in the second quarter of the year - April to June - and saw a significant slowdown from the first quarter of 2025, partly as people brought forward some activity like house purchases to beat the stamp duty rise.

Rachel Reeves is expected to announce further tax rises in her Budget though the full nature of them is still uncertain, with the chancellor saying Britain continues to encounter “harsh global headwinds” which are preventing further growth.

Elsewhere in the British business landscape, Jaguar Land Rover are finally to restart some production after a month-long stoppage caused by a cyber attack, while GSK have announced an impending change at the top after Emma Walmsley stepped down as CEO.

Follow The Independent’s live coverage of the latest stock markets and business news here:

Key points

- UK GDP grew by 0.3% in second three months of the year

- Stamp duty changes contributed to stronger first quarter

- Retail prices increased 1.4% last month but food inflation may have finally peaked

- UK production fell by 0.8% in second quarter

- Royal Mail to take over 8000 convenience stores

- 125 jobs to go at oil refinery, union criticises government

Over 100 jobs to go at Lindsey oil refinery as union slams government

17:04 , Karl MatchettA total of 125 jobs are to be lost at the Lindsey oil refinery, following the collapse of owner Prax Group in June.

Searches for a buyer have been underway but a leading union has criticised the move as “making a mockery of government promises” and said the redundancies are the responsibility of those in power.

It has been reported 255 employees will remain at the Lindsey site, out of 420 staff who are directly employed and 500 contract workers.

Prax appointed administrators over the summer and energy minister Michael Shanks at the time called for the “wealthy owner” to “put his hands in his pockets and deliver proper compensation for the workers,” insisting he could not merely “wash his hands” of employee obligations.

Over 100 jobs to go at Lindsey oil refinery as union slams government

Business and Money - 30 September

06:57 , Karl MatchettMorning all, lots going on once more, from the usual companies focus and stock market updates to more economic data pouring in to tell us how the UK is faring in the lead up to the Budget.

Let’s get going!

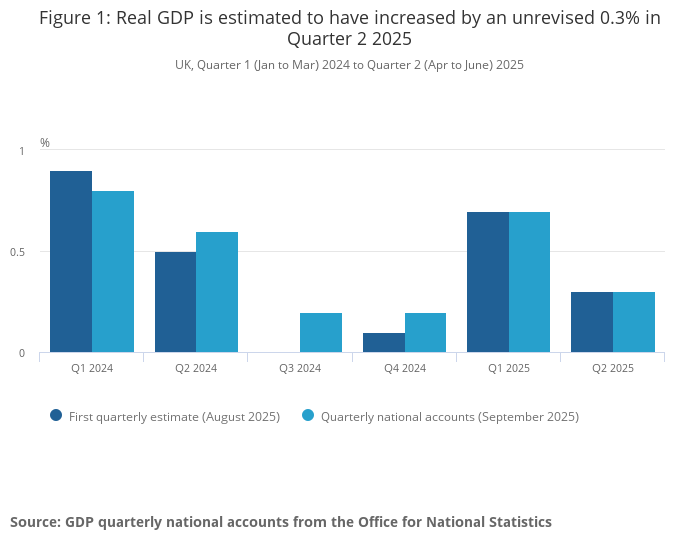

UK economy grew by 0.3% across April to June 2025

07:14 , Karl MatchettThe ONS have released their major accounting figures for the UK across Q2 - the second three months of the year, April to June.

Chief among the headline figures is confirmation that the economy grew 0.3 per cent during that period, a marked slowdown on the 0.7 per cent from the first quarter of 2025.

Perhaps also notably, the second quarter of last year was also higher, at 0.6 per cent.

Revised figures show stronger UK performance at end of 2024

07:19 , Karl MatchettJust to be clear - these figures being released today are not “new” as such - they are the revised figures from ONS after greater checks and slight changes to the data within each set.

Quite often they will revise the overall percentages up or down by an amount to give a more true reading based on data which can be tricky to handle in the tight turnaround for initial readings, which are usually given around mid-month.

It includes no changes so far for 2025, but there are slight alterations for last year, which we’ll detail in a moment.

Explaining the alterations, ONS director of economic statistics Liz McKeown said:

“Today’s figures include improvements to our measurement of the economy, including better information on research and development and the activities of complex multinational companies, alongside the usual inclusion of updated and improved data sources.

“Growth for 2024 as a whole is unrevised, though these new figures show the economy grew a little less strongly at the start of last year than our initial estimates suggested but performed better in later quarters.

“Quarterly growth rates for 2025 are unrevised.

“In the latest quarter we saw an increase in the household saving ratio, very little growth in consumer spending and a slight fall in output for consumer facing services, despite growth in services overall.”

Why the slowdown in UK economy from Q1 to Q2?

07:30 , Karl MatchettRachel Reeves and the rest of the government are desperate for economic growth to fire into gear but, as the chancellor noted yesterday, there have been some pretty big external factors to contend with this year.

However, there have also been several of their own making.

The ONS point to stamp duty as one big reason for the drop in GDP growth between the first and second quarters of the year, as people rushed through certain deals including house purchases to beat the raise.

Their statement today noted the step drop was in part due to “some activity was brought forward to February and March 2025 ahead of changes to Stamp Duty in April and, to some extent, ahead of announced US tariff changes.”

Economy grew faster than expected at the end of last year

07:45 , Karl MatchettAs mentioned, there is no revision to the estimates for 2025, but a couple of alterations for last year.

Essentially, the economy grew by less than the ONS expected at the start of 2024, but by more than expected towards the end of it.

“Across 2024 as a whole, annual growth is estimated at an unrevised 1.1% increase,” the ONS said.

This graph should help showcase that visually.

Retail prices show 1.4% inflation last month - but food prices may have peaked

08:00 , Karl MatchettOutside of UK economic data for the moment (though certainly related), figures from the British Retail Consortium (BRC) and NielsenIQ released today show shop prices continue to increase.

Annual shop price inflation rose to 1.4 per cent in September.

That’s an increase from the 0.9 per cent in August, but food price inflation finally remained the same at 4.2 per cent after rising for most of this year.

Other non-food items had been lower in price of late compared to a year ago, but last month were almost back to level, at 0.1 per cent lower.

Helen Dickinson, the BRC chief executive, said:“Households are finding shopping increasingly expensive. The impact on retailers and their supply chain of both global factors and higher national insurance and wage costs is playing out in prices for consumers.”

UK production fell 0.8% in worrying decline for Reeves

08:20 , Karl MatchettBack to the economic data and we’ve got figures from the ONS which show areas of industry that contributed to the overall 0.3% growth.

Information and communication services grew 2.5 per cent, while human health and social work activities was the second-biggest contributor in services, up 1.2 per cent.

In production, pharmaceuticals was easily the lead contributor, growing 6.9 per cent, but production overall fell by 0.8 per cent.

This will be the major area of concern for Reeeves and co, who cannot afford for production and manufacturing to be on the decline.

Nine of the 13 subsections in production fell though, including metals, manufacturing and repair, and foods, beverages and tobacco.

Households saving more due to Budget uncertainty

08:40 , Karl MatchettWe turn now to one of our economic experts who has sifted through the data, including not just these revised GDP figures but also the accounts which show household saving and spending.

That shows households are saving slightly more and are likely cautious about personal finance situations, given uncertainty on the domestic front and a slew of negative economy-related announcements.

“The big question now is whether speculation about the budget will undermine confidence further,” said Thomas Pugh, chief economist at tax firm RSM UK.

“Headline growth remained at 0.3% in Q2. But the saving rate increased from an already high 10.5% to 10.7%. This was driven by an increase in non-pension saving suggesting that consumer caution after April’s tax and tariff increases prompted households to save more.

“Looking ahead, the second half of the year will be tougher going than the first six months. The combination of inflation reaching 4% and a weakening labour market, means real pay growth is set to slow to almost zero. What’s more, the chances of further interest rate cuts this year look slim.

“The wildcard is how much speculation about tax rises in the upcoming budget will dent consumer and business confidence. The risk is that we get a repeat of last year and growth effectively flatlines in the second half of the year. Overall, we expect growth of around 1.3% this year.”

Labour MP calls for National Insurance to be scrapped

09:00 , Karl MatchettChris Curtis, a Labour MP, has said at the Labour Party Conference that National Insurance should be replaced.

“I think Jeremy Hunt was probably right about getting rid of National Insurance. But we’d pay for it by increasing income tax. The move towards simplification is good,” he said.

He also urged Rachel Reeves to make “bold” choices in the Budget as there were likely no “easy” ones regardless.

“When you’ve got no easy decisions, you might as well make the right ones. We should try to raise more [revenue] than we need to and build more of a headroom than we’ve had in the past.”

Reeves can point to 'heartening' data from 2024, says expert

09:24 , Karl MatchettRachel Reeves can pick a few promising points out of today’s GDP data, says Danni Hewson, AJ Bell head of financial analysis.

While it’s far from a stellar report card, bigger growth after Labour took over is a positive, while an overall 1.3% growth for the year is also...well, better than nothing.

“There is no good news for the chancellor in this latest economic data, but there’s no worse news either,” Ms Hewson said.

“Official figures confirm that the growth spurt enjoyed by the UK economy at the start of the year did indeed start to peter out in the second quarter as a mix of global and domestic headwinds blew through.

“Households were also showing restraint when it came to their own finances, with the savings ratio ticking up in the second quarter as people looked to create a cushion amid concerns about a weakening jobs market.

“What will be heartening for Rachel Reeves is the revision to 2024 data, which showed that growth during Labour’s first months in government was chunkier than had been previously thought, though growth as a whole last year was limited to 1.1%.

“Even with all the challenges, negativity and speculation about tough decisions to come in November’s Budget, the UK economy is proving resilient and it is forecast to grow by around 1.3% over the course of the full year.

“It’s not the kind of growth that the government would like, nor is it the kind of growth that will change those tough decisions, but it is still growth.”

Business and economic confidence drops

09:40 , Karl MatchettLloyds Bank released their index of business confidence overnight and it shows another fall.

The index slid by 12 points in the month to September, down now to 42 per cent.

Additionally, wider optimism in the British economy dipped to 33 per cent, down 11 points.

FTSE 100 suffers sharp fall

10:00 , Karl MatchettA mid-morning look now at the stock markets before we eye up further meaning behind the economic data.

The FTSE 100 is down about 0.3 per cent. In France and Germany, primary indices are down about 0.5 and 0.2 per cent respectively.

Outside the FTSE 100, Asos shares fell 8 per cent after they issued a warning over lower sales this year, despite progress on cost-cutting.

Smaller businesses in the UK aren’t as affected, with the FTSE 250 mostly flat.

Gym brand targets dozens of new UK sites by end of this year

10:20 , Karl MatchettPureGym is embarking on an ambitious expansion drive across the UK, aiming to open up to 60 new gyms this year as it capitalises on a significant increase in people prioritising their fitness.

Known for its numerous 24-hour facilities, PureGym is broadening its reach beyond major urban centres, targeting rural areas and smaller towns alongside big cities.

This push follows a strong start to the year, with 34 new sites already launched across the country, including four that opened on Friday.

The group aims to establish between 55 and 60 new locations in the UK by the close of 2025.

Gym brand targets dozens of new UK sites by end of this year

Royal Mail to take over thousands of UK convenience stores

10:40 , Karl MatchettRoyal Mail’s owner has bought a multi-million pound stake in another firm which will see thousands of convenience stores rebranded.

International Distribution Services (IDS), the firm which owns the postal service, has concluded a purchase of 49 per cent of shares in parcel company Collect+ with part of the deal meaning about 8,000 stores will now be branded Royal Mail.

It means high street stores will sell postage over the counter and customers can pay bills in person rather than only online.

In addition, Royal Mail announced they will hire around 20,000 temporary workers to boost delivery operations across the Christmas period.

Full details here:

Over 100 jobs to go at Lindsey oil refinery as union slams government

11:13 , Karl MatchettIn the past hour it has emerged a total of 125 jobs are to be lost at the Lindsey oil refinery, following the collapse of owner Prax Group in June.

Searches for a buyer have been underway but a leading union has criticised the move as “making a mockery of government promises” and said the redundancies are the responsibility of those in power.

It has been reported 255 employees will remain at the Lindsey site, out of 420 staff who are directly employed and 500 contract workers.

More here on this emerging story:

Over 100 jobs to go at Lindsey oil refinery as union slams government

GDP figures mean interest rates could remain higher until April

11:40 , Karl MatchettBack to today’s GDP figures, while the data is backward-looking, there are certain forward-looking impacts, says one industry expert.

John Wyn-Evans, head of market analysis at Rathbones, says it means interest rates won’t be cut any time soon - and is also a potential reason for high inflation.

“The final revisions to GDP data for the second quarter of 2025 showed that overall economic activity remains sluggish, although at a slightly higher level than previously calculated. On the one hand, this suggests that productivity growth has been less anaemic than previously thought, which is a plus. On the other hand, it might also help to explain the persistently high levels of inflation.

“What does this mean for policy? There will be no revisions to either consumer price or employment statistics, and so the Bank of England will have no reason to change its stance, which remains focused on reducing inflation. Futures markets continue to see no further cuts in the base rate until possibly as late as April 2026. Of more immediate interest will be the Budget in November, and there is nothing in today’s release to change the widely held opinion that the Chancellor will once again be raising taxes.”

Adults earning little or no interest on money surges by 125%

12:00 , Karl MatchettParagon Bank say the number of adults earning 1 per cent interest or lower on their money has more than doubled across this year.

With inflation at or around 4%, those only earning minimal amounts on their cash are seeing their spending power reduced significantly.

Over £10bn is currently sitting in these accounts, they say.

“Given stubbornly high inflation, and plenty of competitive options for savers, consumers have a great choice when it comes to savings accounts, yet many are still missing out on significantly better returns,” the bank said.

“We urge savers to shop around and make sure their money isn’t sitting in an account earning 1% or below. Even a small increase in interest can make a meaningful difference over time.”

Plenty of banks are still offering 4 per cent and more. Market leaders are at around the 4.5 per cent mark right now.

If you are saving regularly at present, consider opening another current account elsewhere to get access to the best regular saver deals - some are still offering about 7 per cent.

You really have no excuse to only be getting 1 per cent!

Virgin offer £50,000 salary social media role documenting cruises spas and more

12:20 , Karl MatchettVirgin are set to employee a ‘Head of Yes’ - essentially a role which documents luxury trips and experiences on social media.

The position has a salary of £50k and includes “luxury Virgin experiences, Upper Class flights, hotel stays, spa days, and Virgin Voyages cruises”.

That’s in response to some research suggesting Brits say their best experiences come from saying “yes” to offers to do exciting things, despite many missing out due to finances, routine or fear of trying something new.

Applications for the position, are, predictably, via TikTok.

A new tax system is coming – here’s what the self-employed and freelancers need to know

12:40 , Karl MatchettMillions of sole traders and landlords have just months to prepare for massive changes to the tax system that take effect next year.

From 6 April 2026, Making Tax Digital for Income Tax Self Assessment (MTD ITSA) will apply to sole traders and landlords whose combined gross income from self-employment and/or property exceeds £50,000 a year. If this applies to you, you’ll need to keep digital records and use HMRC-compatible software to submit four quarterly updates and then a ‘final declaration’ to HMRC each year. This will replace the current self-assessment tax return.

Details here:

A new tax system is coming next year – here’s all the guidance you need

Construction activity missing out on $2.5 trillion of business this year

13:00 , Karl MatchettResearch emerging today suggests global construction will miss out to the tune of £1.8tn this year - due to businesses simply not knowing what’s around the corner.

Upheaval has been paramount worldwide due to everything from tariffs to wars, inflation and geopolitical changes.

Project management firm Currie and Brown say “persistent uncertainty” is behind decision-making from business leaders which will “wipe $2.5 trillion from the value of construction activity globally this year”.

“The construction sector has always experienced its fair share of volatility. But this goes well beyond the usual cycle. In over 40 years in the industry, I’ve not seen such a persistently uncertain market,” said the group’s CEO, Dr Alan Manuel.

FTSE 100 climbs after slow start

13:30 , Karl MatchettA quick look ahead at the afternoon stock market movements now and the FTSE 100 has recovered a poor early session.

It’s now up 0.13 per cent, with the smaller companies FTSE 250 up 0.25 per cent today.

The Euro Stoxx 50 remains just about down, 0.05 per cent.

Among British firms the big FTSE 100 riser is pest control firm Rentokil, up 3 per cent.

Hundreds of thousands of older workers seeking employment - could boost economic growth

14:00 , Karl MatchettFinding jobs for elder workers is a key issue the government have to solve, believes one industry expert.

Nearly a million more people could be working among people aged 50-64, new research shows.

Stephen Lowe, group communications director at retirement specialist Just Group, said: “With the rises in State Pension age and life expectancy it is making more financial sense to work until later in life, which is what the figures reveal.

“Overall, about 876,000 people including 304,000 unemployed and 572,000 who are inactive are either actively seeking work or would like to work. This is up from 750,000 a year ago, so the lack of opportunities for this age group remains a real and growing problem.

“These are some of the most skilled and experienced workers in the country. For the economy to grow, we need to see many more of these people returning to productive roles in the workforce.”

Royal Mail to take over thousands of UK convenience stores

14:30 , Karl MatchettRoyal Mail’s owner has bought a multi-million pound stake in another firm, which will see thousands of convenience stores rebranded.

International Distribution Services (IDS), the firm which owns the postal service, has concluded a purchase of 49 per cent of shares in parcel company Collect+, with part of the deal meaning about 8,000 stores will now be branded Royal Mail.

It means high street stores will sell postage over the counter and customers can pay bills in person rather than only online.

Renewables generate record share of electricity generation, figures show

15:00 , Karl MatchettRenewable sources generated a record share of the UK’s electricity for April, May and June, according to Government figures.

Energy trends data, released by the Energy Department (DENSZ) on Tuesday, show that wind, solar, hydro, and bioenergy together accounted for 54.5% of all the UK’s generation for these three months this year.

This marks an increase of 2.8 percentage points from the same quarter of the year in 2024.

Renewables generate record share of electricity generation, figures show

The one factor that Irn-Bru maker credits for its rising sales

15:30 , Karl MatchettIrn-Bru manufacturer AG Barr has announced a boost in sales and profits, attributing the positive performance to price adjustments implemented earlier in the year.

The Scottish beverage firm highlighted particularly robust sales across its energy and sports drink portfolios over the last six months.

Chief executive Euan Sutherland commented that the business had made "good progress" in positioning itself for sustained future growth.

The one factor that Irn-Bru maker credits for its rising sales