BJ's Restaurants topped revenue estimates and reported a loss less than expected by analysts Thursday. The loss was the restaurant chain's first since the fourth quarter 2021. BJRI stock advanced after the market closed Thursday.

Like other major restaurant chains, BJ's has been struggling to recover from the Covid pandemic. Revenue growth has topped 2019 levels in recent quarters. The bottom line is a different story. Wall Street had forecast a loss in Q3 greater than the loss in 2021 during the same period. However, the restaurant chain proved analysts wrong.

BJ's Restaurants Earnings

Estimates: Wall Street predicted pressure from rising food and labor costs will drive a loss of 28 cents per share, compared to a 13-cent loss in Q3 2021. Analysts forecast revenue growth of 8%, to $304 million, according to FactSet. Same-store sales were expected to be up 6.2%.

Results: BJ's Restaurants reported a net loss of 7 cents per share while revenue increased 10% to $311.3 million. Same-store sales went up 6.2%

The Q3 loss includes a $4.1 million income tax benefit along with a $3.1 million pretax benefit related to the Employee Retention Tax Credit under the CARES Act.

BJRI opened a new location in Las Vegas, Nevada, last week and expects to open two additional restaurants in Q4. Due to construction delays, two restaurants previously expected to open in 2022 are now scheduled to open in Q1 2023, the company reported.

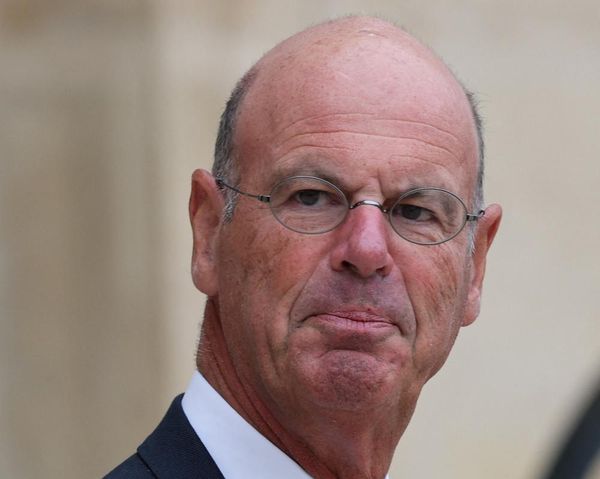

"Restaurant level operating margins remained impacted by inflationary pressures but benefited from labor management efficiencies and early successes of our margin improvement initiative in the third quarter," CEO Greg Levin said in a statement.

BJ's Restaurants stock advanced 4.4% after the market closed. Shares had dropped 2.4% to 26.88 during Thursday's market trading. On Wednesday, shares dropped 0.5% to 27.55.

Founded in 1978, the Huntington Beach, Calif.-based restaurant chain has 214 locations in 29 states. The company also owns microbreweries that supply beer to other locations in the chain. The chain operates under the names BJ's Restaurant & Brewery, BJ's Restaurant & Brewhouse, BJ's Grill and BJ's Pizza & Grill.

On July 21, when the company announced its Q2 earnings, BJ's said that given the "inflationary environment and its impact on our restaurant margins" it would be implementing additional menu price increases in August.

In Q2, BJRI missed on earnings estimates and narrowly topped sales views. BJ's Restaurants earnings sank 96% to 1 cent per share while revenue increased 14% to $330 million.

The restaurant chain suffered along with the rest of the industry during the beginning of the Covid pandemic. The company finally broke a string of five consecutive quarters of losses in Q2 2021 when it reported EPS of 26 cents per share.

Sales also dropped off in 2020, before their recent rebound. In Q3 2021, revenue edged up 1% to $282 million compared to the same period in 2019. In the second-quarter 2022, sales jumped around 14% compared to 2019.

BJ's Restaurants ranks 19th in the Retail-Restaurants industry group. Chipotle and Texas Roadhouse are among the top stocks in the group.

BJRI shares have a 69 Composite Rating out of 99. The stock has a 79 Relative Strength Rating, an exclusive IBD Stock Checkup gauge for share-price movement. The EPS rating is 31.

Please follow Kit Norton on Twitter @KitNorton for more coverage.