Bitcoin (BTCUSD) mining stocks are turning out to be some of the biggest winners in the current climate. Several of them are posting exceptional gains and are dwarfing BTC's own performance. BTC is essentially flat over the past month, but several mining stocks have surged 30-150% in this timeframe.

This could be a part of a broader shift where investors pile into these companies for sharper gains. Crypto mining companies have been left in the dust by Bitcoin and the broader crypto market due to their inefficiencies compounding after the last Bitcoin halving. They may now just be catching up.

Moreover, many of these companies are no longer just Bitcoin miners. They're investing heavily in high-performance computing (HPC) and artificial intelligence (AI) data centers. It's convenient for them, as they already have expertise with GPUs due to crypto mining. These pivots are economically compelling because AI data centers can generate up to 25 times more revenue per kilowatt-hour compared to traditional Bitcoin mining operations.

Here are three crypto mining stocks to consider snapping up:

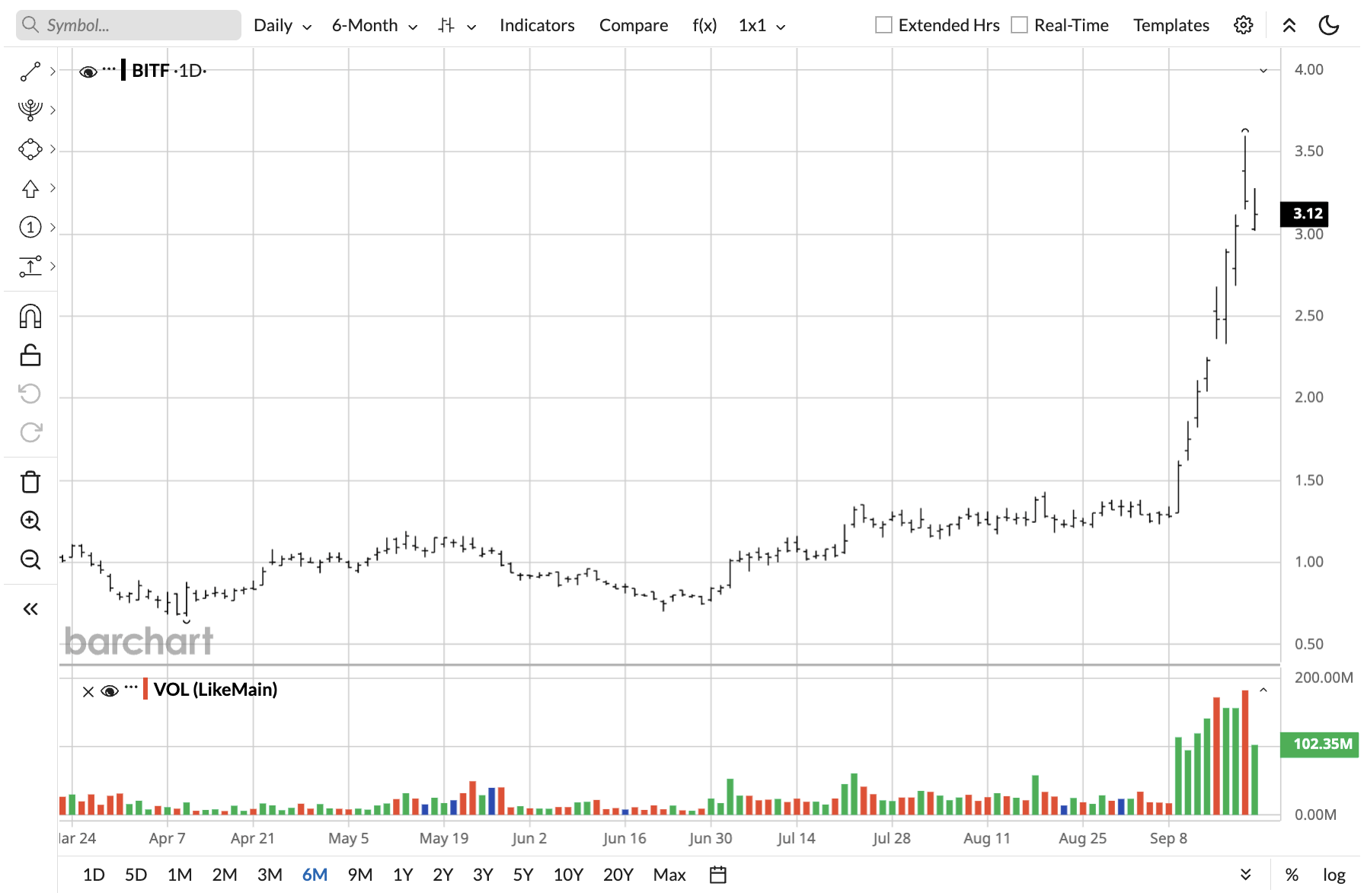

Bitfarms (BITF)

Bitfarms (BITF) has been a standout performer this September. It is up 143.75% in the past month. The company is capitalizing on the AI market and secured $300 million in financing in April for a data center project.

It is transforming itself from being a crypto miner to being a scalable AI infrastructure company. BITF stock is still down from its 2024 peak but is holding above $3 after being rejected at $3.5.

If Bitcoin continues to gain, BITF stock could amplify its gains and break beyond the $3.5 resistance level. Then, a move beyond the $3.6-3.8 range can lead to a jump all the way to $6. BITF stock has soared significantly in the past each time it has broken above $4. The last time it did, it went from $3.29 to $6.78 within three weeks.

I see the rally continuing as long as the broader market has more appetite for risk.

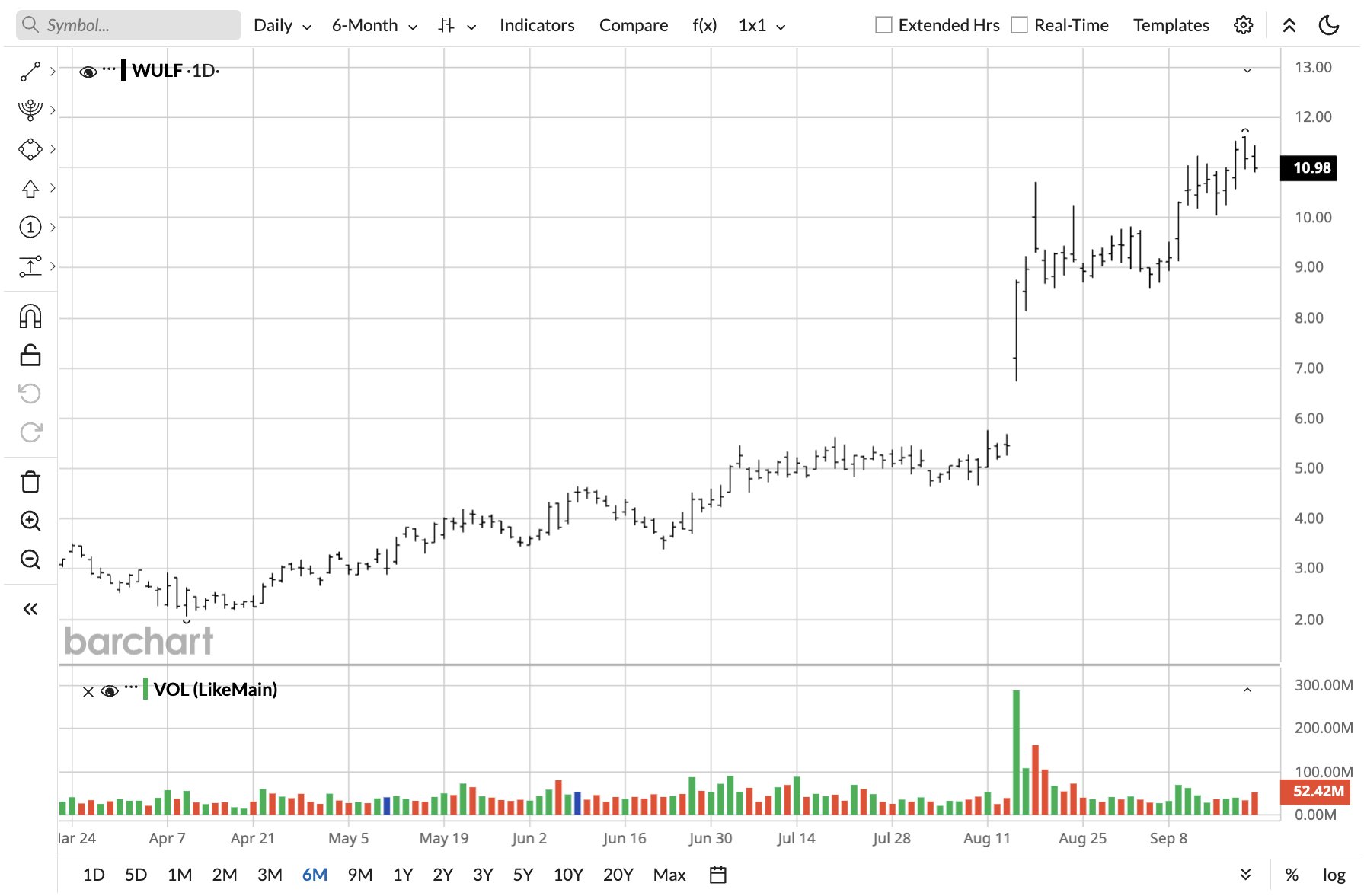

TeraWulf (WULF)

TeraWulf (WULF) is taking a dual-track approach by operating both WULF mining for Bitcoin and WULF Compute for AI and HPC.

On a 30-day basis, WULF is the weakest performer of the three and is up just 25%. However, this still exceeds BTC. WULF is also up over 101% year-to-date (YTD) and has outperformed in that timescale.

The company reached a landmark $3.7 billion colocation agreement with AI platform Fluidstack that could potentially reach $8.7 billion through lease extensions. Most notably, Alphabet (GOOG) (GOOGL) will backstop $1.8 billion of Fluidstack's obligations and receive warrants for approximately 41 million TeraWulf shares. This constitutes an 8% stake in the company.

The first 40 MW is expected to be online by mid-2026, with full deployment by year-end, and the company expects impressive 85% net operating income margins on the AI hosting business, translating to roughly $315 million annually.

WULF has a market cap of $4.48 billion and trades at $11, but if management can execute on the plan, it may reach $20-30 by year-end.

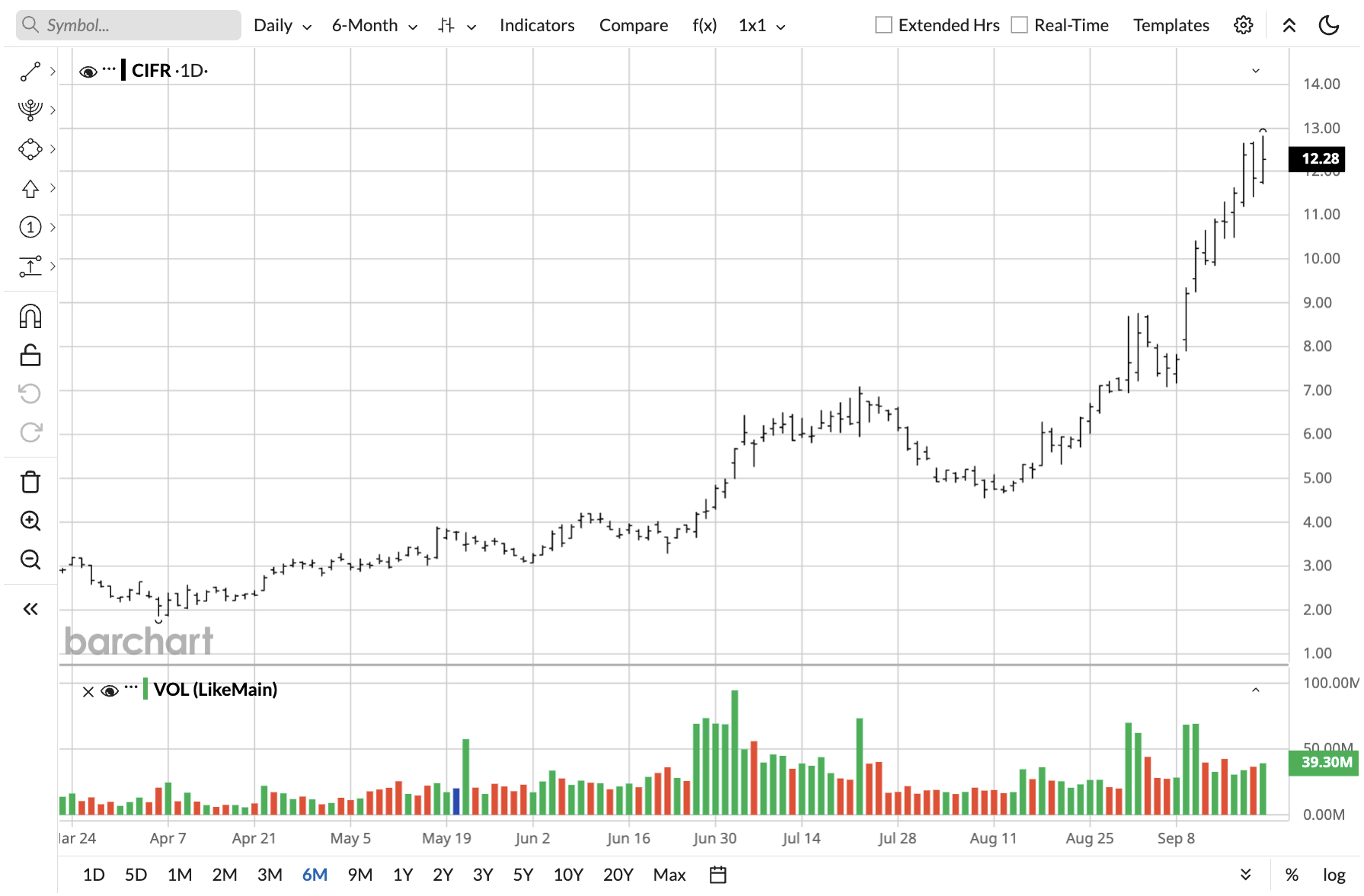

Cipher Mining (CIFR)

Cipher Mining (CIFR) is up 113.2% in the past month and 154% YTD. It has delivered the sharpest gains among the three and may be on the cusp of reaching a new all-time high.

Cipher mined 241 Bitcoin in August while maintaining a hash rate of 23 EH/s with a target of 23.5 EH/s by the end of Q3. It has 115,000 mining rigs deployed and a total holding of 1,414 Bitcoin.

The Black Pearl Phase I facility is spearheading its growth, and its output constituted 39% of the company's BTC production in August.

The company uses a hybrid model to monetize power capacity through whichever application generates higher returns at any given time, and its Black Pearl facility can support both BTC mining and HPC hosting for AI, and the strategy is paying off.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.