Shares of cryptocurrency mining company Bit Origin Ltd. (NASDAQ:BTOG) surged in Friday’s pre-market trading amid Bitcoin's (CRYPTO: BTC) record-shattering rally.

What happened: The Nasdaq-listed firm focuses on the Bitcoin mining ecosystem, as well as the deployment of blockchain technologies.

Earlier in the month, it regained compliance with Nasdaq's equity standard, which mandates listed companies to maintain a minimum of $2.5 million in stockholders' equity.

The latest spike may have to do with the ongoing rally in the cryptocurrency market, which has propelled Bitcoin beyond $118,000.

See Also: Elizabeth Warren Says Crypto Industry Wants Trump To Boost Their Products Just Like He Was ‘Hawking’ Elon Musk’s Cars

The momentum has buoyed most Bitcoin-related equities, with Strategy Inc. (NASDAQ:MSTR) and MARA Holdings Inc. (NASDAQ:MARA) rising 2.71% and 3.37%, respectively, after-hours. CoinShares Valkyrie Bitcoin Miners ETF (NASDAQ:WGMI) was up 1.18%

Price Action: At the time of writing, Bitcoin was exchanging hands at $$117,761.58, up 5.91% in the last 24 hours, according to data from Benzinga Pro.

Shares of Bit Origin were up as much as 75% in pre-market trading after closing 48.8% higher at $0.2900 during Thursday's regular trading session. The stock has risen 81% over the last month.

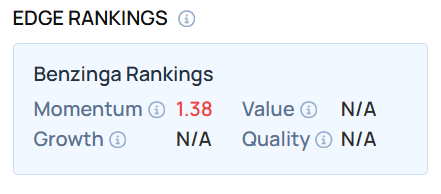

BTOG recorded a low momentum score as of this writing. If you are looking for high-momentum stocks for your portfolio, go to Benzinga Edge Stock Rankings.

Read Next:

Photo: Paopano on Shutterstock.com