Biodesix Inc. (NASDAQ:BDSX) shares jumped 51.64% to $0.64 in after-hours trading on Wednesday, following disclosure of a substantial insider purchase by major shareholder Jack W. Schuler.

Check out the current price of BDSX stock here.

Major Insider Purchase Triggers Rally

The biotech stock’s surge came after SEC filings revealed Schuler purchased 3.49 million shares at $0.43 per share on August 29, for approximately $1.5 million through his living trust. The purchase was executed via a registered at-the-market offering using Schuler’s personal funds.

The timing proved strategic, as regular trading closed at $0.42, according to Benzinga Pro data, representing a 4.22% decline for the session before the after-hours spike.

Schuler Expands Control to 26% Stake

Following the purchase, Schuler’s total beneficial ownership reached 39.82 million shares, representing 26% of outstanding stock. His holdings are structured across multiple entities:

- 24.41 million shares held by Jack W. Schuler Living Trust (16%)

- 15 million shares held by Jack W. Schuler 2025 GRAT (9.8%)

- 414,811 shares through direct ownership and options exercisable within 60 days

Traders and investors on social media also quickly picked up on the activity. One notable post by @StockTrader40 highlighted the insider move, contributing to buzz around the stock's sharp reversal.

Market Context and Fundamentals

The Colorado-based company trades with a $62.4 million market capitalization and 1.44 million average daily volume. The stock has experienced significant volatility, with a 52-week range of $0.17 to $1.91, down 76.94% over the past year.

Insider Confidence Signal

Schuler’s substantial purchase at current price levels signals strong confidence in the diagnostic company’s prospects. As both a 10% owner and major shareholder through various trusts, his investment represents a significant vote of confidence in Biodesix’s strategic direction and valuation at these levels.

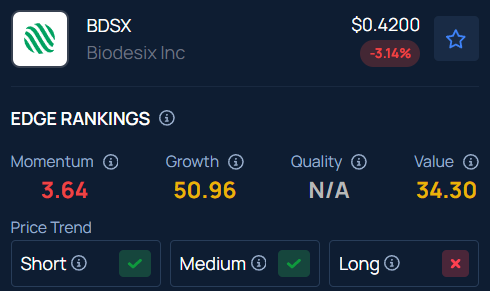

Benzinga’s Edge Stock Rankings indicate that BSDX is experiencing long-term consolidation along with medium and short-term upward movement. Know how its momentum lines up with other well-known names.

Photo Courtesy: Gorodenkoff on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.