/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

Billionaire activist investor Paul Singer's Elliott Management made waves with a new position in Hewlett Packard Enterprise (HPE), acquiring 18.6 million shares in Q2. This strategic bet on the enterprise technology company suggests Singer sees significant upside potential in HPE's transformation story.

HPE competes with Dell (DELL) and Super Micro Compputer (SMCI) in the server technology space. The company aims to capitalize on the artificial intelligence (AI) boom with higher-than-expected AI systems revenue offsetting declines in legacy compute volumes. Moreover, a hybrid cloud approach differentiates it from pure-play cloud vendors, allowing it to serve customers who prefer mixed on-premises and cloud infrastructure.

HPE's subscription-based GreenLake platform remains a key driver of future growth. The business ended Q2 with 42,000 customers and generated over $2.2 billion in annualized revenue, up 47% year-over-year (YOY). This transition to higher-margin software and services revenue represents a business model shift that could drive profitability.

Management is also implementing the comprehensive "Catalyst" program targeting structural cost savings through operational efficiency, portfolio optimization, and AI integration. The server business is targeting 10% margins by Q4, up from current levels, through improved pricing analytics and inventory management.

HPE's combination of AI exposure, subscription revenue growth, and margin improvement initiatives could appeal to value-oriented investors. However, the enterprise technology sector faces ongoing challenges from cloud migration and competitive pressures that investors should consider before following Singer's lead.

Is HPE Stock a Good Buy Right Now?

Hewlett Packard Enterprise's fiscal Q2 earnings reveal several compelling investment catalysts that extend beyond its already-documented AI and subscription growth story.

HPE has successfully addressed recent operational challenges by implementing rigorous pricing analytics, tightening deal desk controls, and improving inventory management.

Unlike many technology companies struggling with uneven demand, HPE achieved year-over-year revenue growth across every product segment. The Intelligent Edge business returned to growth for the first time in five quarters, driven by the networking market recovery and Wi-Fi 7 adoption ramping triple digits sequentially. This broad-based momentum reduces dependence on any single business line.

The pending $14 billion Juniper Networks acquisition is expected to close before the fiscal year-end. Additionally, management projects at least $450 million in annual run rate synergies within 36 months, creating a comprehensive edge-to-cloud networking portfolio. This deal expands HPE's addressable market in the rapidly growing networking infrastructure space.

Despite near-term working capital impacts from large AI deployments, HPE maintains strong fundamentals, with improving free cash flow expected in the second half. The company reduced inventory by $481 million sequentially and continues returning capital to shareholders through dividends and buybacks.

HPE has successfully navigated a volatile trade environment, reducing tariff exposure from $0.07 to $0.04 for fiscal 2025 through USMCA compliance and supply chain optimization. This demonstrates operational agility in managing external headwinds.

Is HPE Stock Undervalued Right Now?

Analysts tracking HPE stock forecast adjusted earnings to expand from $1.99 per share in fiscal 2024 (ended in October) to $2.63 per share in fiscal 2027. In this period, free cash flow is projected to increase from $2.30 billion to $2.71 billion. Valued at 10 times forward FCF, HPE stock is not too expensive, given it also offers shareholders a dividend yield of 2.5%.

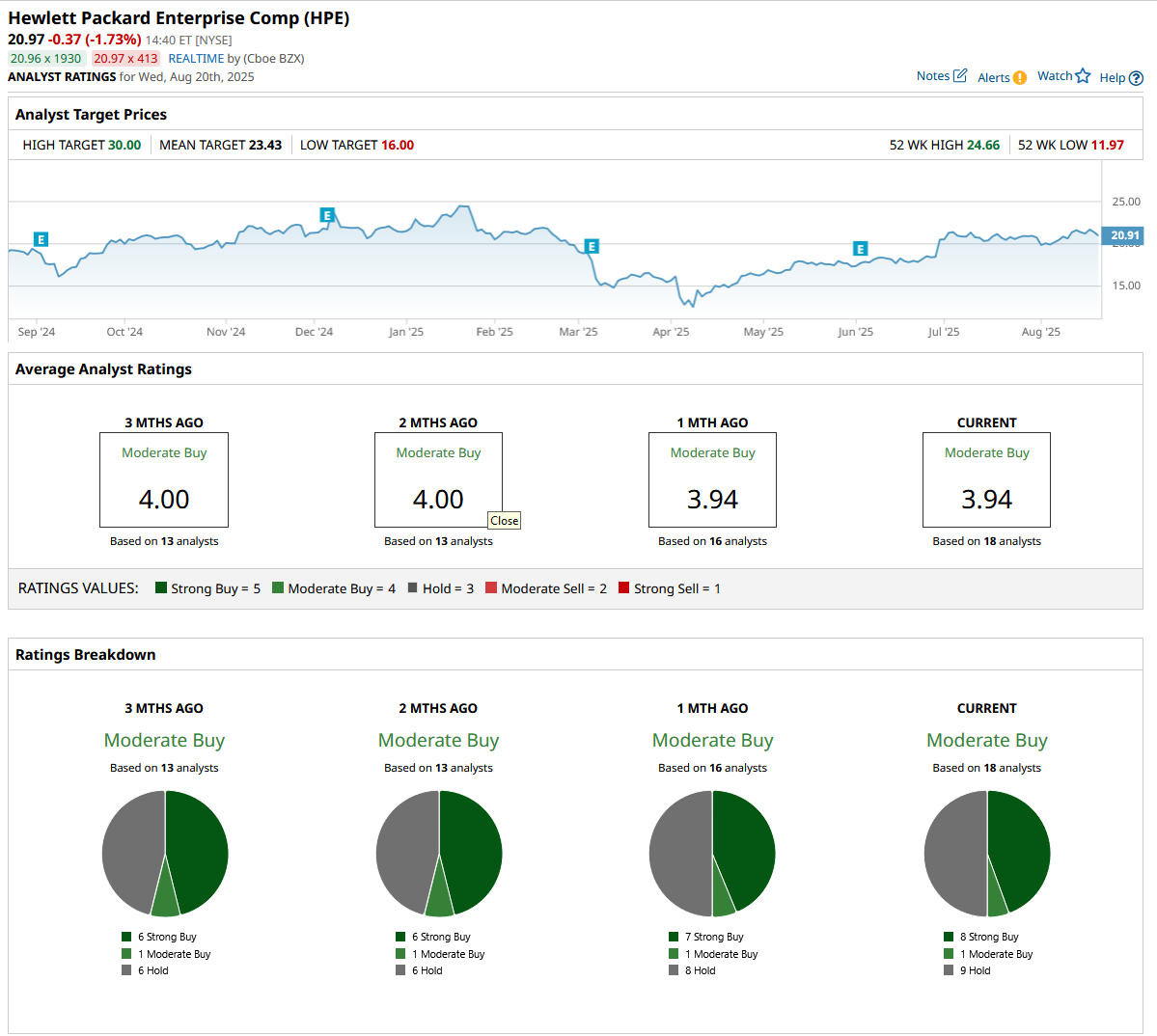

Out of the 18 analysts covering HPE stock, eight recommend “Strong Buy,” one recommends “Moderate Buy,” and nine recommend “Hold.” The average HPE stock price target is $23.43, above the current price of $20.97.