Freddie Mac (FMCC) stock and its counterpart, Fannie Mae (FNMA), have both been hot investments this year, up more than 200% each after the Trump administration indicated that it was considering a public offering for the two government-sponsored enterprises.

While there is considerable interest in a shift toward privatization for Freddie Mac and Fannie Mae, a red flag remains. Federal Housing Finance Agency director Bill Pulte took to social media to urge investors to “read the risks that Freddie Mac has in their 10-K” before investing.

On the surface, that’s sound advice for anyone who is looking at opening a new position. But considering Pulte’s role in the government office that regulates Fannie Mae, Freddie Mac, and the Federal Home Loan Banks, the warning put an immediate damper on Freddie Mac stock. It dropped 10% last week following Pulte’s post.

About Freddie Mac Stock

Freddie Mac, which is also the name of the Federal Home Loan Mortgage Corporation, was created in 1970 to work with smaller banks to help banks finance long-term fixed-rate mortgages with low down payments. Similar to Fannie Mae, which was created during the Great Depression to work with major lenders, Freddie Mac’s role is to expand liquidity and give smaller lenders access to real estate sales.

Freddie Mac has a market capitalization of $6.6 billion, so it’s smaller than Fannie Mae. FMCC stock is up 231% so far this year, although it’s now trading 28% below its 52-week high.

Fannie Mae and Freddie Mac have been under government conservatorship since they needed government bailouts in 2008 when the housing bubble popped. Both companies had taken on risky loans and securities that included subprime loans and were in danger of collapse. Following billions of dollars in losses, Congress created the Federal Housing Finance Agency and placed them under conservatorship. The two organizations have paid billions of dollars in dividends to the U.S. government as part of the arrangement and are now profitable.

A look at the Freddie Mac 10-K

Companies—and enterprises like Freddie Mac that trade on the New York Stock Exchange—annually file a 10-K report that includes financial statements, risk disclosures, management commentary, and legal issues.

Fannie Mae and Freddie Mac have paid billions in dividends to the U.S. government as part of the conservatorship—more than they received as part of the bailout, in fact—and are now profitable.

Freddie Mac’s 10-K, filed Feb. 13 for the 2024 calendar year, is nearly 400 pages, including an entire section about risk—including information about how it manages risk and detail about the inherently risky nature of mortgage credit risk. For instance, it discloses that it may not be able to fully assess the creditworthiness of loans in its portfolio if credit scores don’t reflect the impact of government relief programs stemming from the Covid-19 pandemic.

It includes descriptions of how the organization evaluates market conditions that can affect the credit quality of mortgage loan purchases and how the organization handles foreclosures. It also includes a discussion about natural disasters, interest rate fluctuations, and other market risks.

This lengthy section concludes with a bulleted list that reads like a caution sign. It acknowledges an “uncertain future” and that federal policy controls its profitability, liquidity, and its existence. The organization has no control over long-term planning or capital distributions as long as it's under the control of the federal government.

Part of this risk section includes language that refers to Pulte, who had not been confirmed at the time that the 10-K was filed. “The current Administration has nominated a new Director of FHFA who may change our priorities and strategy in various ways, including ending the conservatorship, and could direct us to undertake new business activities and limit or cease existing activities,” the filing reads. “Some or all of our functions could be transferred to other institutions, and we could cease to exist as a stockholder-owned company. If any of these events occur, our shares could diminish in value, or cease to have any value. Our stockholders may not receive any compensation for such loss in value.”

What Do Analysts Say About FMCC Stock?

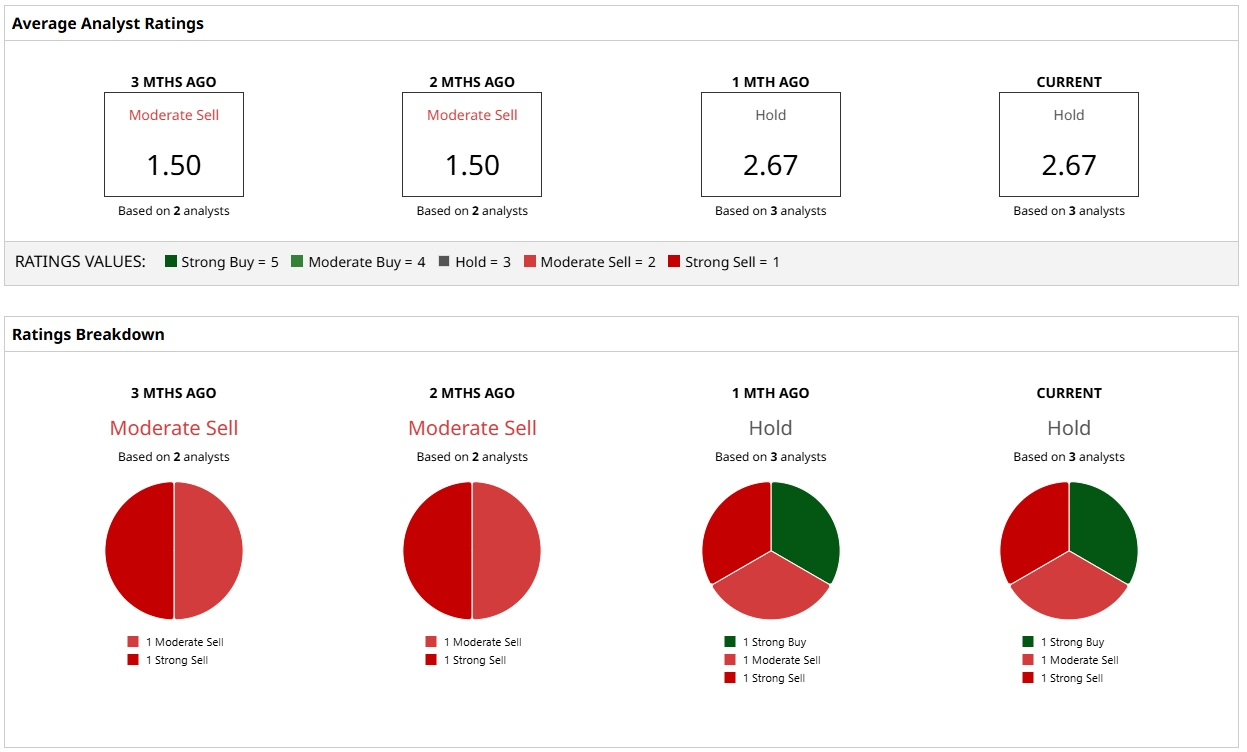

Analyst sentiment has definitely shifted on Freddie Mac since the government indicated it would consider a public offering. Just two months ago, analysts called FMCC stock a “Moderate Sell,” but now the consensus advice is to hold, with one analyst calling it a “Strong Buy,” one a “Strong Sell,” and one a “Moderate Sell.”

In addition, the price targets for FMCC stock are all over the board, with a high target of $25 and a low target of $2. The stock is currently trading just below the mean target of $12.67.

Here’s the bottom line: there’s nothing in the government’s disclosure that surprises me because it all appears to be boilerplate language. That’s the purpose of the 10-K, to disclose every possible risk and make sure that management is covered. In today’s litigious society, these types of disclosures are common so shareholders can’t say they weren’t warned. To me, it’s the same type of warning that you would find on an iron that says, “Do not iron clothes on the body,” or a coffee cup that says, “Contents are hot.”

If you were interested in Freddie Mac stock before Pulte’s social media post, there’s nothing here to change your outlook.