On Sunday, Pershing Square Capital Management founder Bill Ackman endorsed "The Philosopher in the Valley: Alex Karp, Palantir and the Rise of the Surveillance State," Michael Steinberger's new biography of Alex Karp and Palantir Technologies (NASDAQ:PLTR).

Ackman Calls Karp's Biography ‘Honest' And ‘Fascinating'

In a post on X, formerly Twitter, Ackman said he found the book to be well-told and revealing. “It was a quick, well-written, and fascinating read… Definitely worth a read,” he wrote.

Ackman added that the book felt unusually straightforward in its depiction of both the CEO and the company. “I am a Karp fan. We need more high-profile people who are unafraid of speaking freely about important issues.”

From Outsider To Surveillance-Tech Pioneer

Karp, whose net worth is pegged at $15.3 billion by the Bloomberg Billionaire Index, co-founded Palantir in 2003 with Peter Thiel and several Stanford technologists.

The company's data-analysis platforms were initially funded by In-Q-Tel, the CIA's venture arm and became widely used across U.S. intelligence and military agencies after 9/11.

Born in New York in 1967 and raised near Philadelphia, Karp grew up in a socially active household and later earned degrees from Haverford College, Stanford Law School and Germany's Goethe University.

Steinberger's book portrays him as an unconventional leader driven by a sense of vulnerability, extreme discipline and an outsider's mindset.

An Eccentric, Private And Intensely Driven CEO

"Fear is something that really drives him," said journalist Steinberger, according to The Guardian.

The biography paints Karp as a fitness-obsessed, highly private executive with a nomadic lifestyle, a fondness for tai chi and cross-country skiing and an unconventional personal life.

Steinberger writes that Karp's quirks are not an act — but core to how he runs Palantir, the report noted

Palantir Tops Wall Street Forecasts With Strong Q3 Revenue

Earlier this month, Palantir reported third-quarter revenue of $1.18 billion, topping analyst expectations of $1.09 billion. The AI software firm also delivered adjusted earnings of 21 cents per share, outperforming the 17 cents per share analysts projected, according to Benzinga Pro.

Palantir shares have surged 105.94% year to date, climbing to $154.85 as of Friday.

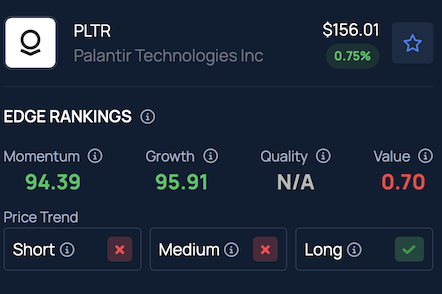

Palantir ranks in the 95th percentile for Growth and the 94th percentile for Momentum in Benzinga's Edge Stock Rankings — explore how it stacks up against other stocks here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Hiroshi-Mori-Stock On Shutterstock.com