Editor’s Note: The story has been corrected to reflect the correct designation of Bill Smead.

Bill Smead, the chairman and chief investment officer of Smead Capital, has announced that his firm fully exited its position in Berkshire Hathaway Inc. (NYSE:BRK) last quarter, citing valuation concerns related to Warren Buffett's impending departure from the company.

Check out the current price of BRK-B stock here.

What Happened: On Saturday, Smead announced that his fund had sold the entirety of its Berkshire stake last quarter. “We sold the last of our Berkshire,” he said, while appearing on CNBC’s “The Exchange.”

“The reason is, there was a premium associated with him [Warren Buffett] being deeply involved in most every aspect of the major investments,” Smead says, referring to Buffett announcing that he would be stepping down as CEO, during the company’s 60th Annual Shareholders Meeting in May.

Besides this, Smead believes that Berkshire’s inclusion among the largest stocks in the S&P 500 may become a liability in a market reversal.

He says, “The cyclically adjusted PE ratio of Schiller broke the record lately… And over the following three- and five-year periods, the S&P did not make any money.” He adds that at some point, this “momentum in the S&P 500 index, which has been great for 15 years, will become momentum in the wrong direction.”

That shift, Smead warned, would disproportionately affect large-cap names. “When somebody sells their position in the S&P 500, it’s mainly selling the 10 largest cap companies,” he says. “And Berkshire has been dancing around that top 10 regularly.”

Despite this, Smead expressed deep respect for Buffett and his late business partner, Charlie Munger. “I admire the man immensely. I am grateful and thankful that he has been so kind and taught us all,” he said.

Regarding the company’s future, Smead says, “this is going to be a wonderful conglomerate,” but adds that it is no longer “the closed-ended company where the greatest stock picker of all time is doing his work.”

Why It Matters: Since the company’s annual shareholders meeting on May 3, when Buffett announced that he would be stepping down, handing over the reins to Greg Abel as CEO, the stock has dropped 10.3%.

Berkshire’s cash balance now stands at $347 billion, a part of which, according to recent reports, is aimed at making acquisitions in the railroad sector.

Price Action: Shares of Berkshire Hathaway’s Class B shares increased 0.72% on Friday, closing at $484.07, and is up 0.42% after hours.

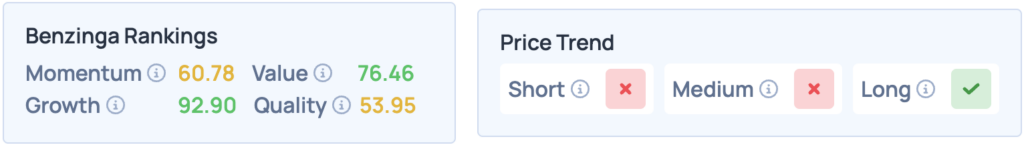

Berkshire shares score high on Growth and Value according to Benzinga’s Edge Stock Rankings, and have a favorable price trend in the long run. Click here for deeper insights on the stock, as well as the company.

Read More:

Photo Courtesy: Sergio Photone on Shutterstock.com