Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week ending October 31:

Bank of New York Mellon Corporation (NYSE:BK): Benzinga reader interest increased in the stock of America's oldest bank company. The Bank of New York Mellon has a long history dating back to the Bank of New York. Shares are up 40% year-to-date and trade near all-time highs. Analysts have been raising their price targets recently, which comes after the company posted a 10th straight double beat in October. The bank stock is one of several public financial companies looking to grow in the cryptocurrency sector. WisdomTree recently appointed BNY for banking-as-a-service infrastructure for digital assets. The bank's growing presence in the cryptocurrency sector could add new growth opportunities.

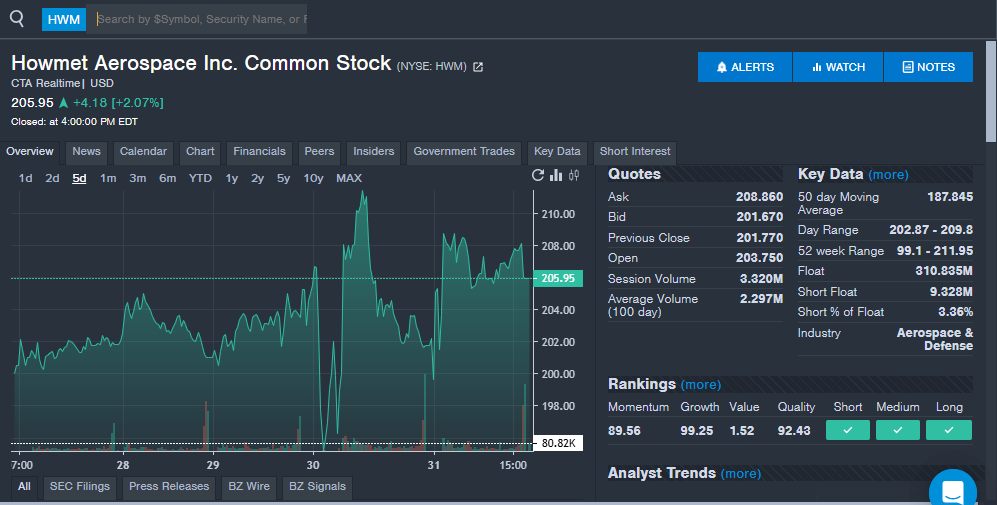

Howmet Aerospace (NYSE:HWM): The aerospace company returns to the Stock Whisper Index after recently reporting third-quarter financial results and raising full-year guidance. The company beat analyst estimates for both revenue and earnings per share. Howmet Aerospace reported strong revenue growth for several segments, citing strong demand for commercial aerospace and defense aerospace. The strong financial results and guidance led to several price target increases from analysts, including TD Cowne raising the price target from $210 to $240, UBS raising the price target from $199 to $209 and RBC Capital raising the price target from $210 to $235.

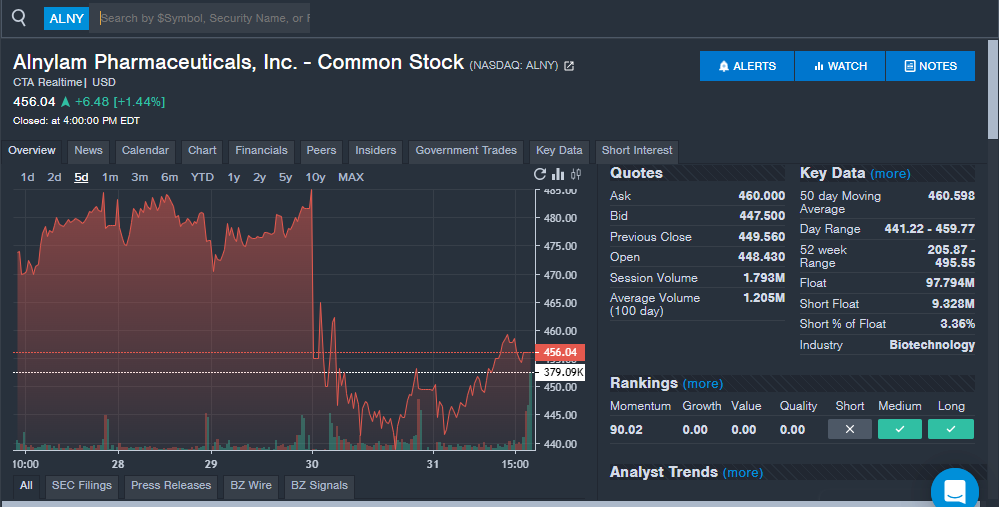

Alnylam Pharmaceuticals (NASDAQ:ALNY): A top performing pharmaceutical stock in 2025, Alnylam Pharmaceuticals saw strong interest from readers during the week with shares trading lower. The company announced it received a subpoena from the U.S. Attorney's Office for the District of Massachusetts over prices on several drugs. The news came as the company announced third-quarter results, with revenue and earnings per share both beating analyst estimates. The company saw sales up 149% year-over-year to $1.25 billion in the quarter. Alnylam raised its full-year sales guidance after the strong quarterly results. Analysts raised their price targets on the stock after the quarterly results. Investors will be closely monitoring the results of the look at pricing as the company experiences significant growth.

American Airlines Group (NASDAQ:AAL): The airline stock saw strong interest from readers during the week, as the sector faces potential setbacks from the government shutdown. An air traffic control shortage could disrupt air travel during the shutdown and potentially the Thanksgiving holiday if it remains prolonged. American Airlines reported third-quarter financial results in late October with revenue and earnings per share both beating analyst estimates. With $13.69 billion in revenue, the company broke its all-time third quarter record. The company reported strength in capacity and loyalty during the quarter. With shares down over 20% year-to-date, the stock could be worth monitoring depending on the length of the government shutdown.

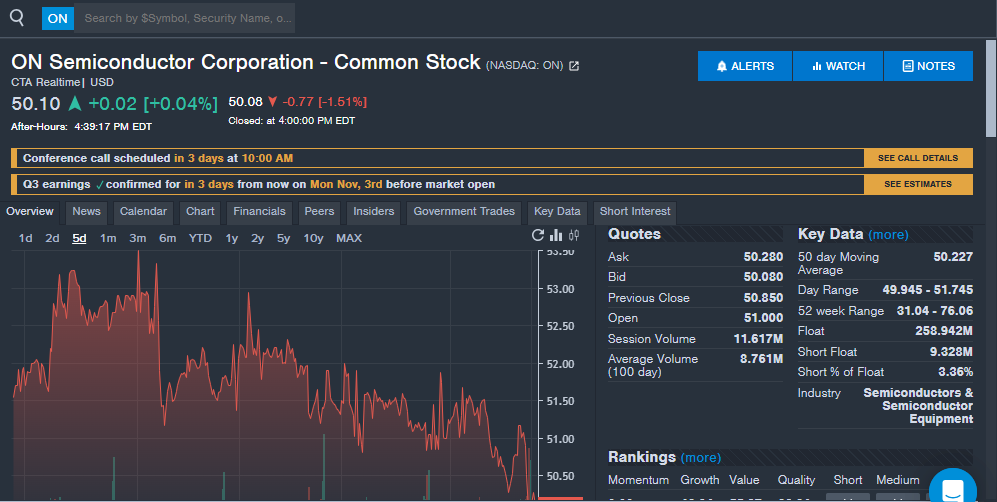

ON Semiconductor Corporation (NASDAQ:ON): The semiconductor company saw strong interest from readers during the week, which comes ahead of third-quarter financial results. The company will report third-quarter results on Monday Nov. 3 before market close. Analysts expect the company to report 59 cents in earnings per share, down from 99 cents per share in last year's third quarter. The company missed analyst estimates for earnings per share in the last fiscal quarter, but has beaten estimates in eight of the last 10 quarters overall. Analysts expect the company to report third-quarter revenue of $1.51 billion, down from $1.76 billion in last year's third quarter. The company has beaten analyst estimates for revenue in two straight quarters and in nine of the last 10 quarters overall.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next: