Each week, Benzinga's Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week ending July 18:

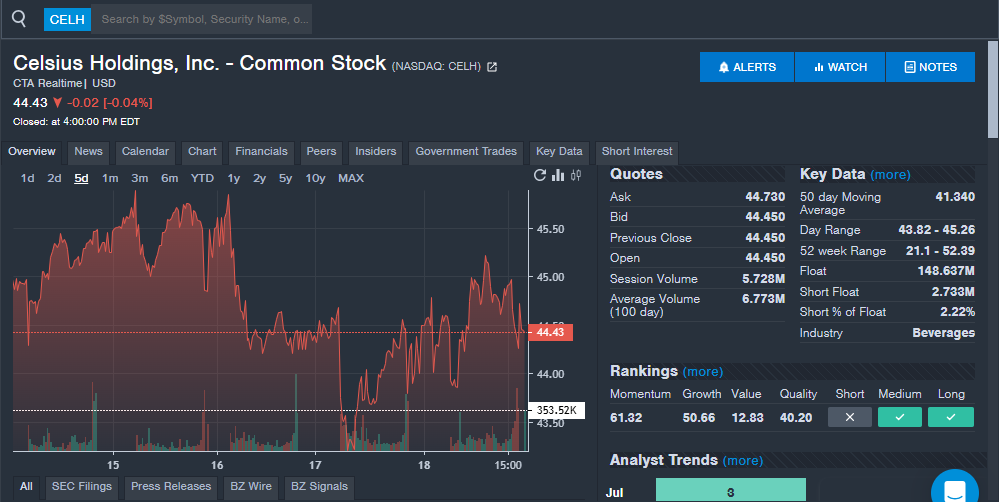

Celsius Holdings (NASDAQ:CELH): The energy beverage company saw strong interest from readers during the week with new reports that Liquid Death is entering the energy drink sector and brings a new competitor to the field. The entry of another well-known brand could hurt Celsius and others. Celsius also saw increased interest with distribution partner PepsiCo reporting quarterly financial results and sharing some details on how the partnership is going. Analysts have been raising their price targets on the stock in July, including Truist, Needham and UBS. Shares were down on the week, but the stock remains up 63% year-to-date in 2025.

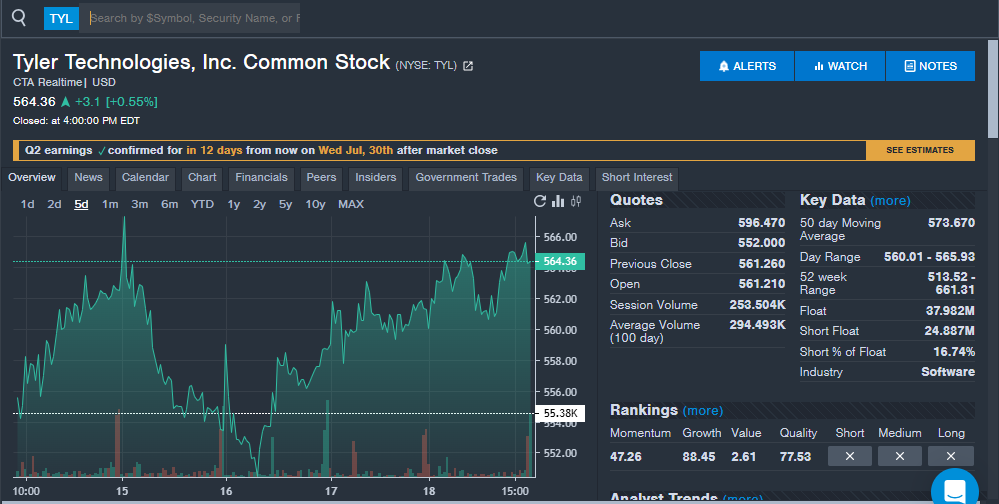

Tyler Technologies (NYSE:TYL): The software company saw strong interest from readers during the week ahead of second-quarter financial results scheduled for July 30. Analyss expect the company to report earnings per share of $2.77, up from $2.40 in last year's second quarter. The company has beaten analyst estimates for earnings per share in eight of the last 10 quarters. Analysts expect the company to report revenue of $587.9 million, up from $541.0 million in last year's second quarter. The company has beaten analyst estimates for revenue in six of the last 10 quarters, including two straight quarters.

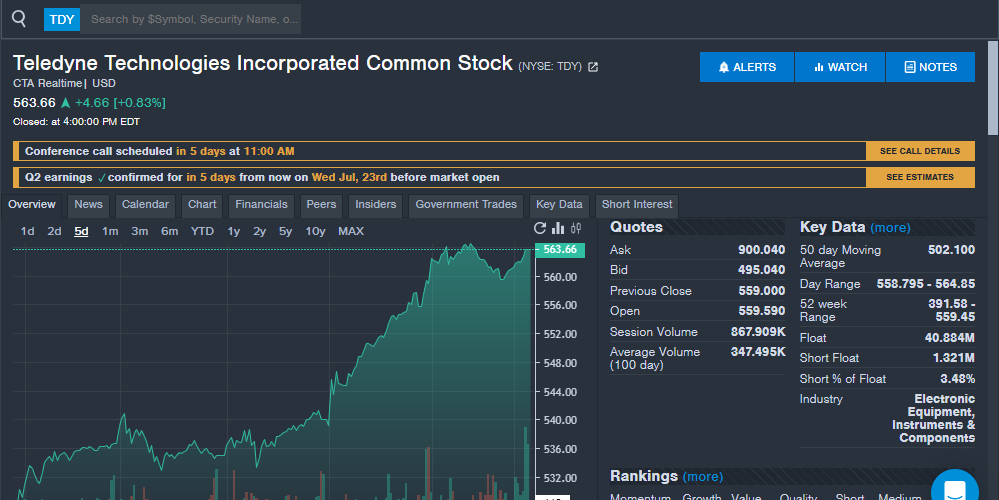

Teledyne Technologies Inc (NYSE:TDY): With business segments that include government contracts, Teledyne has been getting attention as a drone stock in recent weeks. The company's FLIR Defense segment issues a press release on drones and praising recent comments from Defense Secretary Pete Hegseth. The company reports second-quarter financial results on July 23. Analysts expect the company to show increases in earnings per share and revenue on a year-over-year basis. The company has beaten analyst estimates for earnings per share in nine of the last 10 quarters, including four straight quarters. The company has beaten revenue in seven of the last quarters, including four straight quarters.

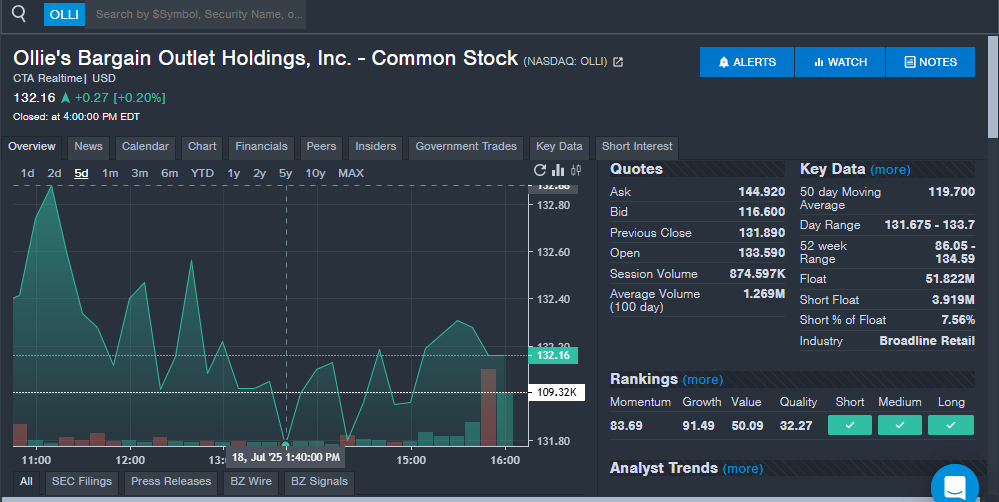

Ollie's Bargain Outlet Holdings (NASDAQ:OLLI): The retailer of closeout merchandise saw increased interest from readers during the week likely due to an appearance at the Nasdaq to ring the opening bell. The company is celebrating its 10th anniversary of being a public company. Ollie's is also celebrating the opening of its 600th store and entering its 34th state (New Hampshire). Shares trade at all-time highs despite missing analyst estimates for both revenue and earnings per share in the last fiscal quarter.

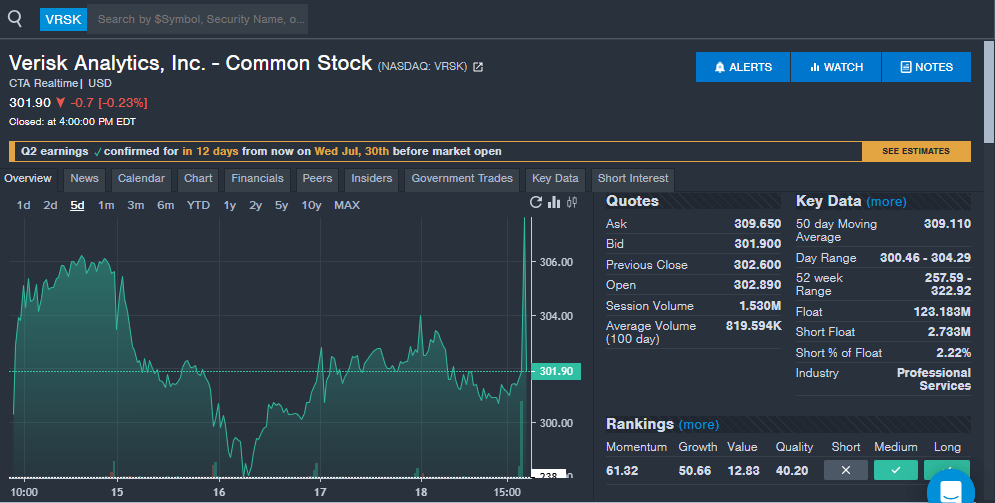

Verisk Analytics (NASDAQ:VRSK): The insurance company saw increased interest, which comes as the company announced the acquisition of SuranceBay. The acquisition will expand Verisk's operations in the life insurance and annuity segments. Verisk is set to report second-quarter financial results on July 30. The company has beaten analyst estimates for earnings per share in five straight quarters and nine of the last 10 quarters overall. The company has beaten analyst estimates for revenue in three straight quarters and nine of the last 10 quarters overall.

Stay tuned for next week's report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next: