/Becton%20Dickinson%20%26%20Co_%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $56.2 billion, Becton, Dickinson and Company (BDX) is a global medical technology leader that develops, manufactures, and sells medical devices, laboratory equipment, and diagnostic products. Headquartered in Franklin Lakes, New Jersey, BD serves healthcare institutions, life science researchers, and the pharmaceutical industry worldwide.

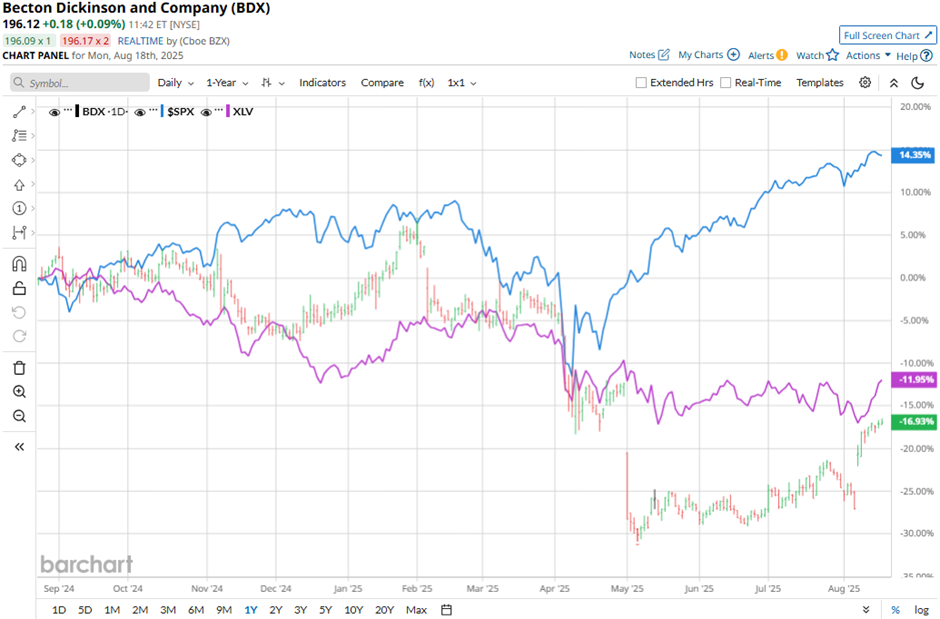

Shares of the medical device manufacturer have underperformed the broader market over the past 52 weeks. BDX stock has decreased 16.8% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.1%. Moreover, shares of the company have declined 13.4% on a YTD basis, compared to SPX's 9.6% rise.

Looking closer, the medical device manufacturer stock has also lagged behind the Health Care Select Sector SPDR Fund's (XLV) 10.5% drop over the past 52 weeks.

Shares of Becton Dickinson climbed 8.9% on Aug. 7 after the company reported stronger-than-expected Q3 2025 results, with adjusted EPS of $3.68 and revenue of $5.5 billion. Growth was driven by a 14.4% increase in sales from its medical unit to $2.93 billion, slightly topping forecasts, as demand for drug-delivery devices remained strong. Additionally, BD raised its 2025 adjusted profit forecast to a range of $14.30 per share - $14.45 per share.

For the fiscal year ending in September 2025, analysts expect BDX's adjusted EPS to grow 9.1% year-over-year to $14.33. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

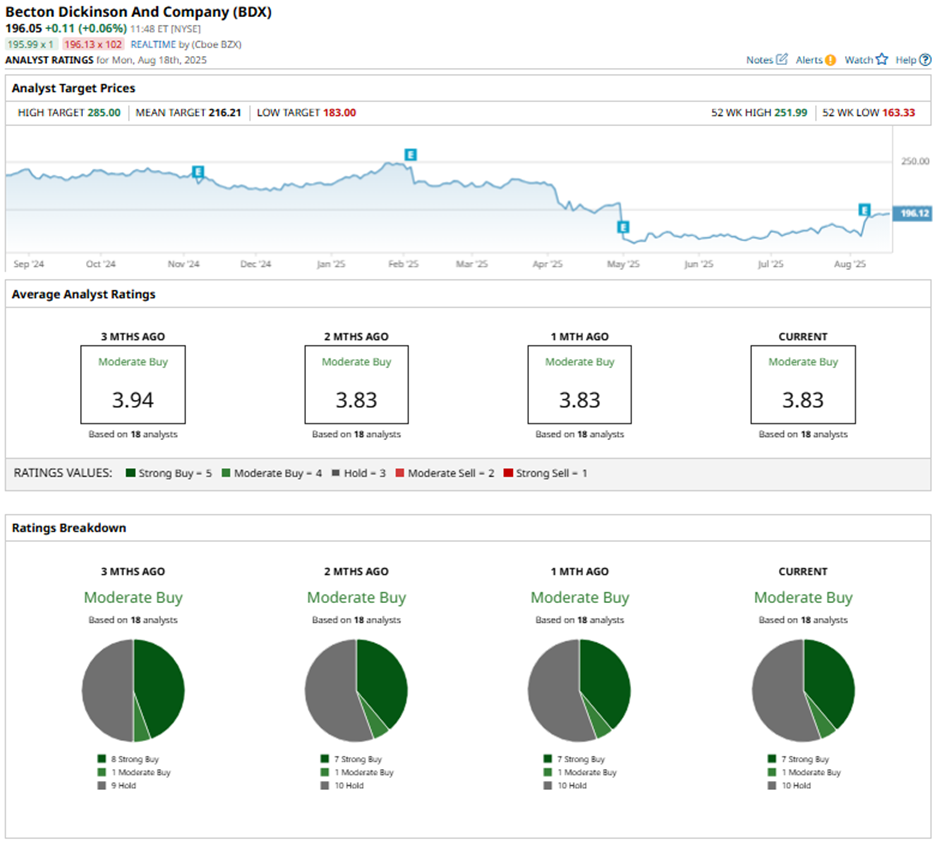

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, one “Moderate Buy,” and 10 “Holds.”

This configuration is slightly less bullish than three months ago, with eight “Strong Buy” ratings on the stock.

On Aug. 11, Morgan Stanley raised its price target on Becton Dickinson to $197 and maintained an “Overweight” rating.

As of writing, the stock is trading below the mean price target of $216.21. The Street-high price target of $285 implies a potential upside of 45.4% from the current price levels.