/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

With artificial intelligence, as well as electric vehicles (EVs) putting a strain on the power grid in America, battery storage is now the second largest contributor to new power grid capacity, after solar. Data center power demand may increase tenfold by 2030, as stated by global risk expert firm DNV.

In this context, innovative zinc battery expert Eos Energy Enterprises (EOSE) has emerged as a major stock performer, with EOSE's stock price rising about 220% in 2025. Its battery, which will provide a safer, more durable battery life compared with existing lithium-ion batteries, has started to get attention from stock players.

About Eos Energy Enterprises Stock

Eos Energy Enterprises, a Nasdaq-listed stock under the ticker “EOSE,” produces zinc-based battery solutions for storing grid-scale energy. With its headquarters in Edison, New Jersey, the firm caters to utilities as well as industrial consumers who require a long-duration, fire-safe storage solution that goes beyond that offered by lithium batteries. It has a market value of approximately $3.9 billion.

EOSE stock has surged 220% year-to-date (YTD), far outperforming the S&P 500 Index’s ($SPX) ~11% gain. Shares have traded between $2.06 and $19.05 over the past 52 weeks, recently changing hands around $15.25.

Eos Energy remains highly valued, with a price/sales (P/S) multiple of approximately 250x, thanks to its early stage and expectations of explosive expansion. The company may not yet be generating profits, but it continues putting out its production capacities while reducing costs of finance with a view to being able to produce at scale as soon as possible. EOSE does not distribute a dividend.

Eos Energy Enterprises Delivers Record Results

Eos posted revenue of $15.2 million for Q2 2025, its highest ever, almost equal to its total sales in 2024. It reiterated its guidance for 2025 at $150-190 million for the whole year. Its Z3 customer system efficiency registered an average of 88-89.5%, corroborating its technology’s quality.

Eos also generated $336 million from concurrent equity and convertible note offerings, which enhanced its liquidity. It received $22.7 million for its second DOE loan program advance, making a cumulative contribution of $91 million from government aid since late 2024. Its management extended its 26.5% convertible notes maturity to 2034, with a significant reduction in interest costs at 7% from 2026.

The commercial pipeline increased to $18.8 billion, a jump of $3.2 billion from the previous quarter, primarily fueled by its UK Cap & Floor business and strong eight-hour+ storage sales. With its first production line now automated and a second production line on order, Eos is poised for volumetric expansion over 2026.

What Do Analysts Expect for EOSE Stock?

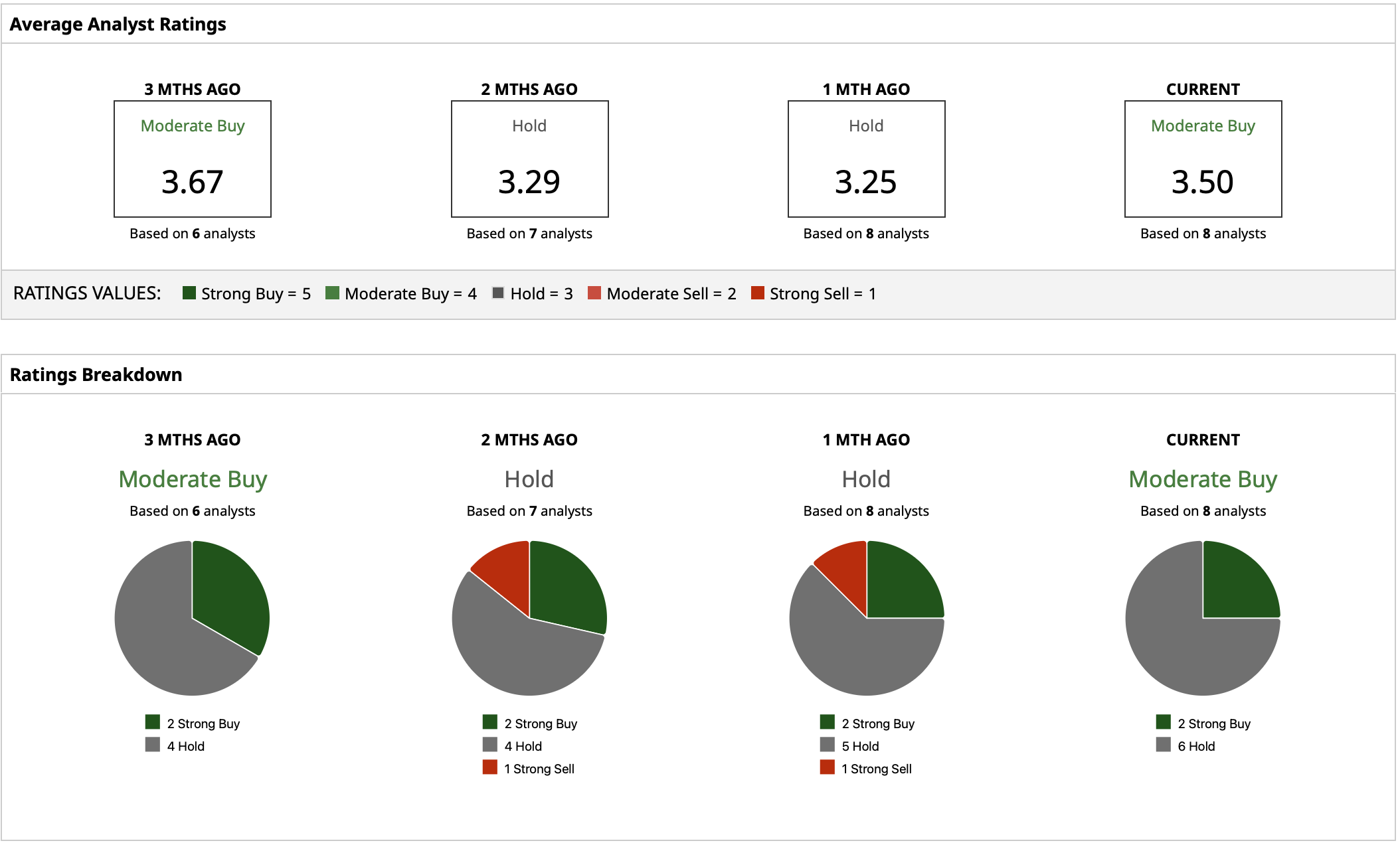

Analysts remain divided. Barchart data shows a “Moderate Buy” rating consensus and a mean target of $13.08, implying downside potential of ~14% from recent levels, with estimates ranging from $6.50 to $22. Some on Wall Street view EOSE stock as overextended in the short run after its massive rally; others see a strategic leader in long-duration energy storage supported by federal loan programs and manufacturing tax credits under the “One Big Beautiful Bill Act.” Eos Energy could be, according to one Barchart writer, part of a “dark horse” zinc battery revolution.