/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Bank of America just threw cold water on Intel's (INTC) recent rally, downgrading the stock to “Underperform” with a $34 price target. That implies roughly 8% downside from current levels after INTC stock surged nearly 85% in 2025.

The analysts believe Intel has climbed too far, too fast. While the company's balance sheet has improved and its foundry business shows external partnership potential, BofA thinks the recent $80 billion jump in market cap more than reflects these positives.

Intel lacks a discernible AI portfolio or strategy at a time when AI is driving the semiconductor industry. Its server CPU business is uncompetitive against rivals like AMD (AMD). Additionally, Intel now has less flexibility to divest its loss-making manufacturing operations than it did before recent government involvement.

INTC stock got a boost after the Trump administration took a stake in August and Intel announced a manufacturing partnership with Nvidia (NVDA) last month. Speculation about potential deals with Apple (AAPL) and AMD fueled further gains. But BofA argues these expectations have become detached from reality.

Intel dropped over 4% on Tuesday following the downgrade, making it one of the S&P 500's ($SPX) biggest decliners. Most analysts remain neutral on the tech stock, waiting for concrete evidence that Intel's foundry business can attract sustained customer commitments.

The average analyst price target sits near BofA's $34 forecast, suggesting limited upside ahead.

Is Intel Stock a Good Buy Right Now?

Intel closed one of the most dramatic quarters in its history from a capital perspective. It secured $5.7 billion from the U.S. government in exchange for a 10% equity stake, raised $2 billion from SoftBank (SFTBY), sold nearly $1 billion of Mobileye (MBLY) shares, and expects another $3.5 billion from closing the Altera sale.

Intel also announced a historic partnership with Nvidia to jointly develop x86 CPUs. The Nvidia collaboration addresses two major market gaps for Intel. First, it brings x86 into Nvidia's NVLink ecosystem for AI supercomputers, creating rack-scale systems previously only available with Nvidia's ARM-based Grace chips. Second, it fuses Intel x86 CPUs with Nvidia GPU chiplets for consumer PCs, targeting 150 million laptops sold annually, where Intel currently has limited presence.

CEO Jensen Huang was enthusiastic enough to make Nvidia a key shareholder, calling the return on investment "fantastic." Intel will become a major customer of x86 CPUs from its own foundry while simultaneously supplying GPU chiplets to a market it has never addressed before. The partnership could address $25 billion to $50 billion in annual opportunity.

Intel’s gross margins hover around 40%, well below its historical targets. The path towards expanding profit margins depends on better pricing through competitive products and improving cost efficiency across silicon usage, packaging, test times, and inventory management.

Is INTC Stock Undervalued?

Intel is forecast to report an adjusted earnings per share of $2.65 in 2029, compared to a loss per share of $0.13 in 2024. If INTC stock is priced at 20x forward earnings, it should trade around $53 in early 2029, indicating an upside potential of 43% from current levels.

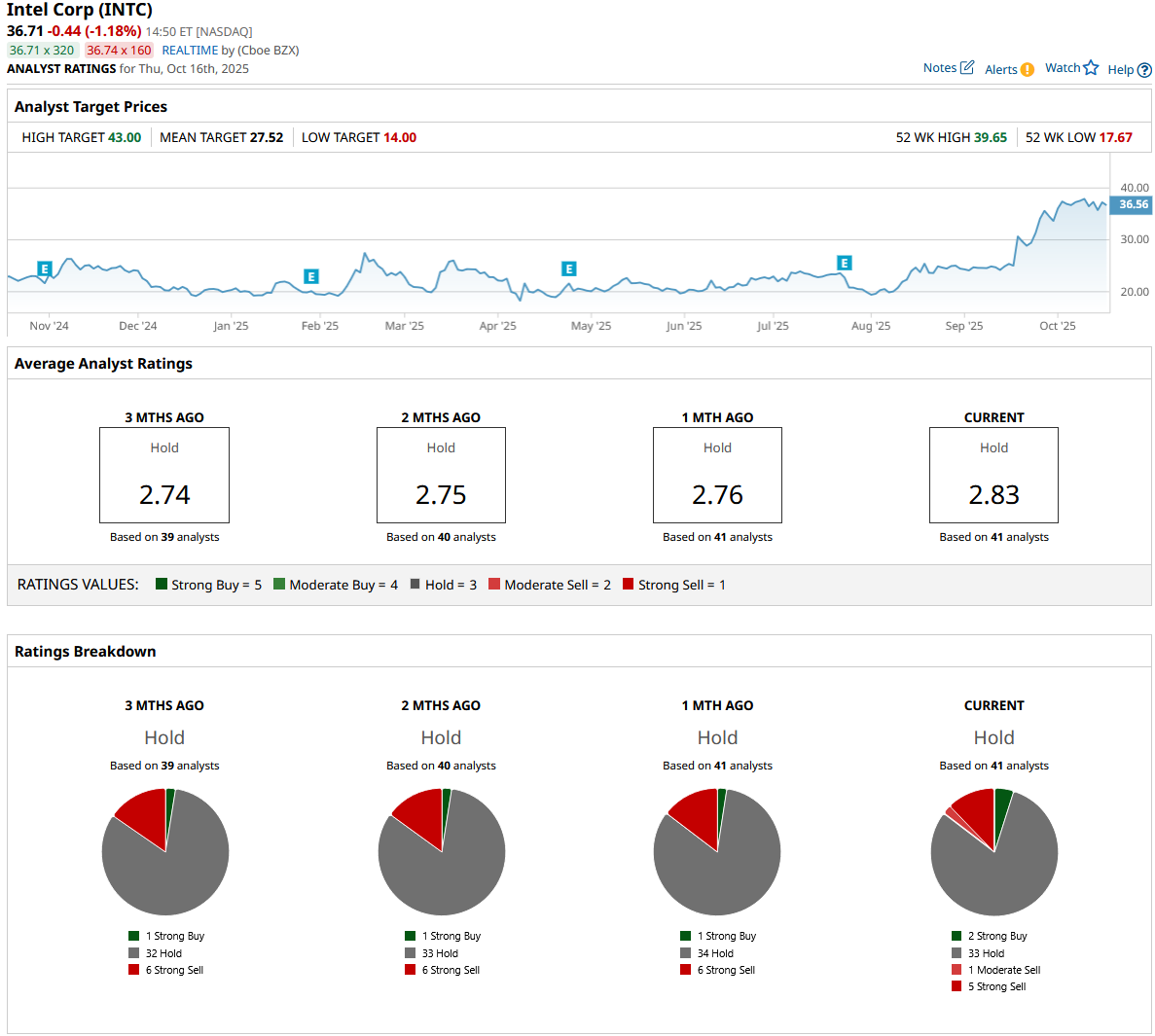

Out of the 41 analysts covering INTC stock, two recommend “Strong Buy,” 33 recommend “Hold,” one recommends “Moderate Sell,” and five recommend “Strong Sell.” The average INTC stock price target is $27.52, below the current price of $37.

The government stake eliminates uncertainty around CHIPS Act funding and provides an implicit endorsement. The Nvidia partnership opens new revenue streams, but Intel still faces years of execution risk transforming its foundry ambitions into reality while simultaneously fixing its core product competitiveness. The capital structure is stronger, but the fundamental turnaround remains a work in progress.