With a market cap of $46.3 billion, Baker Hughes Company (BKR) is one of the world’s largest energy technology and oilfield service providers. Through its two segments: Oilfield Services & Equipment (OFSE) and Industrial & Energy Technology (IET), the company delivers advanced products, services, and digital solutions across the energy and industrial value chain.

Companies valued more than $10 billion are generally considered “large-cap” stocks, and Baker Hughes fits this criterion perfectly. With expertise spanning oilfield operations, LNG, and clean energy solutions, Baker Hughes plays a key role in helping customers drive efficiency while supporting the global transition to lower-carbon energy.

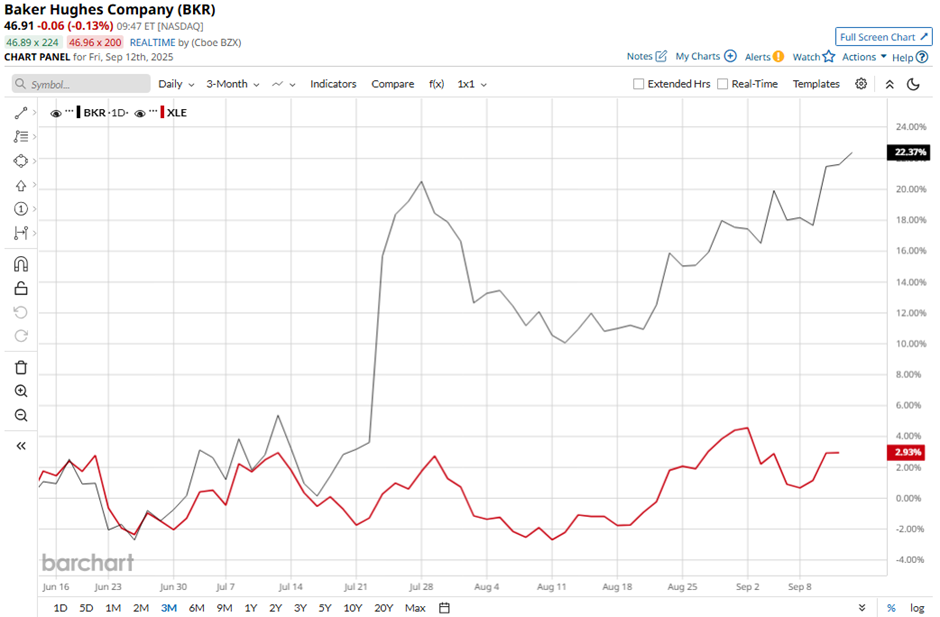

However, shares of the Houston, Texas-based company have dipped 5.3% from its 52-week high of $49.40. Over the past three months, the stock has soared 21.1%, which outpaced the Energy Select Sector SPDR Fund’s (XLE) rise of 3.4% during the same period.

In the long term, BKR stock is up 14.1% on a YTD basis, outperforming XLE’s 4.5% gain. Moreover, shares of the oilfield services company have surged 40.6% over the past 52 weeks, compared to XLE’s 5.2% increase over the same time frame.

The stock has been trading above its 50-day moving average since early June. Also, it has climbed above its 200-day moving average since late August.

Shares of Baker Hughes climbed 11.6% following its Q2 2025 results on July 22 as the company posted adjusted EPS of $0.63, topping analyst estimates. Revenue came in at $6.9 billion, above Wall Street forecasts, with its Industrial & Energy Technology (IET) segment rising 28% in gas technology orders to $3.3 billion, driven by strong LNG and data center demand.

Despite a 3% year-over-year revenue decline from weaker drilling activity, investors responded positively to Baker Hughes’ ability to beat profit expectations, capitalize on natural gas growth, and signal confidence in exceeding its $1.5 billion data center equipment order target ahead of schedule.

In comparison, BKR stock has outperformed its rival Halliburton Company (HAL). HAL stock has dropped 19.7% over the past 52 weeks and 17.3% on a YTD basis.

Due to the stock’s strong performance, analysts are bullish about its prospects. BKR stock has a consensus rating of “Strong Buy” from the 23 analysts in coverage, and the mean price target of $50.91 represents a premium of 8.5% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.