/Autodesk%20Inc_%20logo%20on%20laptap-by%20monticello%20via%20Shutterstock.jpg)

With a market cap of $69.3 billion, Autodesk, Inc. (ADSK) is a global leader in 3D design, engineering, and entertainment software, serving industries such as architecture, construction, manufacturing, and digital media. Its portfolio includes widely used solutions like AutoCAD, Revit, Fusion, Maya, and BIM Collaborate Pro, which enable design, simulation, collaboration, and visualization across projects.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Autodesk fits this criterion perfectly. Autodesk delivers its products through subscriptions, cloud services, and enterprise agreements worldwide.

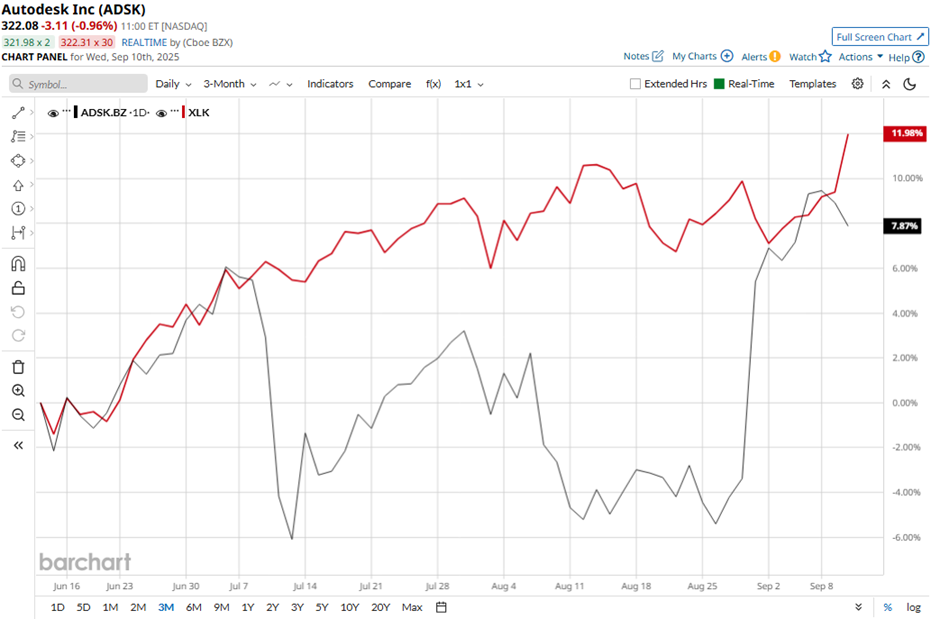

Shares of the San Francisco, California-based company have dipped 1.6% from its 52-week high of $329.09. Over the past three months, ADSK stock has increased 8.8%, which lagged behind the Technology Select Sector SPDR Fund's (XLK) rise of 12.6% during the same period.

In the longer term, shares of the design software company have risen 9.5% on a YTD basis, underperforming XLK’s 16.7% return. Moreover, ADSK stock has soared 25.7% over the past 52 weeks, compared to XLK’s nearly 29% gain over the same time frame.

The stock has climbed above its 50-day and 200-day moving averages since late August.

Shares of ADSK jumped 9.1% after the company delivered Q2 2026 adjusted EPS of $2.62 and revenues of $1.76 billion, surpassing expectations. Strong growth in AECO revenues, robust subscription sales, and billings growth of 36% to $1.68 billion highlighted broad-based momentum. Additionally, Autodesk raised its 2026 guidance significantly, with revenue now projected at $7.03 billion - $7.08 billion and adjusted EPS at $9.80 - $9.98.

In comparison, rival Salesforce, Inc. (CRM) has lagged behind ADSK stock. CRM stock has dropped 25.7% on a YTD basis and risen marginally over the past 52 weeks.

Despite APH’s underperformance relative to the sector, analysts are bullish about its prospects. The stock has a consensus rating of “Strong Buy” from the 28 analysts covering the stock, and the mean price target of $362.74 is a premium of 12.6% to current levels.