/AI%20(artificial%20intelligence)/Close-%20up%20of%20computer%20chip%20with%20AI%20sign%20by%20YAKOBCHUK%20V%20via%20Shutterstock.jpg)

Taiwan Semiconductor Manufacturing Company (TSM), the world’s leading contract chipmaker, reported blowout second-quarter earnings, exceeding Wall Street expectations and raising its guidance for the rest of the year.

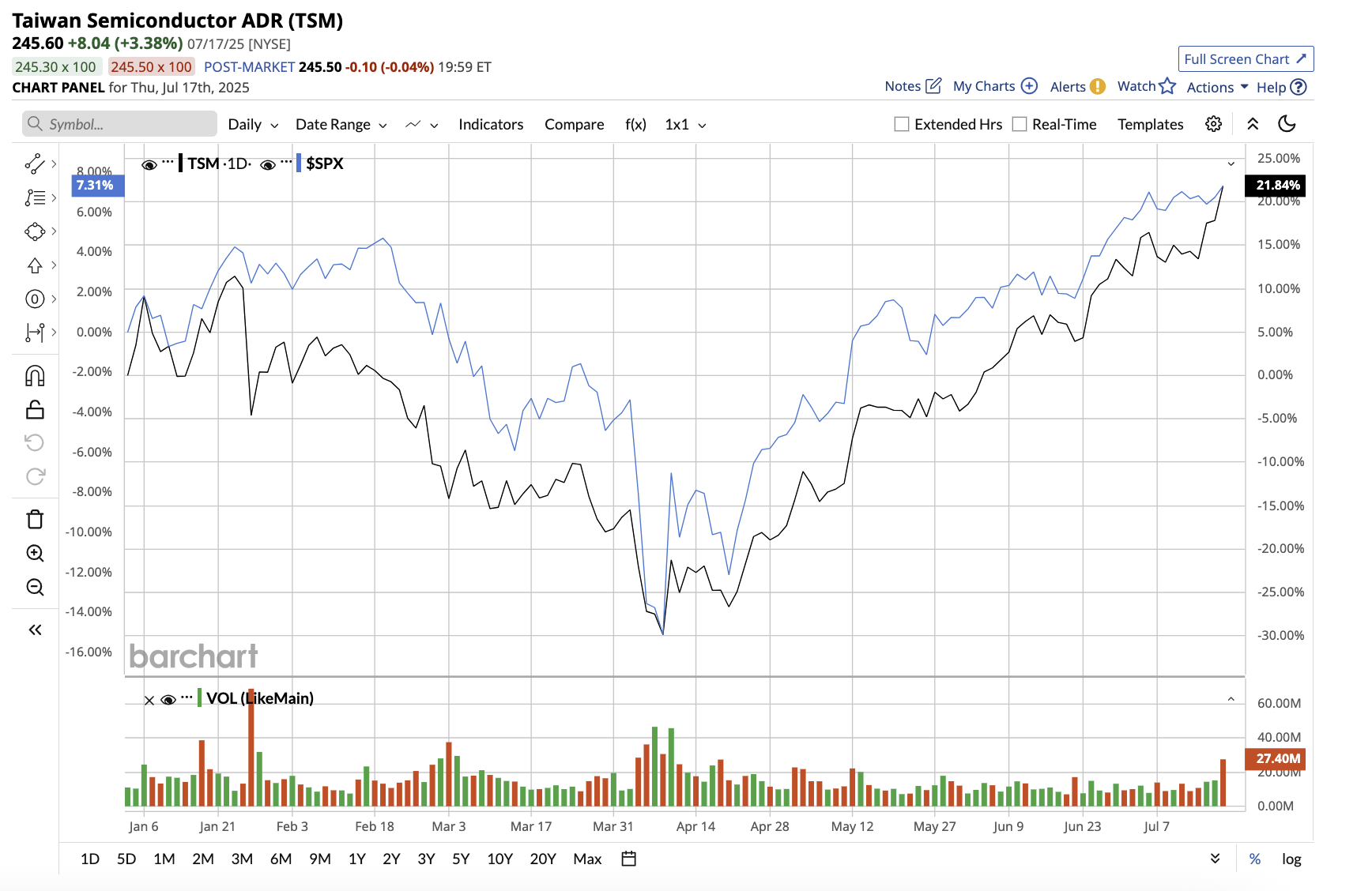

On Thursday, TSM stock rose to an all-time high of $248.28 before closing at $245.60. The stock is up 21.1% year-to-date, outperforming the broader market significantly.

Let’s dig into the results and determine if it’s the beginning of TSMC’s next big rally and whether the stock is a buy now.

TSMC’s AI-Fueled Growth and Global Expansion Is Leading the Way

While companies such as Nvidia (NVDA), Advanced Micro Devices (AMD), and Broadcom (AVGO) might garner more attention as “AI winners,” none of their visions would be realized without TSMC's cutting-edge manufacturing capabilities. TSMC is the sole manufacturer of Nvidia’s most advanced chips, such as the H100 and H200 GPUs. These AI accelerators, which are based on TSMC’s 5-nm and 4-nm nodes, are essential components for data center and cloud workloads.

TSMC reported $30 billion in second-quarter revenue, a 44.4% increase over the same period last year. The results exceeded expectations, owing to strong demand in high-performance computing (HPC), smartphones, and internet of things platforms. Diluted earnings per share (EPS) increased 60.7%, while gross margin fell to 58.6%. This drop was primarily caused by current headwinds and margin dilution from overseas fabrication plants, including the expansion of its Arizona facility.

TSMC’s cutting-edge nodes continue to drive its revenue profile. Notably, 3-nm technology accounted for 24% of wafer revenue, with 5-nm and 7-nm nodes contributing 36% and 14%, respectively. Overall, advanced nodes (7-nm and below) accounted for 74% of wafer revenue, proving TSMC's strong position in next-generation chip fabrication.

Platform-wise, HPC led the way, accounting for 60% of total revenue, while smartphone revenue increased by 7%, accounting for 27%. Additionally, IoT revenue increased 14%, while automotive revenue remained flat at 5%. Digital Consumer Electronics accounted for just 1% of revenue. Despite $9.6 billion in capital expenditures during the quarter, the company ended with a solid $90 billion balance in cash and marketable securities.

Strong Outlook, But Margin Headwinds Persist

Despite cost pressures, TSMC has reaffirmed its full-year 2025 capital budget of $38 billion to $42 billion, as it continues to invest in global capacity expansion and next-generation technologies. The company emphasized that it is actively working to improve operational efficiency at its overseas sites to offset structural cost disadvantages.

C.C. Wei, TSMC's CEO, warned of macro risks in the second half of 2025. These include tariff policy uncertainty, particularly in consumer and price-sensitive segments, China's rebate programs, and non-AI demand remaining in a mild recovery mode.

Looking ahead to the third quarter, TSMC anticipates revenue between $31.8 billion and $33 billion, with a gross margin of 55.5% to 57.5%. TSMC is also confident in maintaining a long-term gross margin of 53% or higher, despite short-term headwinds from foreign exchange and overseas costs. The company identified six drivers of profitability:

- Leadership, technology development, and ramp-up

- Competitive pricing

- High capacity utilization

- Cost reduction efforts

- Optimal technology mix

- Foreign exchange (not controllable)

Management expects the sixth factor to pose near-term challenges. Nonetheless, the long-term outlook remains undeniably positive. As Wei stated, "The demand for semiconductors is very fundamental and will continue to be robust." To meet rising demand and diversify geopolitical risk, TSMC is embarking on one of its most ambitious international manufacturing expansions. It has committed $165 billion to U.S. expansion in Arizona, where it plans to build a “giga fab cluster.” Upon completion, Arizona will house 30% of TSMC’s 2-nm and beyond capacity.

Management believes that this bold investment will result in a self-contained, cutting-edge chip cluster in the U.S., designed to support smartphone, AI, and HPC customers while strengthening America’s chip supply chain resilience. TSMC is also expanding its global footprint by establishing fabs in Japan, Europe, and Taiwan, which remains the crown jewel of its capacity. TSMC plans to build 11 new wafer fabs and four advanced packaging plants in Taiwan alone over the next few years. Analysts expect TSMC's earnings to increase by 38% in 2025, with another 13% expected in 2026. Trading at 25 times forward earnings, TSMC remains reasonably priced.

The company’s technology roadmap, which extends through 2028 and beyond, reveals why nearly every leading chip designer relies on TSMC. Despite ongoing macro risks, TSMC’s disciplined planning and strategic investments make it one of the most compelling AI stocks today.

With this strategy, I believe TSMC can continue to deliver sustainable, profitable growth for many years to come.

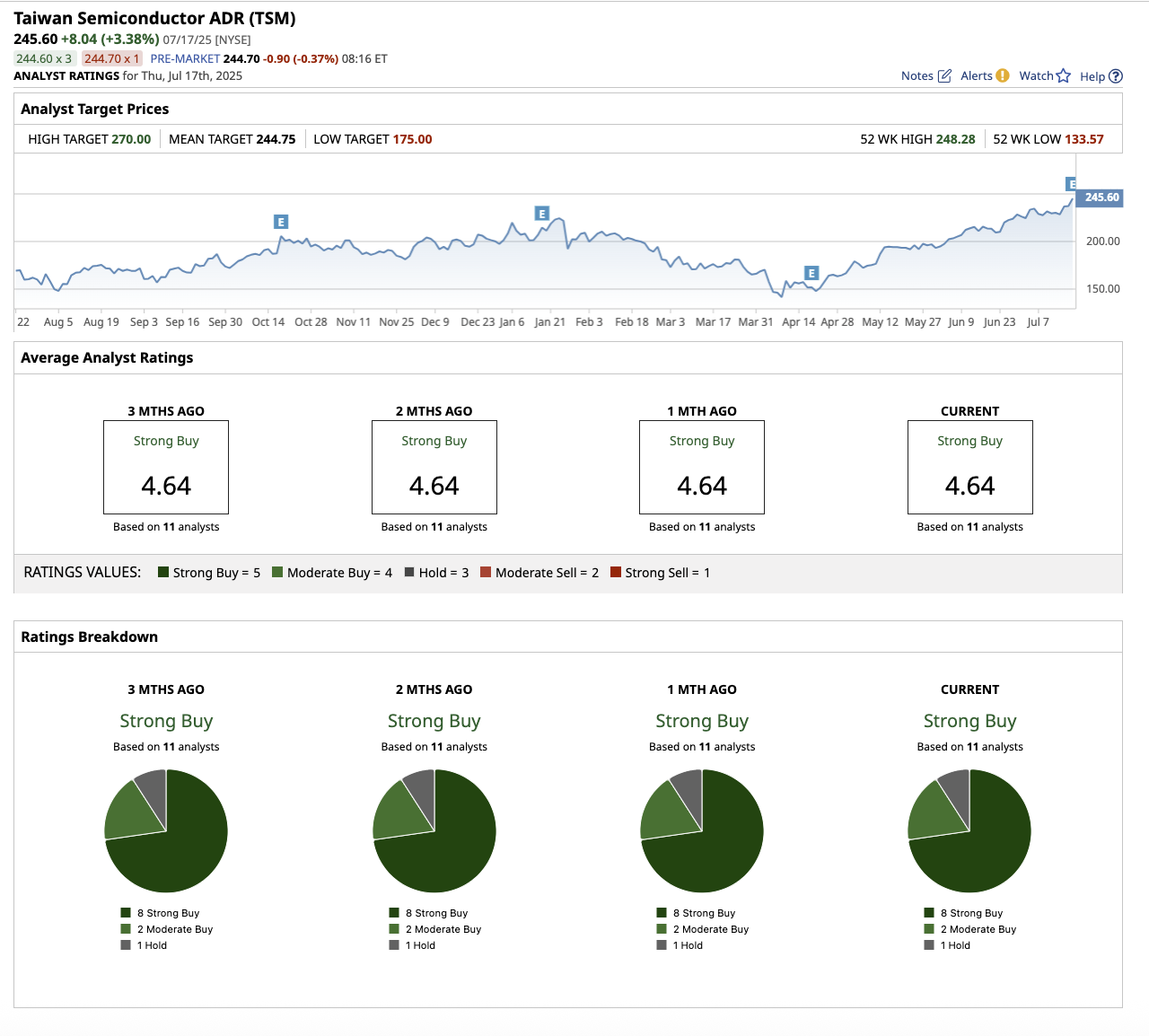

What Does Wall Street Say About TSMC Stock?

Following the earnings release, Needham analyst Charles Shi reiterated his “Buy” rating on TSMC, noting that the company not only exceeded its Q2 guidance, but also demonstrated resilience in the face of a challenging macroeconomic environment. He added that, despite ongoing global uncertainties, TSMC’s continued access to the Chinese market, particularly for AI-related demand, strengthens its long-term growth prospects. Shi set a price target of $270 for the stock.

Separately, TD Cowen analyst Krish Sankar maintained a “Hold” rating on TSMC, with a $250 price target. His cautious outlook reflects a balanced assessment of the company’s strengths and challenges. Sankar believes that while the company’s long-term growth is dependent on new fabs in Taiwan and the U.S., it faces short-term margin pressures.

Overall, TSMC stock is a “Strong Buy” on Wall Street. Out of the 11 analysts that cover the stock, eight rate it a “Strong Buy,” two rate it a “Moderate Buy,” and one rates it a “Hold.” The stock trades 2% below its average price target of $244.75. Its high target price of $270 implies a potential upside of 12.5% in the next 12 months.