- Used EV prices are at an all-time low, but they're showing signs of stabilizing.

- Teslas saw the steepest average depreciation over the last year, with the Model S being the worst-hit.

- The looming end of federal EV tax credits could trigger short-term price drops, then longer-term gains.

There has never been a better time to buy a used EV. There are a wide range of EVs catering to all budgets, used EV prices are at an all-time low with signs of stabilizing and there’s still a used EV tax credit in place.

The average value of a used EV in June was 4.8% lower year-over-year compared to 2024, while used gas cars overall got more expensive by 5.2% over the same period. Tesla vehicles recorded the largest price drop for one- to five-year-old used cars, with a 5.3% difference year-over-year and an average value that, for the first time, fell below the $30,000 mark.

According to new data published by iSeeCars, EVs have some of the highest depreciation on the used market. That's partially because of how aggressive automakers have been with offering new-vehicle discounts, including Tesla, General Motors and Hyundai.

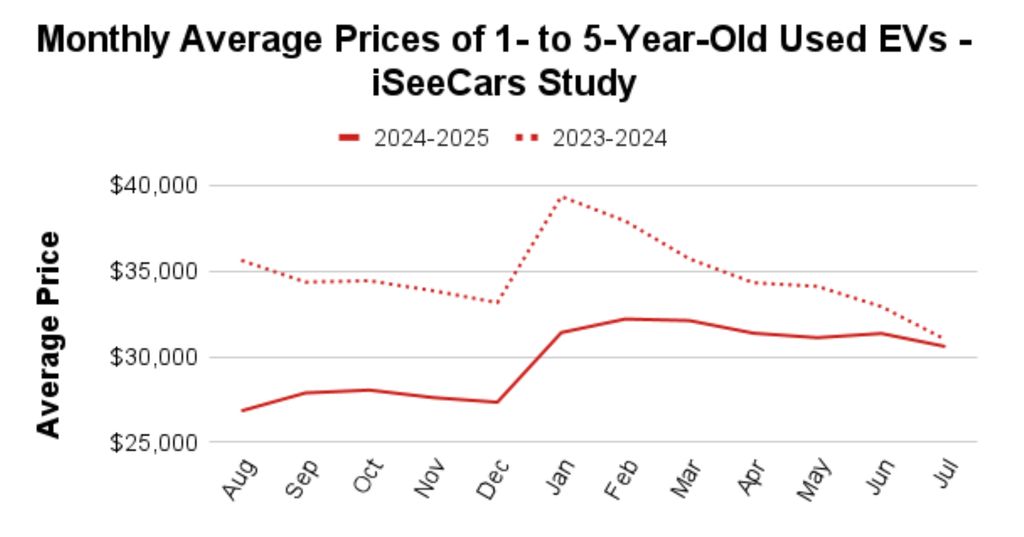

But prices are finally starting to level out. A year ago, EV prices were falling by more than 24%, or nearly $9,000 on average. Last month, they dropped just 1.3%, equating to a difference of around $408. This is still a decline, but it also shows how the market is becoming more mature.

The average used Tesla Model S lost the most value over the past year, according to data published by iSeeCars last month. That’s down 12.3%, or a difference of $6,662, followed by the Model Y, which lost the same 12.3%, which equated to $4,071, while the Model X lost 12.1%, or $6,950. The Model 3 wasn’t as bad, only losing 4.3% year-over-year, or $1,129. Teslas were the best-selling used EVs in May, according to Cox Automotive.

“Just as used electric vehicle prices are stabilizing, traditional used cars are going back up in value," Karl Brauer, executive analyst for iSeeCars, said in the release. "The combination of high new car prices, plus concern over tariffs and their impact on future car values, is likely leading to increased near-term demand for both new and used vehicles.”

EVs represented just 3.3% of the one- to five-year-old used market analyzed in this study. The number of used EVs for sale is going up rapidly, though,. Used EV sales increased 61.8% year-over-year compared to 22.2% for combustion cars. With so many electric vehicles flooding the used market, it makes sense for prices to fluctuate less, although the supply is now likely much greater than demand.

“It’s interesting to see electric vehicle prices stabilizing just as the tax incentives for new and used models are withdrawn," Brauer added. "It’s likely we’ll see a last-minute increase in both new and used EV purchases before the incentives vanish, followed by a decline in sales and demand. That could cause a short-term drop in prices right after the incentives go away, but also a longer-term increase, as fewer EV sales will ultimately mean a lower supply and a likely increase in values.”

We are likely headed into a scenario where used EV values will be dictated more by supply and policy changes than by novelty or tech fears. It does appear that it’s finding a balance and it will be interesting to see how the elimination of the used EV federal tax credit will affect demand and prices after September, when it’s supposed to go away. As we get closer to that day, we'll be following along closely.