On the global chessboard, the pieces are moving fast, and the stakes are nuclear. The war in Ukraine has tightened Russia’s grip on uranium enrichment, while China is sprinting ahead with its own atomic ambitions. Trade wars and fractured supply chains are splitting nations into rival camps.

In this charged atmosphere, Centrus Energy (LEU) is rolling out a multi-billion-dollar expansion in Piketon, Ohio, designed to restore America’s industrial-scale uranium enrichment. Supported by a nationwide supply chain, the venture signals, more than growth, a declaration of U.S. energy independence and a bet on American technology and workers.

Prices are speaking for themselves. From roughly $63.50 per pound in early 2025, uranium has surged north of $80 this month. LEU shares mirror the momentum, touching a fresh 52-week high today of $346.96 with a 13.1% intraday climb on Sept. 25 due to Centrus' expansion news.

The Piketon facility, a Cold War veteran in national defense, remains America’s only domestic site with the technology capable of industrial-scale enrichment. Centrus has also been fortifying its fiscal arsenal with $1.2 billion through convertible notes and over $2 billion in contingent utility commitments globally.

Collaborations with Korea Hydro & Nuclear Power and POSCO International hint at a wider ambition. All said, the tide seems to be in Centrus' favor at the moment.

About Centrus Stock

Centrus Energy's headquarters sits in Bethesda, Maryland, but its reach stretches across the nuclear world. Valued at approximately $5.7 billion, its Low-Enriched Uranium (LEU) segment powers nuclear utilities with uranium products and separative work units, while its Technical Solutions segment delivers engineering, technical, and manufacturing services to government and private clients.

LEU shares have blasted 438% over the past 52 weeks and surged 420% year-to-date (YTD). The broader sector is moving at a slower pace, though. Global X Uranium ETF (URA) has gained 67% over the past year and 86% in 2025.

One could say investors are paying a premium for performance and foresight. This is because LEU trades at 62.83 times forward adjusted earnings and 12.32 times sales, both above industry averages and their own five-year multiples.

Centrus Surpasses Q2 Earnings

On Aug. 5, Centrus pulled back the curtain on its Q2 2025 results, and the market had to sit up. Revenue came in at $154.5 million, comfortably above the expected $130.18 million. Sure, revenue was down 18.3% year-over-year (YoY), but the story was not in the decline.

It was in how the company had sharpened its margins and grown gross profit 47.7% to $53.9 million, prompting a stock jump of 1.8% on the day of the announcement and another 8.7% the next. EPS landed at $1.59, and although down 15.9% YoY, it came in far ahead of the predicted $0.84.

During the quarter, Centrus also raised $114.0 million in net proceeds from its at-the-market equity offering, strengthening its balance sheet. Its backlog stretched to $3.6 billion, securing work through 2040. The company also delivered 900 kilograms of high-assay low-enriched uranium (HALEU) to the Department of Energy, marking a major operational milestone.

Looking ahead, Centrus eyes expansion to 96 cascades, with the first spinning into action in 42 months. Strong demand for nuclear fuel and smart strategic investments might drive this growth. On the other hand, analysts project Q3 2025 EPS to climb 163.3% YoY to $0.19. However, full fiscal year 2025 could see a dip of 18.3% to $3.65.

What Do Analysts Expect for LEU Stock?

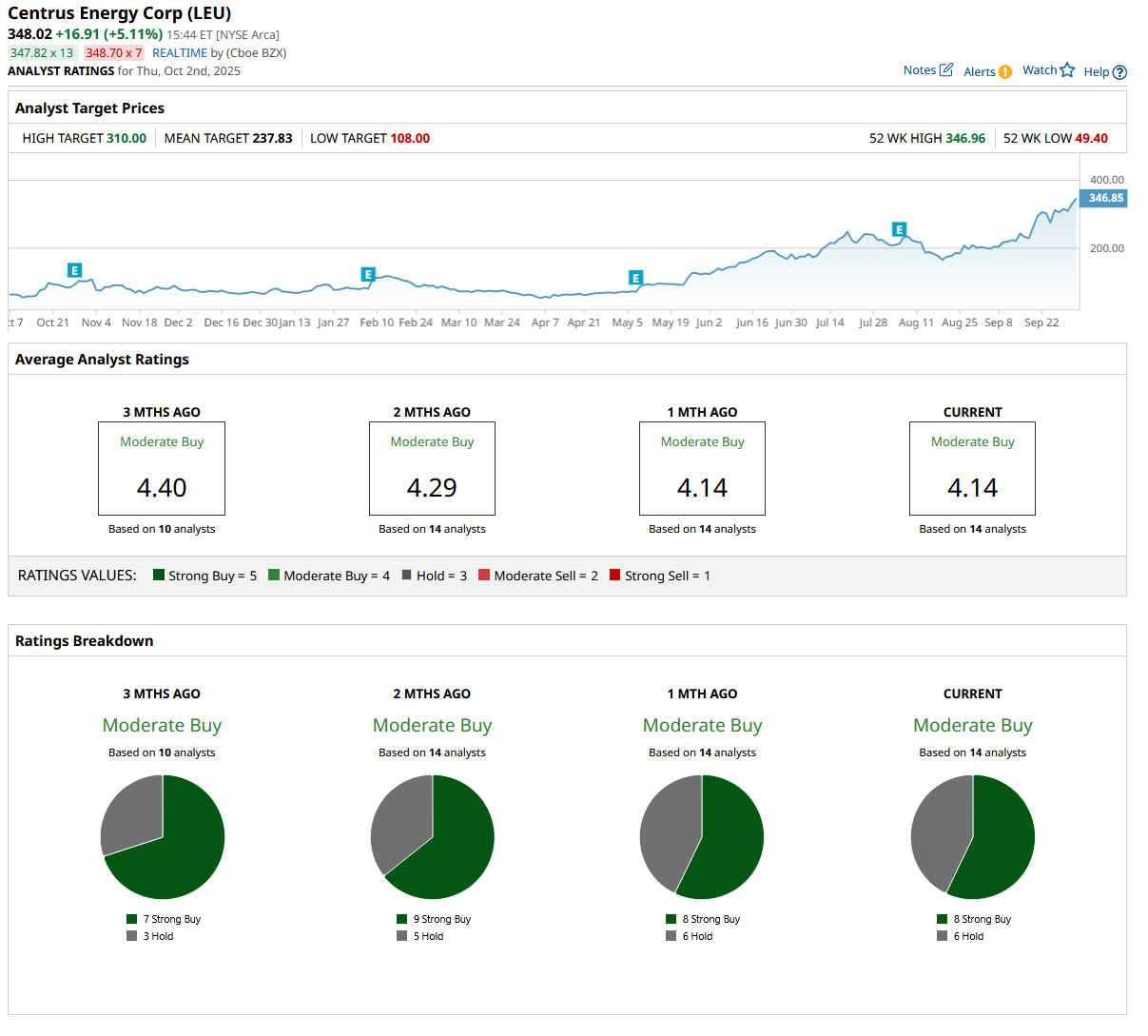

Analysts keeping an eye on LEU stock are walking a confident line. The Street seems to like what it sees, with the consensus rating landing at a “Moderate Buy.” Out of 14 analysts tracking the stock, eight are waving the “Strong Buy” flag, while six are settling into a “Hold,” seemingly content to watch the momentum play out.

LEU shares have already pushed past their average price target of $237.83, and even the Street-high benchmark of $310 is now in their rearview. This signals that the stock is running ahead of expectations.