A top executive of the European Union’s securities watchdog said Monday that tokenised stock offerings could potentially lead to “investor misunderstanding.”

Need For Clear Communication And Safeguards

Natasha Cazenave, executive director of the European Securities and Markets Authority, delivered a keynote speech on tokenization, the digital representation of financial products on blockchains, at a conference in Croatia.

“This is not just a technological evolution. It could lead to a transformational change of our markets,” Cazenave said. “It can also cut costs for businesses by embedding compliance and reporting obligations directly into digital assets.”

Cazenave stated that while some fintech businesses have introduced products that provide exposure to a company’s listed shares, they do not confer shareholder rights.

“If structured as synthetic claims rather than direct ownership, this can create a specific risk of investor misunderstanding and underlines the need for clear communication and safeguards,” the executive director said.

Robinhood’s Push For Tokenization

Cazenave’s remarks come a couple of months after Robinhood Markets Inc. (NASDAQ:HOOD) launched tokenized stocks for its European customers, with the highlight being blockchain-powered equities of companies like OpenAI and SpaceX.

However, the novel initiative soon ran into controversy after OpenAI issued a statement clarifying that the tokens offered by Robinhood are not OpenAI equity and that the company has no involvement with Robinhood regarding the product.

Several well-known market commentators, like macro strategist Raoul Pal, hailed the firm’s plan to introduce tokenized stock offerings, describing it as the “democratization of finance.”

Robinhood said it was working with U.S. regulators to unlock opportunities in tokenized stocks.

That said, the Securities Industry and Financial Markets Association, a trade group that represents the interests of financial institutions, urged the SEC to deny digital asset companies the opportunity to offer tokenized equities through specific exemptive relief and instead adopt an "open and transparent" process.

Price Action: Shares of Robinhood dipped 0.89% in Tuesday’s pre-market trading after closing 0.33% higher at $104.03 during Friday’s regular trading session, according to data from Benzinga Pro. The stock has soared 179% year-to-date.

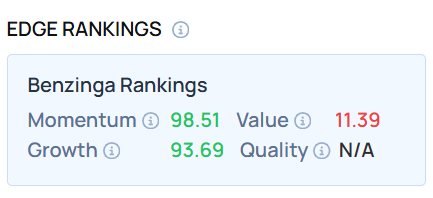

HOOD exhibited very high Momentum and Growth scores as of this writing. Wondering how it compares to the highest-weighted stock in your portfolio? Go to Benzinga Edge Stock Rankings and find out.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: Sergei Elagin On Shutterstock.com